Form 3588 2008

What is the Form 3588

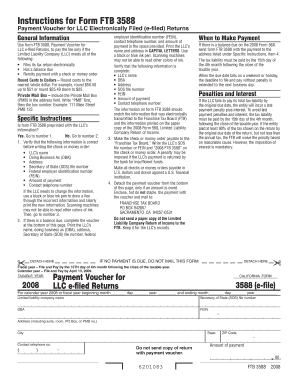

The Form 3588, also known as the California Form 3588, is a document used by individuals and businesses in California for specific tax-related purposes. This form is primarily utilized to request a tax voucher from the California Franchise Tax Board (FTB). It is essential for those who need to make estimated tax payments or manage their tax obligations efficiently. Understanding the purpose and function of the form is crucial for ensuring compliance with state tax regulations.

How to Use the Form 3588

Using the Form 3588 involves several steps to ensure accurate completion and submission. First, gather all necessary information, including your personal details and tax identification number. Next, fill out the form by providing the required information, such as the amount you wish to pay and the relevant tax year. Once completed, the form can be submitted electronically through a secure platform or mailed to the appropriate address provided by the FTB. It is important to double-check all entries for accuracy to avoid delays in processing.

Steps to Complete the Form 3588

Completing the Form 3588 requires attention to detail. Follow these steps for a smooth process:

- Obtain the latest version of the Form 3588 from the California Franchise Tax Board website.

- Fill in your name, address, and social security number or taxpayer identification number.

- Specify the tax year for which you are making the payment.

- Enter the amount you wish to pay on the designated line.

- Review the form for any errors or omissions.

- Submit the completed form electronically or by mail, as per your preference.

Legal Use of the Form 3588

The legal validity of the Form 3588 hinges on compliance with California tax laws. To ensure that the form is legally binding, it must be filled out accurately and submitted in accordance with the guidelines set forth by the FTB. Utilizing a reliable electronic signature solution can enhance the legal standing of the document, as it provides a digital certificate that verifies the signer's identity. This is particularly important when dealing with tax matters, as any discrepancies can lead to penalties or delays.

Key Elements of the Form 3588

Several key elements must be included in the Form 3588 to ensure its effectiveness:

- Taxpayer Information: Accurate personal details, including name and identification number.

- Tax Year: Clearly indicate the tax year for which the payment is being made.

- Payment Amount: Specify the exact amount of the estimated tax payment.

- Signature: An electronic or handwritten signature is required to validate the form.

Form Submission Methods

The Form 3588 can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online Submission: Complete and submit the form through the FTB's secure online portal.

- Mail: Send the completed form to the designated address provided by the FTB.

- In-Person: Drop off the form at a local FTB office if preferred.

Quick guide on how to complete form 3588

Prepare Form 3588 effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to access the right forms and securely keep them online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 3588 across any platform using airSlate SignNow's Android or iOS applications and enhance your document-oriented process today.

The simplest way to modify and eSign Form 3588 with ease

- Find Form 3588 and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Form 3588 to guarantee outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 3588

Create this form in 5 minutes!

How to create an eSignature for the form 3588

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3588 and how can airSlate SignNow help with it?

Form 3588 is a document utilized for specific regulatory processes. airSlate SignNow simplifies the completion and eSigning of form 3588, allowing businesses to streamline their workflows and stay compliant without hassle.

-

Is there a cost associated with using airSlate SignNow for form 3588?

Yes, airSlate SignNow offers a range of pricing plans designed to fit various business needs. Each plan provides access to features that enhance the eSigning experience for documents like form 3588, ensuring cost-effective solutions.

-

What features does airSlate SignNow offer for managing form 3588?

airSlate SignNow includes features such as document templates, secure eSigning, and real-time tracking for form 3588. These tools not only increase efficiency but also ensure that your document handling remains both organized and compliant.

-

Can I integrate airSlate SignNow with other applications for form 3588?

Absolutely! airSlate SignNow offers integration capabilities with various platforms, facilitating smooth workflows for handling form 3588. Whether using CRMs, cloud storage, or productivity tools, you can connect easily with airSlate SignNow.

-

How does airSlate SignNow ensure the security of form 3588?

airSlate SignNow prioritizes security with advanced encryption and authentication measures for form 3588. This ensures that your sensitive information remains protected while complying with industry standards and regulations.

-

What are the benefits of using airSlate SignNow for form 3588?

Using airSlate SignNow for form 3588 provides signNow benefits, including faster processing times, reduced paper usage, and improved accuracy in documentation. These advantages lead to enhanced operational efficiency and cost savings.

-

Can I customize form 3588 in airSlate SignNow?

Yes, airSlate SignNow allows for customization of form 3588, enabling you to tailor the document to your specific requirements. This flexibility helps ensure that all necessary information is collected with ease during the signing process.

Get more for Form 3588

Find out other Form 3588

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA