IRS Releases Draft Form 941 Series Instructions

What is the IRS Releases Draft Form 941 Series Instructions

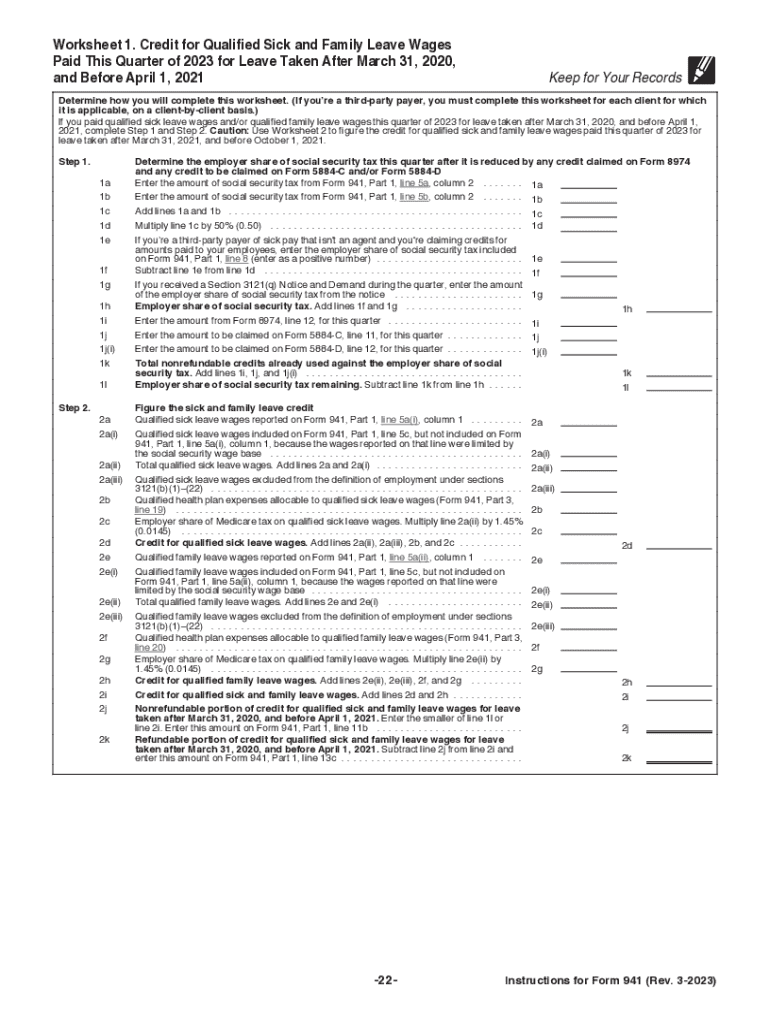

The IRS Releases Draft Form 941 Series Instructions provide guidance on how to accurately complete Form 941 for 2023. This form is essential for employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. The draft instructions outline the necessary steps, key information required, and any updates or changes for the current tax year. Understanding these instructions is crucial for compliance and to avoid potential penalties.

Steps to complete the IRS Releases Draft Form 941 Series Instructions

Completing the IRS Releases Draft Form 941 Series Instructions involves several key steps:

- Review the latest draft instructions to understand any changes for 2023.

- Gather all necessary documentation, including employee wage records and tax withholding information.

- Fill out the form accurately, ensuring all fields are completed as per the instructions.

- Double-check calculations for accuracy, particularly for tax amounts owed.

- Submit the completed form by the specified deadline to avoid penalties.

Filing Deadlines / Important Dates

For 2023, it is important to be aware of the filing deadlines associated with Form 941. Generally, the form must be filed quarterly, with specific due dates for each quarter:

- First quarter: Due by April 30, 2023

- Second quarter: Due by July 31, 2023

- Third quarter: Due by October 31, 2023

- Fourth quarter: Due by January 31, 2024

Late submissions may result in penalties, so adhering to these deadlines is crucial for compliance.

