Schedule 1 Form 1040 Additional Income and Adjustments to Income

Understanding the Schedule 1 Form 1040

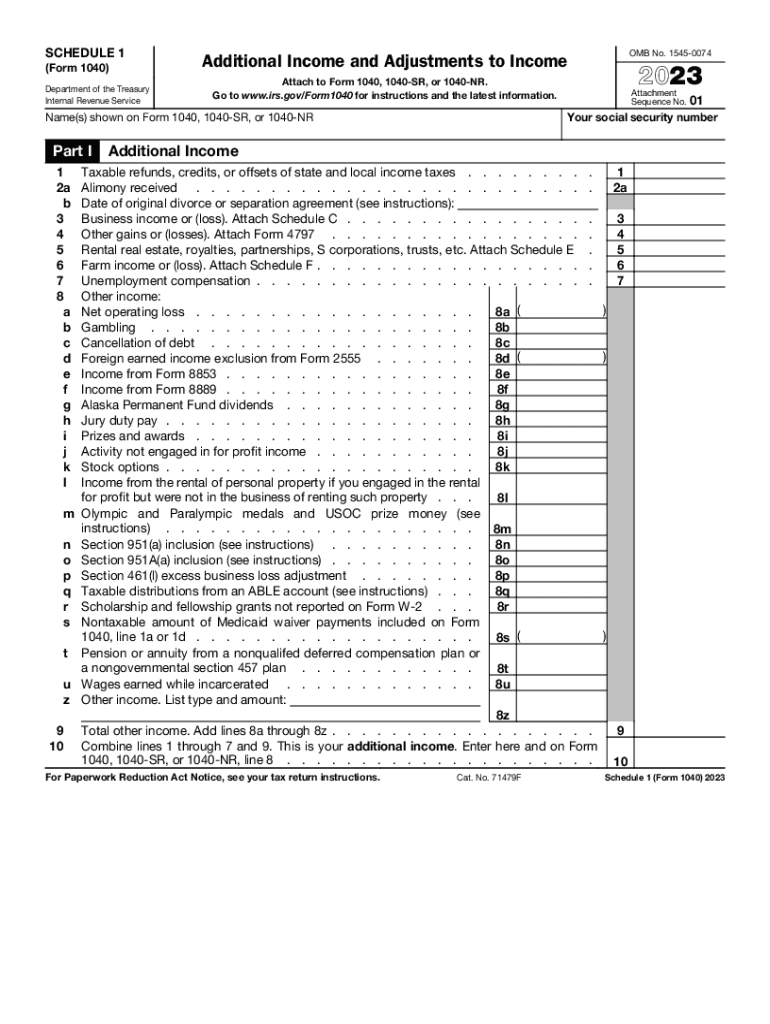

The Schedule 1 form, officially known as the IRS Schedule 1, is a crucial document for taxpayers in the United States. It is used to report additional income and adjustments to income that are not included directly on the main Form 1040. This form helps taxpayers accurately calculate their total income and determine their tax liability. Common types of income reported on Schedule 1 include unemployment compensation, rental income, and certain types of interest. Additionally, adjustments such as educator expenses and student loan interest can also be claimed on this form.

Steps to Complete the Schedule 1 Form 1040

Completing the Schedule 1 form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and receipts for adjustments.

- Fill out personal information: Enter your name, Social Security number, and other identifying information at the top of the form.

- Report additional income: In Part I, list all sources of additional income, ensuring accuracy to avoid discrepancies.

- Claim adjustments to income: In Part II, enter any applicable adjustments, such as contributions to retirement accounts or health savings accounts.

- Review and verify: Double-check all entries for accuracy before submitting the form.

How to Obtain the Schedule 1 Form 1040

The Schedule 1 form can be easily obtained through several methods:

- IRS website: Download the form directly from the official IRS website in PDF format.

- Tax preparation software: Many tax software programs automatically include Schedule 1 when you prepare your return.

