Rev 1500 2016

What is the Rev 1500

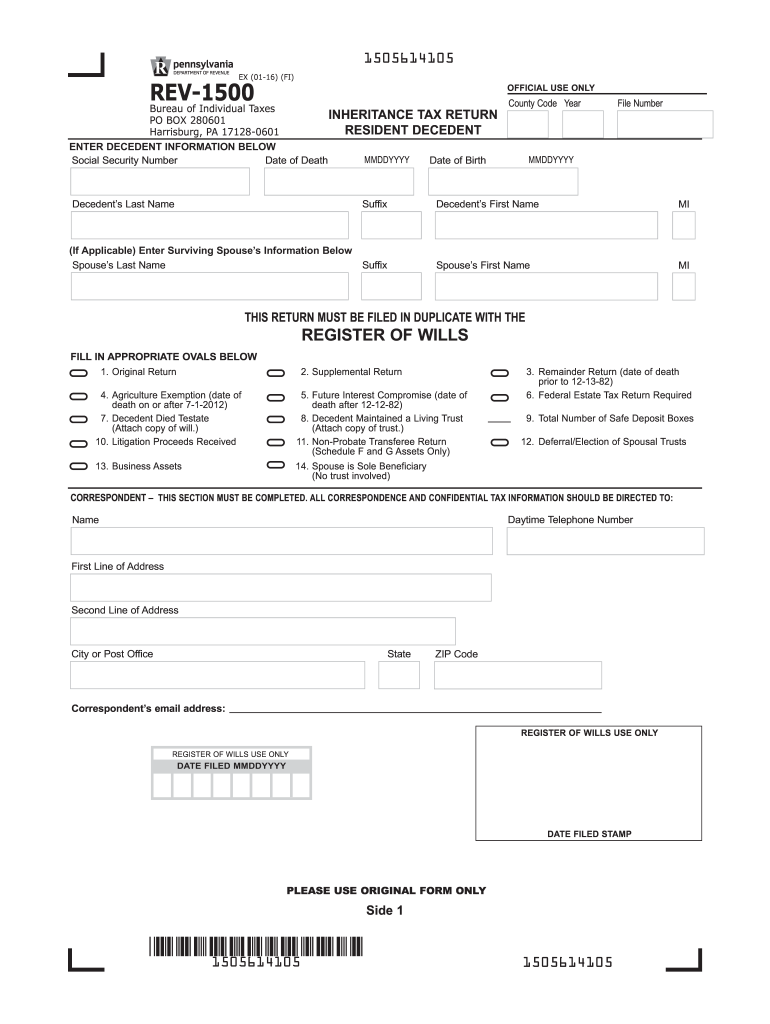

The Rev 1500 is a Pennsylvania inheritance tax return form used to report the transfer of assets from a deceased individual to their heirs. This form is essential for calculating the inheritance tax owed to the state. The Rev 1500 is designed to ensure compliance with Pennsylvania tax laws and to facilitate the proper assessment of taxes on inherited property. It includes detailed sections that require information about the deceased's estate, the beneficiaries, and the value of the assets transferred.

How to use the Rev 1500

Using the Rev 1500 involves several key steps. First, gather all necessary documentation regarding the deceased's assets, debts, and beneficiaries. Next, accurately complete the form by filling in the required fields, including the decedent’s information, the value of the estate, and details about each beneficiary. Once the form is completed, it must be signed and dated by the executor or administrator of the estate before submission. It is important to retain copies of the completed form and any supporting documents for your records.

Steps to complete the Rev 1500

Completing the Rev 1500 requires careful attention to detail. Follow these steps:

- Gather all relevant documents, including the death certificate, asset valuations, and beneficiary information.

- Fill out the decedent’s information, including their name, date of death, and Social Security number.

- List all assets in the estate, providing accurate valuations for each item.

- Identify each beneficiary and their respective share of the inheritance.

- Calculate the total inheritance tax due based on the value of the assets and applicable tax rates.

- Review the completed form for accuracy before signing it.

Legal use of the Rev 1500

The Rev 1500 must be used in accordance with Pennsylvania law. It is legally binding and must be filed within nine months of the decedent's death to avoid penalties. The form ensures that the inheritance tax is assessed correctly and that the estate complies with state regulations. Executors or administrators of the estate are responsible for ensuring that the form is filled out accurately and submitted on time.

Required Documents

To complete the Rev 1500, certain documents are required. These include:

- The death certificate of the deceased.

- Valuations of all assets within the estate, such as real estate, bank accounts, and personal property.

- Documentation of any debts or liabilities of the deceased.

- Information about the beneficiaries, including their names and relationships to the decedent.