Required Documents

To complete Form 941 for 2023, certain documents are necessary. These include:

- Payroll records detailing employee wages and tax withholdings.

- Previous quarter's Form 941, if applicable, for reference.

- Any relevant tax forms or documentation related to tax credits or adjustments.

Having these documents on hand will facilitate a smoother completion process and ensure accuracy.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 941 can lead to significant penalties. These may include:

- Failure-to-file penalty, which can be a percentage of the unpaid tax.

- Failure-to-pay penalty, which accrues daily until the tax is paid in full.

- Interest on unpaid taxes, which continues to accumulate until the balance is settled.

Understanding these penalties emphasizes the importance of timely and accurate filing.

Form Submission Methods

Form 941 can be submitted through various methods, providing flexibility for employers. The available submission options include:

- Online filing through authorized e-file providers.

- Mailing a paper form to the designated IRS address based on your location.

- In-person submission at local IRS offices, if necessary.

Choosing the right method can help ensure that the form is received on time and processed efficiently.

Quick guide on how to complete irs releases draft form 941 series instructions

Effortlessly Prepare IRS Releases Draft Form 941 Series Instructions on Any Device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle IRS Releases Draft Form 941 Series Instructions on any device using the airSlate SignNow applications for Android or iOS and simplify any document-related tasks today.

How to Edit and eSign IRS Releases Draft Form 941 Series Instructions with Ease

- Find IRS Releases Draft Form 941 Series Instructions and select Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools explicitly designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign IRS Releases Draft Form 941 Series Instructions to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs releases draft form 941 series instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 941 for 2023 form and why is it important?

The 941 for 2023 is a key quarterly tax form used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. Understanding and effectively managing the 941 for 2023 is crucial for maintaining compliance with the IRS while avoiding penalties.

-

How can airSlate SignNow assist with filing the 941 for 2023?

airSlate SignNow offers a seamless solution to prepare and eSign your 941 for 2023 forms electronically. This enables businesses to save time and reduce the risk of errors, ensuring that documents are correctly signed and submitted in a timely manner.

-

What pricing plans does airSlate SignNow offer for managing the 941 for 2023?

AirSlate SignNow provides various pricing plans to suit different business sizes and needs. These plans ensure that companies looking to manage their 941 for 2023 forms can choose an economical solution that best fits their budget while accessing robust features.

-

What features does airSlate SignNow provide for 941 for 2023 document management?

AirSlate SignNow includes features like customizable templates, real-time collaboration, and automated reminders to manage the 941 for 2023 effectively. These tools make it easier for businesses to streamline their document workflows while ensuring legal compliance.

-

Can airSlate SignNow integrate with accounting software for handling the 941 for 2023?

Yes, airSlate SignNow can seamlessly integrate with a variety of accounting software platforms, allowing for efficient management of the 941 for 2023. This integration ensures that all necessary data is synced accurately, reducing manual entry and the likelihood of errors.

-

What are the benefits of eSigning the 941 for 2023 with airSlate SignNow?

Using airSlate SignNow to eSign the 941 for 2023 offers numerous benefits, such as increased efficiency and faster turnaround times. With a secure and legally binding electronic signature, businesses can be confident that their forms are valid, saving both time and resources.

-

Is airSlate SignNow secure for submitting sensitive documents like the 941 for 2023?

Absolutely! AirSlate SignNow employs top-tier encryption and security protocols to ensure that sensitive documents, such as the 941 for 2023, are protected. Businesses can have peace of mind knowing that their data is safe and their compliance needs are met.

Get more for IRS Releases Draft Form 941 Series Instructions

- Use this form to report suspected abuse neglect financial exploitation or an immediate risk of serious injury or death press

- Wvdhhr adoption form

- Pdf application for benefits west virginia department of health and form

- Form 61b pdf

- Chambers appointment hearing request form motions

- California revocation form

- Civil self help center saclaw org form

- Authorization and payment for investigative expert and other form

Find out other IRS Releases Draft Form 941 Series Instructions

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word