- Local IRS office: Visit a local IRS office to request a physical copy of the form.

IRS Guidelines for Schedule 1

The IRS provides specific guidelines for filling out Schedule 1, which include:

- Eligibility: Ensure you meet the criteria for reporting additional income and adjustments.

- Filing requirements: Follow the IRS instructions for when and how to file the form, including any deadlines.

- Documentation: Keep all supporting documents for reported income and adjustments for at least three years in case of an audit.

Common Scenarios for Using Schedule 1

Various taxpayer scenarios may require the use of Schedule 1, including:

- Self-employed individuals: Report income from freelance work or side businesses.

- Students: Claim adjustments for student loan interest or qualified education expenses.

- Retirees: Report pension income or other retirement distributions.

Filing Deadlines for Schedule 1

It is important to be aware of the filing deadlines associated with Schedule 1:

- Tax return due date: Typically, individual tax returns, including Schedule 1, are due on April 15 of each year.

- Extensions: If you file for an extension, the deadline may be extended to October 15, but Schedule 1 must still be submitted with your tax return.

Quick guide on how to complete schedule 1 form 1040 additional income and adjustments to income

Prepare Schedule 1 Form 1040 Additional Income And Adjustments To Income effortlessly on any device

Web-based document management has gained traction with businesses and individuals alike. It offers an ideal sustainable alternative to conventional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Handle Schedule 1 Form 1040 Additional Income And Adjustments To Income on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and electronically sign Schedule 1 Form 1040 Additional Income And Adjustments To Income with ease

- Find Schedule 1 Form 1040 Additional Income And Adjustments To Income and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Schedule 1 Form 1040 Additional Income And Adjustments To Income and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule 1 form 1040 additional income and adjustments to income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule 1 in the context of airSlate SignNow?

Schedule 1 refers to a specific timeline or roadmap for implementing airSlate SignNow solutions within your business. It involves aligning your document management processes with the eSigning capabilities of the platform to enhance efficiency and compliance.

-

How can I create a schedule 1 for my eSigning needs?

To create a schedule 1 for your eSigning needs using airSlate SignNow, you can start by assessing the types of documents you frequently send and the corresponding approval processes. Once identified, map out the timeline and responsibilities required for each step to streamline your eSigning workflow.

-

What are the pricing options for airSlate SignNow's services?

airSlate SignNow offers various pricing plans to meet different business needs. You can choose from monthly or annual subscriptions, with options that cater to small businesses as well as larger enterprises, ensuring that you can customize your schedule 1 without breaking your budget.

-

What features are included in airSlate SignNow to assist with schedule 1?

The features included in airSlate SignNow that assist with schedule 1 encompass document templates, customizable workflows, and integration capabilities. These tools allow you to set deadlines, automate reminders, and track the status of your documents, providing clarity to your eSigning process.

-

How does airSlate SignNow enhance collaboration for schedule 1?

airSlate SignNow enhances collaboration for schedule 1 by allowing multiple users to view, edit, and sign documents in real time. This feature ensures that all stakeholders are informed and that the signing process can proceed quickly, minimizing delays and improving overall efficiency.

-

Can airSlate SignNow integrate with other tools to support my schedule 1?

Yes, airSlate SignNow can integrate with a variety of tools such as CRM systems, project management software, and cloud storage services. These integrations support your schedule 1 by linking different platforms, streamlining document handling, and maintaining consistent data flow across your operations.

-

What business benefits can I expect with schedule 1 implementation?

Implementing schedule 1 with airSlate SignNow offers numerous business benefits, including increased efficiency, reduced turnaround time for document approvals, and enhanced compliance. These advantages not only save time but also improve customer satisfaction and retention, making your processes more effective.

Get more for Schedule 1 Form 1040 Additional Income And Adjustments To Income

Find out other Schedule 1 Form 1040 Additional Income And Adjustments To Income

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template