Business LicenseNew ApplicationsTreasurer Tax Form

What is the Business License New Applications Treasurer Tax

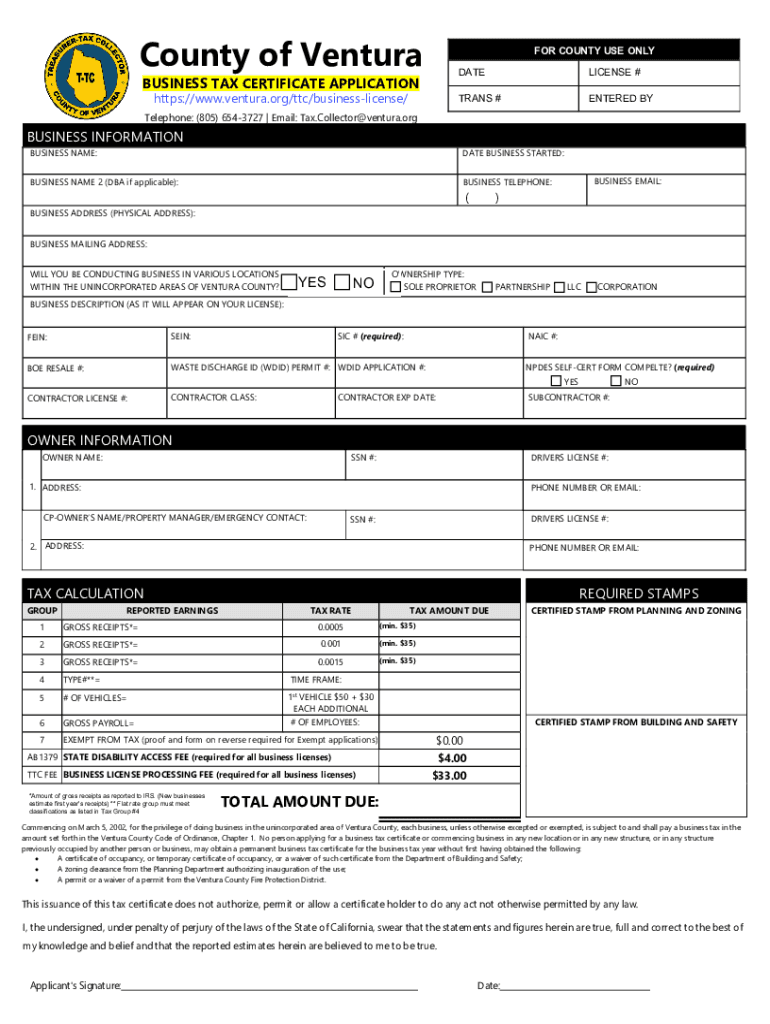

The Business License New Applications Treasurer Tax is a crucial document required for businesses operating within various jurisdictions in the United States. This form serves as an official application for obtaining a business license, allowing entities to legally conduct operations. It is essential for compliance with local, state, and federal regulations, ensuring that businesses meet necessary legal standards.

This form often includes information about the business structure, ownership, and the nature of the services or products offered. Proper completion of this document is vital for avoiding potential legal issues and penalties associated with operating without a valid license.

How to Obtain the Business License New Applications Treasurer Tax

Obtaining the Business License New Applications Treasurer Tax involves several steps to ensure compliance with local regulations. Initially, businesses must identify the specific requirements set by their state or local government. This can typically be done through the official website of the local treasurer's office or business licensing department.

Once the requirements are understood, businesses should gather all necessary documentation, which may include proof of identity, business structure details, and any relevant permits. After compiling the required documents, the application can be submitted either online or in person, depending on the jurisdiction's guidelines.

Steps to Complete the Business License New Applications Treasurer Tax

Completing the Business License New Applications Treasurer Tax requires careful attention to detail. Here are the general steps involved:

- Research local requirements: Visit your local government website to understand specific licensing requirements.

- Gather necessary documents: Collect all required documentation, such as identification, business structure information, and any permits.

- Fill out the application: Carefully complete the application form, ensuring all information is accurate and complete.

- Submit the application: Depending on local regulations, submit the application online, by mail, or in person.

- Pay applicable fees: Ensure that any required fees are paid at the time of submission.

