IRS Form 1095 B Questions and Answers

What is the IRS Form 1095-B?

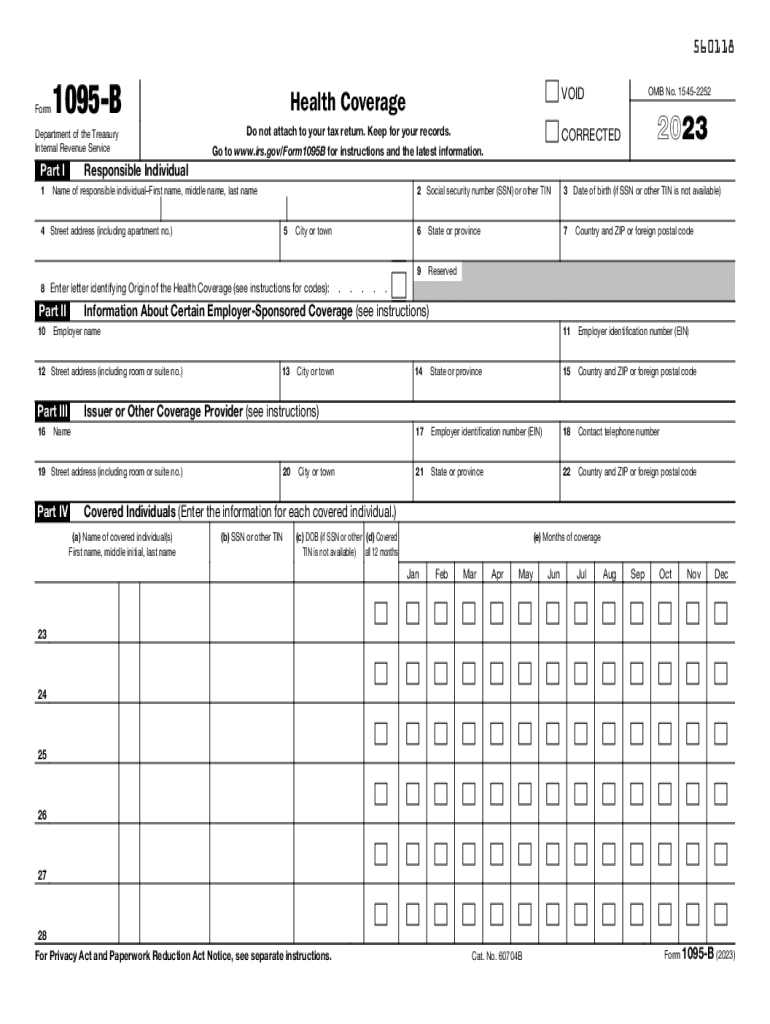

The IRS Form 1095-B is a tax document that provides information about an individual's health coverage. It is used to report the type of health insurance coverage a taxpayer had during the year. This form is essential for verifying compliance with the Affordable Care Act (ACA) requirements. The information included on Form 1095-B helps individuals complete their tax returns accurately, ensuring they meet the necessary health coverage mandates.

How to Obtain Form 1095-B

To obtain Form 1095-B, individuals can request it from their health insurance provider. Most insurance companies automatically send this form to their policyholders by mail or electronically. If you do not receive your form, you can contact your insurer directly to request a copy. Additionally, for those who qualify for Medicaid or Medicare, these programs also provide Form 1095-B, which can often be accessed through their respective online portals.

Steps to Complete the IRS Form 1095-B

Completing Form 1095-B requires several key steps:

- Gather necessary information, including your insurance policy details and the names of covered individuals.

- Fill out the form with accurate information about the coverage period and type of coverage.

- Ensure all details are correct, including the coverage individuals' names and Social Security numbers.

- Review the completed form for any errors before submission.

Key Elements of the IRS Form 1095-B

Form 1095-B includes several important components:

- Coverage Provider Information: This section includes the name, address, and contact details of the insurance provider.