Form Submission Methods

The Rev 1500 can be submitted in various ways. The preferred method is online submission through the Pennsylvania Department of Revenue's secure portal. Alternatively, the completed form can be mailed to the appropriate office or submitted in person at designated locations. It is important to ensure that the form is submitted correctly to avoid delays in processing.

Quick guide on how to complete and printable pa 1500 2016 2019 form

Your assistance manual on preparing your Rev 1500

If you’re wondering how to finalize and submit your Rev 1500, below are some brief guidelines to simplify tax submission.

First, you only need to create your airSlate SignNow profile to transform your document management online. airSlate SignNow is a very user-friendly and effective document solution that allows you to modify, create, and complete your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to adjust answers as necessary. Enhance your tax management with advanced PDF editing, eSigning, and easy sharing.

Follow the directions below to complete your Rev 1500 in a few minutes:

- Create your account and start working on PDFs in no time.

- Utilize our directory to access any IRS tax form; browse through various versions and schedules.

- Click Get form to launch your Rev 1500 in our editor.

- Fill in the required fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save your updates, print a copy, send it to the intended recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please be aware that submitting on paper can lead to return errors and slow down reimbursements. Be sure to check the IRS website for submission regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct and printable pa 1500 2016 2019 form

FAQs

-

How and when can I fill out the IPMAT 2019 admission form?

Thanks for A2A.The form is still not out. Generally, form filling date is announced in Feb.Keep checking IIM Indore site for more info.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

Do we need to fill out different forms for the January and April attempts of the JEE Mains 2019?

Dear studentYes ! There is different notification for each of these two exams , So a separate application for each of these two exam is required.Since it is not compulsory for candidate to appear in both the exam.NTA will prepare for exam and allot the seats as per actual no. of candidate to be appear in examination.Wishing you all the best !God bless !

Create this form in 5 minutes!

How to create an eSignature for the and printable pa 1500 2016 2019 form

How to make an eSignature for the And Printable Pa 1500 2016 2019 Form online

How to make an electronic signature for your And Printable Pa 1500 2016 2019 Form in Chrome

How to generate an eSignature for signing the And Printable Pa 1500 2016 2019 Form in Gmail

How to generate an electronic signature for the And Printable Pa 1500 2016 2019 Form from your smart phone

How to create an eSignature for the And Printable Pa 1500 2016 2019 Form on iOS devices

How to create an electronic signature for the And Printable Pa 1500 2016 2019 Form on Android

People also ask

-

What is Pennsylvania REV 1500?

The Pennsylvania REV 1500 form is a key document used for various transactions and requires eSignature capabilities. With airSlate SignNow, you can easily fill out and eSign the Pennsylvania REV 1500, ensuring compliance and efficiency.

-

How does airSlate SignNow help with filling the Pennsylvania REV 1500?

airSlate SignNow streamlines the process of completing the Pennsylvania REV 1500 by providing user-friendly templates. You can quickly fill out the necessary fields and eSign the document, saving valuable time and reducing errors in the process.

-

Is airSlate SignNow a cost-effective solution for managing the Pennsylvania REV 1500?

Absolutely! airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Utilizing our service for the Pennsylvania REV 1500 allows you to manage your documents without overspending while enjoying premium features.

-

What features does airSlate SignNow offer for the Pennsylvania REV 1500?

airSlate SignNow provides essential features such as secure eSigning, document storage, and template management tailored for the Pennsylvania REV 1500. Additionally, our platform enhances collaboration and tracking, making document management seamless.

-

Can I integrate airSlate SignNow with other applications for the Pennsylvania REV 1500?

Yes! airSlate SignNow offers integrations with a variety of popular applications, enhancing your workflow when dealing with the Pennsylvania REV 1500. You can connect with CRM systems, cloud storage solutions, and more for increased efficiency.

-

What are the benefits of using airSlate SignNow for the Pennsylvania REV 1500?

Using airSlate SignNow for the Pennsylvania REV 1500 provides benefits like improved turnaround time on documents, enhanced security features, and easy accessibility. You can streamline your business processes and keep everything organized in one platform.

-

Is mobile access available for the Pennsylvania REV 1500 form in airSlate SignNow?

Yes, airSlate SignNow is fully mobile-friendly, allowing you to access and sign the Pennsylvania REV 1500 from any device. This flexibility means you can manage important documents on the go, ensuring you never miss a deadline.

Get more for Rev 1500

- Eu ewr bescheinigung form

- Gravel moses lake form

- Fnb smart bond application form fnb co

- The platinum rule pdf form

- Kansas tag refund worksheet 225294652 form

- Family planning contraceptive implant consent form

- Instituto mexicano de la propiedad industrial solicitud de impi impi gob form

- Application spotlight employer sponsored coverage esc form

Find out other Rev 1500

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word