- Await approval: After submission, monitor the application status and respond to any requests for additional information.

Required Documents

When applying for the Business License New Applications Treasurer Tax, several documents may be required to support the application. Commonly required documents include:

- Proof of identity: Such as a driver's license or state ID.

- Business formation documents: Articles of incorporation or partnership agreements, depending on the business structure.

- Tax identification number: An Employer Identification Number (EIN) may be necessary for tax purposes.

- Proof of address: Utility bills or lease agreements can serve as proof of business location.

- Any relevant permits: Depending on the industry, additional permits may be required.

Who Issues the Form

The Business License New Applications Treasurer Tax is typically issued by the local or state treasurer's office or the business licensing department. These offices are responsible for ensuring that businesses comply with local regulations and maintain proper licensing. It is important for applicants to check with their specific jurisdiction to identify the correct issuing authority and any additional requirements that may apply.

Penalties for Non-Compliance

Non-compliance with the Business License New Applications Treasurer Tax can result in significant penalties. Businesses operating without a valid license may face fines, legal action, or even closure of the business. Additionally, the inability to obtain necessary permits can hinder business operations and damage credibility with customers and partners. It is crucial to ensure that all licensing requirements are met to avoid these potential repercussions.

Quick guide on how to complete business licensenew applicationstreasurer tax

Effortlessly Prepare Business LicenseNew ApplicationsTreasurer Tax on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Handle Business LicenseNew ApplicationsTreasurer Tax on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The simplest way to modify and eSign Business LicenseNew ApplicationsTreasurer Tax effortlessly

- Acquire Business LicenseNew ApplicationsTreasurer Tax and click Get Form to begin.

- Employ the tools available to complete your template.

- Select important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal value as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to share your template, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form hunts, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Business LicenseNew ApplicationsTreasurer Tax while ensuring exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the business licensenew applicationstreasurer tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's solution for Business LicenseNew ApplicationsTreasurer Tax?

airSlate SignNow offers a streamlined platform for handling Business LicenseNew ApplicationsTreasurer Tax. Users can easily create, send, and eSign documents related to their business license applications, ensuring a smooth and efficient process.

-

How does airSlate SignNow ensure the security of my Business LicenseNew ApplicationsTreasurer Tax documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and compliance measures to safeguard your Business LicenseNew ApplicationsTreasurer Tax documents, giving you peace of mind that your sensitive information is protected.

-

What are the pricing options for using airSlate SignNow for Business LicenseNew ApplicationsTreasurer Tax?

airSlate SignNow offers various pricing plans tailored to meet different business needs, starting with a free trial. Evaluate our plans to find the best fit for your requirements related to Business LicenseNew ApplicationsTreasurer Tax and gain access to all essential features.

-

Can I integrate airSlate SignNow with other tools for Business LicenseNew ApplicationsTreasurer Tax?

Yes, airSlate SignNow seamlessly integrates with popular tools such as Google Workspace, Salesforce, and more. This allows you to manage your Business LicenseNew ApplicationsTreasurer Tax documents within your existing workflows, enhancing efficiency and productivity.

-

What features does airSlate SignNow provide for managing Business LicenseNew ApplicationsTreasurer Tax?

Our platform offers features such as customizable templates, automated workflows, and real-time tracking for Business LicenseNew ApplicationsTreasurer Tax. These tools help you manage documents more efficiently and stay organized throughout the application process.

-

Is training available for new users of airSlate SignNow focused on Business LicenseNew ApplicationsTreasurer Tax?

Absolutely! airSlate SignNow provides comprehensive training resources, including tutorials and webinars, specifically designed for users handling Business LicenseNew ApplicationsTreasurer Tax. This ensures you can maximize the platform's potential from the start.

-

How can airSlate SignNow improve my business's efficiency with Business LicenseNew ApplicationsTreasurer Tax?

By utilizing airSlate SignNow for Business LicenseNew ApplicationsTreasurer Tax, you streamline the signing process and reduce paperwork. This results in faster approvals and fewer delays, allowing your business to operate more efficiently.

Get more for Business LicenseNew ApplicationsTreasurer Tax

Find out other Business LicenseNew ApplicationsTreasurer Tax

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application