- Covered Individuals: Names and Social Security numbers of individuals covered under the policy.

- Coverage Period: The specific months during which the individual was covered by health insurance.

- Type of Coverage: Indicates the type of health insurance plan, such as employer-sponsored or government program.

Filing Deadlines for Form 1095-B

Form 1095-B must be filed by insurance providers with the IRS by specific deadlines. Typically, providers must send copies of the form to policyholders by January 31 of the following year. The deadline for filing with the IRS is usually February 28 for paper submissions and March 31 for electronic submissions. It is essential for both providers and individuals to adhere to these deadlines to avoid penalties.

Legal Use of the IRS Form 1095-B

The IRS Form 1095-B is legally required for individuals who had health coverage during the tax year. It serves as proof of health insurance, which is necessary for compliance with the ACA. Failure to provide accurate information on this form can result in penalties for both the insurance provider and the individual. It is crucial to keep this form for your records and include it with your tax return as needed.

Quick guide on how to complete irs form 1095 b questions and answers

Complete IRS Form 1095 B Questions And Answers effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents swiftly and without issues. Handle IRS Form 1095 B Questions And Answers on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The best method to edit and electronically sign IRS Form 1095 B Questions And Answers smoothly

- Find IRS Form 1095 B Questions And Answers and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then hit the Done button to preserve your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or mislaid documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements with just a few clicks from any device you prefer. Edit and electronically sign IRS Form 1095 B Questions And Answers and ensure exceptional communication throughout the form preparation stage with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 1095 b questions and answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1095 b tax form and why do I need it?

The 1095 b tax form is an essential document provided by health insurers, detailing the health coverage offered to individuals. It's required for tax filings to demonstrate compliance with the Affordable Care Act. Having your 1095 b tax form helps ensure you’re properly documented for tax purposes and can further assist in avoiding penalties.

-

How can airSlate SignNow help me with the 1095 b tax form?

airSlate SignNow allows you to electronically sign and send the 1095 b tax form easily and securely. Our platform streamlines the process, ensuring that you can manage and track your tax documentation efficiently. This signNowly reduces the time spent on paperwork, helping you focus on other important tasks.

-

Is airSlate SignNow a cost-effective solution for managing the 1095 b tax form?

Yes, airSlate SignNow offers a cost-effective solution for handling the 1095 b tax form and other documents. Our pricing plans are designed to fit various business sizes and needs, allowing you to manage your tax forms without breaking the bank. This helps you save both money and resources.

-

Can I integrate airSlate SignNow with other software for 1095 b tax form management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications to help you manage your 1095 b tax form. Whether you're using accounting, HR, or other management tools, our integrations simplify workflows and enhance productivity. This enables you to streamline your tax documentation process effortlessly.

-

What features does airSlate SignNow offer for the 1095 b tax form?

airSlate SignNow includes features such as e-signatures, document tracking, and templates specifically for the 1095 b tax form. These tools ensure that you can create, send, and receive important tax documents in a user-friendly manner. With our platform, managing your tax forms becomes a hassle-free experience.

-

How secure is the handling of my 1095 b tax form with airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the 1095 b tax form. Our platform utilizes advanced encryption methods and secure access protocols to protect your data. You can be confident that your information is safeguarded throughout the signing process.

-

What are the benefits of using airSlate SignNow for tax documents like the 1095 b form?

Using airSlate SignNow for your 1095 b tax form brings numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform enables you to manage documents digitally, making the entire process quicker and easier. This ultimately leads to better organization and less stress during tax season.

Get more for IRS Form 1095 B Questions And Answers

- Midrand state of the environment south africa soer environment gov form

- New apscurf membership form

- Coast guard edit aplicatiob 2015 2019 form

- Alvernia university transfer credit approval form alvernia

- Special inspector city of miami form

- Form 821d daca 2017 2019

- Hipaa confidentiality agreement needed on some rotations nspt form

- T san diego epiphyllum society form

Find out other IRS Form 1095 B Questions And Answers

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation