California Form 565 Partnership Return of Income , California Form 565, Partnership Return of Income

Understanding the California Form 565 Partnership Return of Income

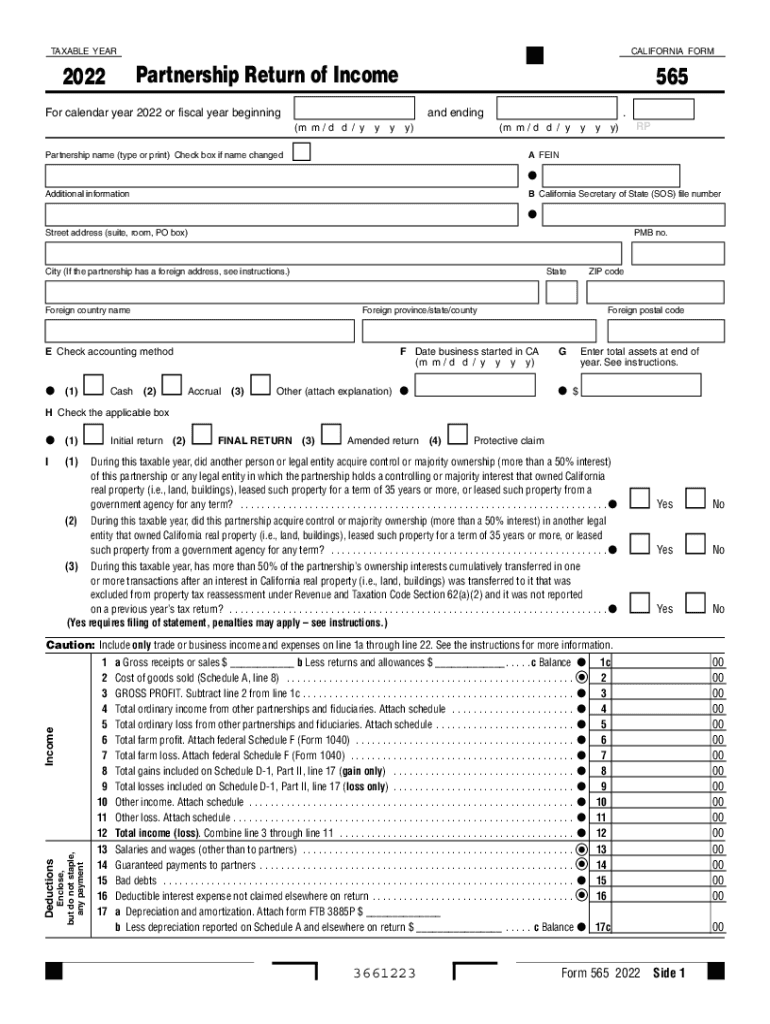

The California Form 565 is a crucial document for partnerships operating in California. This form, officially known as the Partnership Return of Income, is used to report the income, deductions, and credits of partnerships. It plays a significant role in ensuring compliance with California tax laws. Partnerships must file this form annually to provide the California Franchise Tax Board (FTB) with essential information about their financial activities.

By accurately completing the Form 565, partnerships help ensure that all partners are properly taxed on their share of the income. This form is particularly important for limited partnerships and general partnerships, as it outlines each partner's distributive share of income, deductions, and credits.

Steps to Complete the California Form 565 Partnership Return of Income

Completing the California Form 565 requires careful attention to detail. Here are the essential steps to follow:

- Gather necessary information: Collect all relevant financial documents, including income statements, expense reports, and partner information.

- Complete the header section: Fill in the partnership's name, address, and federal employer identification number (FEIN).

- Report income: Enter total income earned by the partnership, including sales, services, and other revenue streams.

- Deduct allowable expenses: List all deductible expenses, such as operating costs, salaries, and other business-related expenditures.

- Calculate distributive shares: Determine each partner's share of income, deductions, and credits based on the partnership agreement.

