Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

What is Form 109?

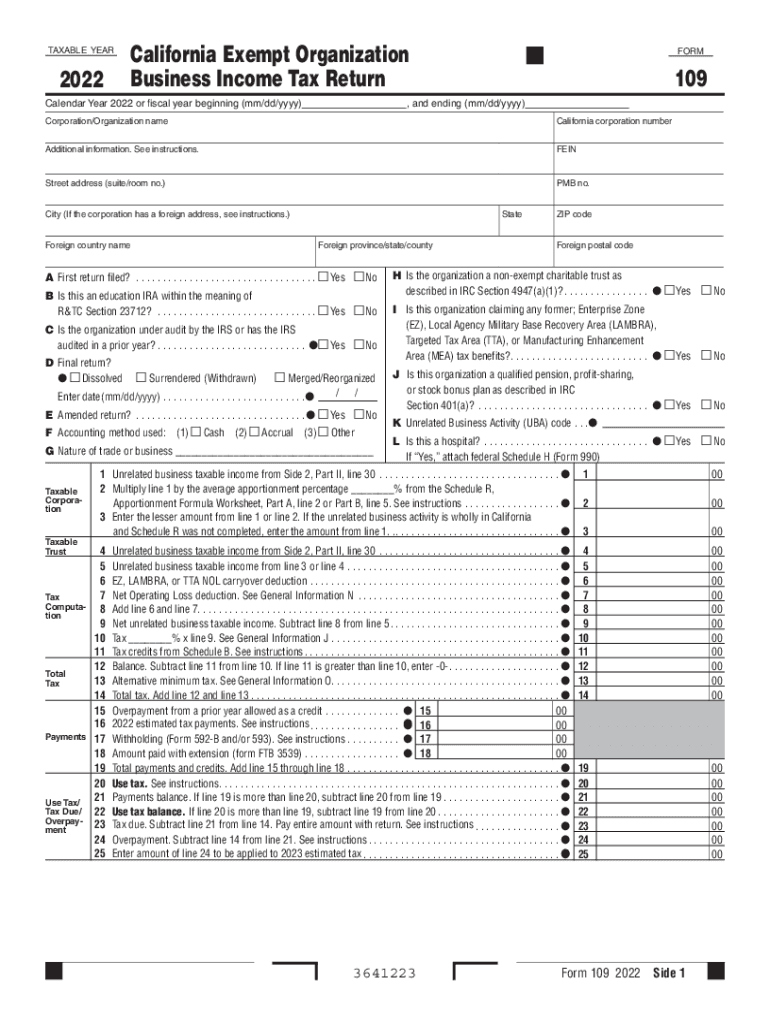

Form 109, officially known as the California Exempt Organization Business Income Tax Return, is a tax document used by certain nonprofit organizations in California. This form is specifically designed for organizations that are exempt from federal income tax but may still have to report income generated from business activities. Understanding the purpose of Form 109 is essential for compliance with state tax regulations.

The California Franchise Tax Board (FTB) requires this form to ensure that exempt organizations accurately report their business income and pay any applicable taxes. It is important for organizations to recognize that even though they are classified as tax-exempt, they may still have obligations related to income derived from activities that are not directly related to their exempt purpose.

Steps to Complete Form 109

Completing Form 109 involves several key steps to ensure accurate reporting of business income. Organizations should begin by gathering all necessary financial information, including revenue from business activities and any expenses incurred. This information is crucial for filling out the form correctly.

Next, organizations must accurately complete each section of the form, ensuring that all income and deductions are reported. It is advisable to refer to the California Form 109 instructions for detailed guidance on each line item. After completing the form, organizations should review it for accuracy before submission to avoid any potential penalties.

How to Obtain Form 109

Organizations can obtain Form 109 from the California Franchise Tax Board's official website. The form is available in PDF format, allowing for easy printing and completion. Additionally, organizations may also request a paper copy of the form directly from the FTB if they prefer not to download it online.

It is essential to ensure that the correct version of Form 109 is used, as there may be updates or changes in the instructions from one tax year to the next. Keeping abreast of any changes will help organizations remain compliant with state tax laws.

