Form 3805V Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations Individuals, Estates, and Trusts Form 3805V

Understanding the 3805V Form for Net Operating Loss Computation

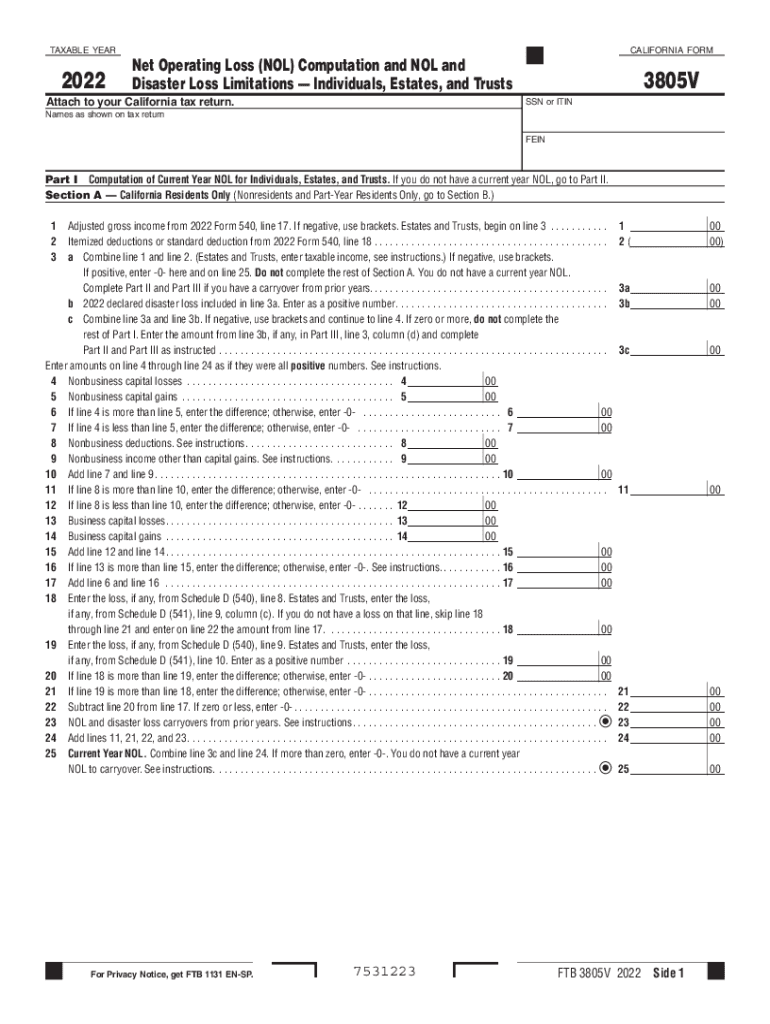

The 3805V form, officially known as the FTB Form 3805V, is designed for individuals, estates, and trusts to compute net operating losses (NOL) and disaster loss limitations. This form is crucial for taxpayers who have incurred losses that can be applied to offset taxable income in other years, potentially resulting in tax refunds or reduced tax liabilities. It is particularly relevant for those affected by disasters, as it allows for specific deductions and adjustments related to such events.

Steps to Complete the 3805V Form

Completing the 3805V form involves several key steps:

- Gather necessary financial documents, including prior year tax returns and records of losses.

- Fill out personal information, including your name, Social Security number, and tax year.

- Calculate your net operating loss by following the guidelines provided on the form.

- Detail any disaster losses, ensuring to meet the specific criteria outlined by the IRS.

- Review your calculations for accuracy before submission.

Obtaining the 3805V Form

The 3805V form can be obtained directly from the California Franchise Tax Board (FTB) website. It is available in a downloadable format, allowing taxpayers to print and complete it at their convenience. Additionally, the form can be requested by mail if preferred. Ensure you are using the most current version to comply with all regulations.

Key Elements of the 3805V Form

Important components of the 3805V form include:

- Taxpayer Information: Essential details such as name and Social Security number.

- Net Operating Loss Calculation: A section dedicated to determining the amount of loss available for carryover.

- Disaster Loss Reporting: Specific lines for detailing losses due to federally declared disasters.

- Signature Section: A requirement for the taxpayer's signature to validate the form.

Legal Use of the 3805V Form

The 3805V form is legally recognized for calculating net operating losses and disaster losses under California tax law. It is essential for taxpayers to ensure that they meet all eligibility requirements and adhere to filing guidelines to avoid penalties. Misuse of the form or incorrect calculations can lead to compliance issues with the California Franchise Tax Board.

Examples of Using the 3805V Form

There are various scenarios in which the 3805V form is applicable:

- A self-employed individual who experienced a significant drop in income due to a natural disaster.

- An estate that incurred losses from investments that can be offset against future income.

- A trust that needs to report losses from property damage in a federally declared disaster area.

Quick guide on how to complete form 3805v net operating loss nol computation and nol and disaster loss limitations individuals estates and trusts form 3805v

Easily prepare Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as it allows you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your papers swiftly without complications. Manage Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V on any platform using airSlate SignNow’s apps for Android or iOS and streamline any document-related task today.

How to modify and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V effortlessly

- Find Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select important sections of your documents or redact sensitive details with tools that airSlate SignNow offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to apply your changes.

- Choose how you would like to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3805v net operating loss nol computation and nol and disaster loss limitations individuals estates and trusts form 3805v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3805v form and why do I need it?

The 3805v form is a key document used for various regulatory needs. It's essential for compliance, ensuring that your business meets necessary requirements. By utilizing the 3805v form efficiently, you streamline your processes and avoid penalties.

-

How does airSlate SignNow simplify the completion of the 3805v form?

airSlate SignNow provides an intuitive platform that allows users to complete the 3805v form electronically. With features like easy document editing and eSigning, you can efficiently fill out and submit the form without hassles. This not only saves time but also reduces the likelihood of errors.

-

What are the pricing options for using the 3805v form in airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different business sizes and needs, all of which include access to the 3805v form features. Whether you’re a small business or a large enterprise, there's a plan that suits your budget. You can check the website for detailed pricing information.

-

Can I integrate the 3805v form with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integration with multiple applications, allowing you to seamlessly use the 3805v form in conjunction with your existing systems. This capability enhances workflow efficiency, making it easier to manage documents across platforms. You can connect with CRMs, cloud storage, and more.

-

What benefits does using airSlate SignNow for the 3805v form provide?

Using airSlate SignNow for the 3805v form provides numerous benefits, including improved speed and security in document management. The digital format allows you to track and manage submissions effortlessly. Additionally, the platform enhances collaboration among teams, facilitating quicker decision-making.

-

Is electronic signing of the 3805v form legally valid?

Yes, electronic signing of the 3805v form through airSlate SignNow is legally valid in most jurisdictions. The platform complies with electronic signature laws such as the ESIGN Act and UETA, ensuring that your signed documents are enforceable. This makes it a reliable solution for handling your forms.

-

How can I ensure the security of my 3805v form documents in airSlate SignNow?

airSlate SignNow employs advanced security measures to protect your 3805v form documents. Features include secure data encryption, two-factor authentication, and regular security audits. With these protections, you can confidently manage sensitive information without concerns about data bsignNowes.

Get more for Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V

Find out other Form 3805V Net Operating Loss NOL Computation And NOL And Disaster Loss Limitations Individuals, Estates, And Trusts Form 3805V

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now