- Sign and date the form: Ensure that an authorized partner signs the form before submission.

Obtaining the California Form 565 Partnership Return of Income

Partnerships can obtain the California Form 565 from the California Franchise Tax Board's website or through various tax preparation software. The form is available for download in PDF format, allowing for easy printing and completion. Additionally, tax professionals can assist in obtaining the form and ensuring it is filled out correctly. It is essential to use the most current version of the form to comply with any recent changes in tax regulations.

Key Elements of the California Form 565 Partnership Return of Income

The California Form 565 includes several key elements that partnerships must complete:

- Partnership information: Basic details about the partnership, including name, address, and FEIN.

- Income and deductions: Sections to report total income and allowable deductions, which affect the overall tax liability.

- Partner information: A detailed breakdown of each partner's share of income, deductions, and credits.

- Signature section: A space for an authorized partner to sign, confirming the accuracy of the information provided.

Legal Use of the California Form 565 Partnership Return of Income

The California Form 565 is legally required for partnerships operating in California. Filing this form ensures compliance with state tax laws and helps avoid potential penalties for non-compliance. Partnerships that fail to file or inaccurately report their income may face fines and interest on unpaid taxes. It is essential for partnerships to understand their legal obligations regarding this form to maintain good standing with the California Franchise Tax Board.

Filing Deadlines for the California Form 565 Partnership Return of Income

Partnerships must adhere to specific filing deadlines for the California Form 565. Generally, the form is due on the 15th day of the third month following the close of the partnership's tax year. For partnerships operating on a calendar year, this means the form is typically due by March 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Partnerships may also request an automatic six-month extension to file, but any taxes owed must still be paid by the original due date to avoid penalties.

Quick guide on how to complete california form 565 partnership return of income california form 565 partnership return of income

Complete California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents promptly without delays. Handle California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income effortlessly

- Locate California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or conceal sensitive details using the tools that airSlate SignNow specifically offers for this purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to finalize your changes.

- Decide how you would like to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and electronically sign California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california form 565 partnership return of income california form 565 partnership return of income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 565 form and how can airSlate SignNow assist with it?

The 565 form is an essential document used for various business and tax purposes. airSlate SignNow simplifies the process of completing and eSigning the 565 form by providing an intuitive platform that allows you to fill out, send, and manage your documents securely.

-

Are there any costs associated with using airSlate SignNow for the 565 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including a free trial to get started. Once the trial period ends, you can choose a plan that best fits your business requirements when managing documents like the 565 form.

-

What features does airSlate SignNow offer for completing the 565 form?

airSlate SignNow provides a range of features for the 565 form, including customizable templates, automated workflows, and secure eSignature capabilities. These features streamline the process, allowing for easier collaboration and quicker turnaround times.

-

Can airSlate SignNow integrate with other software for handling the 565 form?

Absolutely! airSlate SignNow supports various integrations with other software tools that businesses commonly use. This means you can easily connect your existing applications to enhance the efficiency of managing the 565 form and other documents.

-

How does airSlate SignNow ensure the security of the 565 form?

Security is a top priority for airSlate SignNow, especially when dealing with important documents like the 565 form. The platform employs encryption, secure data storage, and rigorous access controls to ensure that your information remains protected throughout the signing process.

-

Can I track the status of my 565 form with airSlate SignNow?

Yes, airSlate SignNow offers a tracking feature that allows you to monitor the status of your 565 form in real-time. You will receive notifications when the document is viewed and signed, keeping you informed throughout the entire process.

-

Is it easy to invite others to eSign the 565 form using airSlate SignNow?

Yes, inviting others to eSign your 565 form is incredibly simple with airSlate SignNow. You can easily send out invitations via email, and recipients can sign the document from any device, making the process seamless and efficient.

Get more for California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income

Find out other California Form 565 Partnership Return Of Income , California Form 565, Partnership Return Of Income

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online