Key Elements of Form 109

Form 109 includes several key elements that organizations need to be aware of when filing. These elements typically include sections for reporting gross receipts, allowable deductions, and any taxable income. Additionally, the form may require information about the organization's exempt status and details on any business activities conducted.

Understanding these key components is vital for ensuring that the form is filled out accurately and completely. Organizations should pay close attention to the instructions provided with the form to ensure compliance with all reporting requirements.

Filing Deadlines for Form 109

Organizations must be aware of the filing deadlines associated with Form 109 to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization's fiscal year. For organizations operating on a calendar year, this typically falls on May 15. It is crucial for organizations to mark their calendars and prepare their filings in advance to meet these deadlines.

In certain circumstances, organizations may be eligible to request an extension for filing. However, it is important to note that any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Legal Use of Form 109

Form 109 serves a legal purpose in ensuring that exempt organizations comply with California tax laws. By accurately reporting business income, organizations fulfill their obligations under state regulations. Failure to file Form 109 or inaccuracies in reporting can lead to penalties, including fines and potential loss of tax-exempt status.

Organizations should consult with tax professionals or legal advisors to understand their specific obligations regarding Form 109 and to ensure compliance with all legal requirements. This proactive approach can help mitigate risks associated with non-compliance.

Quick guide on how to complete form 109 california exempt organization business income tax return form 109 california exempt organization business income tax

Effortlessly prepare Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R on any device

Web-based document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R on any platform with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to edit and electronically sign Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R with ease

- Locate Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R and then click Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and bears the same legal significance as a conventional ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and electronically sign Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R while ensuring effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 109 california exempt organization business income tax return form 109 california exempt organization business income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the starting price for using airSlate SignNow 109?

The starting price for using airSlate SignNow 109 is designed to be cost-effective for businesses of all sizes. With flexible pricing plans, you can choose the one that best fits your needs and budget. Additionally, airSlate SignNow offers a free trial, allowing you to explore the features before committing to a plan.

-

How does airSlate SignNow 109 enhance document management?

airSlate SignNow 109 enhances document management by providing a streamlined platform for sending and eSigning documents. It allows users to create, edit, and manage documents efficiently, signNowly reducing turnaround times. The intuitive interface ensures that teams can collaborate seamlessly on all document-related tasks.

-

What features are included in the airSlate SignNow 109 plan?

The airSlate SignNow 109 plan includes essential features such as customizable templates, bulk sending, and robust tracking capabilities. Users can also utilize advanced features like document expiration and reminders, ensuring timely responses and management. These features collectively optimize the eSigning process for businesses.

-

Is airSlate SignNow 109 compliant with industry regulations?

Yes, airSlate SignNow 109 is compliant with a variety of industry regulations, including ESIGN and UETA. This ensures that all eSigned documents have the same legal weight as traditional signatures, providing peace of mind for businesses. Compliance is a top priority for airSlate SignNow, making it a trusted choice for many industries.

-

What integrations does airSlate SignNow 109 support?

airSlate SignNow 109 supports integrations with various business tools and applications, including Salesforce, Google Workspace, and Microsoft Office. These integrations enhance workflow efficiency by allowing users to send and manage documents directly from their favorite applications. This connection helps streamline processes, making document management more cohesive.

-

Can I customize templates in airSlate SignNow 109?

Absolutely! In airSlate SignNow 109, users can easily create and customize templates to suit their specific needs. This feature signNowly speeds up the document creation process, as you can reuse standard documents without starting from scratch each time. Customization also ensures that your branding remains consistent across all communications.

-

How can airSlate SignNow 109 benefit my business?

airSlate SignNow 109 can greatly benefit your business by improving the efficiency of your document processes. By enabling quick eSigning, the platform reduces the time it takes to finalize agreements, enhancing productivity. Additionally, it provides a secure way to manage sensitive documents, thereby protecting your business interests.

Get more for Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

- Form 3676 2014

- Michigan department of treasury 4640 rev 12 10 2018 2019 form

- Michigan department of treasury 4640 rev 12 10 2015 form

- 2018 michigan adjustments of capital gains and losses mi 1040d form

- 2014 michigan mi 1040 individual income tax state of michigan form

- Ig260 2015 form

- Minnesota form ig260 2018 2019

- Minnesota form ig260 2016

Find out other Form 109 California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax R

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors