Types of Statements, Form 700 Years and

Understanding the Types of Statements for Form IL 700

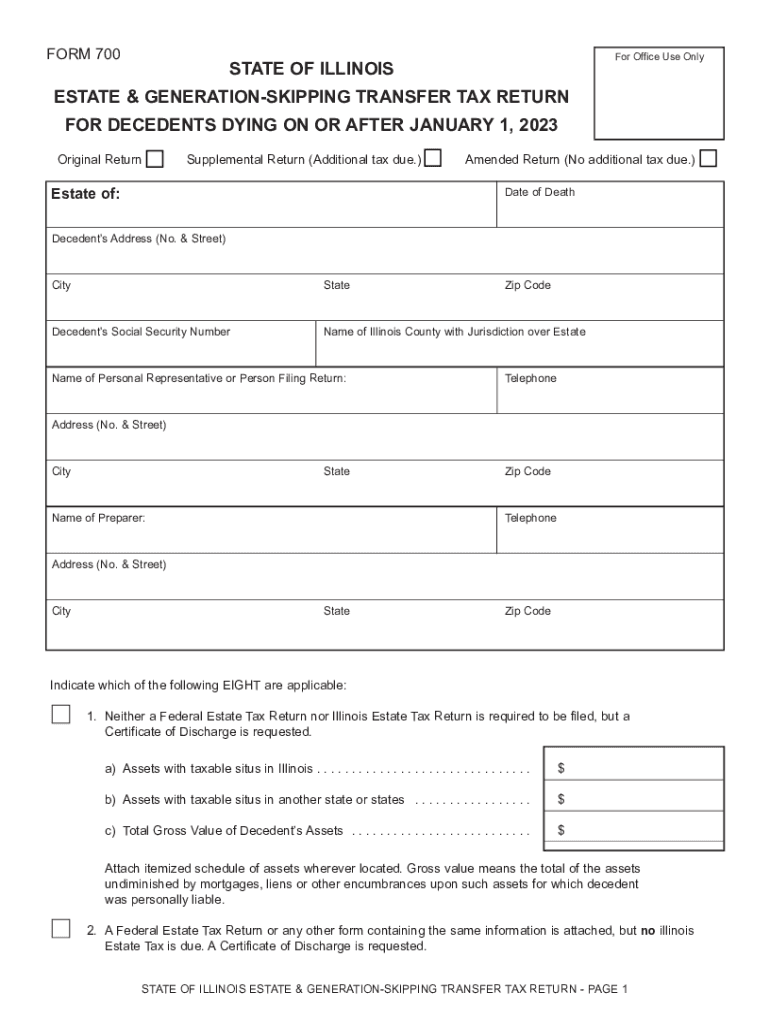

Form IL 700 is primarily used for estate tax purposes in Illinois. This form requires the filing of various types of statements related to the estate's value and assets. The types of statements typically include information about the decedent's property, debts, and any other relevant financial details. Understanding these statements is crucial for accurate reporting and compliance with state tax laws.

How to Complete the Form IL 700

Completing Form IL 700 involves several steps that require careful attention to detail. First, gather all necessary documentation, including the decedent's financial records, property deeds, and any outstanding debts. Next, fill out the form by providing accurate values for each asset and liability. Ensure that all calculations are correct, as errors can lead to penalties or delays in processing. Finally, review the form thoroughly before submission to confirm that all required information is included.

Filing Deadlines for Form IL 700

It is essential to be aware of the filing deadlines associated with Form IL 700. Generally, the form must be filed within nine months of the decedent's date of death. However, extensions may be available under certain circumstances. It is advisable to check with the Illinois Department of Revenue for specific dates and any updates related to filing requirements.

Required Documents for Form IL 700 Submission

When submitting Form IL 700, specific documents are required to support the information provided. These documents typically include the decedent's will, death certificate, property appraisals, and any relevant financial statements. Having these documents ready will facilitate a smoother filing process and help ensure compliance with state regulations.

Legal Use of Form IL 700

Form IL 700 serves a legal purpose in the estate administration process. It is used to report the value of the estate for tax assessment and to ensure that the appropriate taxes are paid. Failure to file this form accurately or on time can result in legal penalties, including fines or interest on unpaid taxes. Understanding the legal implications of this form is crucial for executors and administrators of estates.

Examples of Form IL 700 Usage

Form IL 700 is commonly used in various scenarios involving estate settlements. For instance, if an individual passes away leaving behind a house, bank accounts, and personal property, the executor must file this form to report the total value of the estate. Another example includes situations where the estate has outstanding debts that must be accounted for in the filing. Each case may differ based on the assets and liabilities involved, making it important to tailor the information accordingly.

Quick guide on how to complete types of statements form 700 years and

Effortlessly Prepare Types Of Statements, Form 700 Years And on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It presents a superb eco-friendly option to conventional printed and signed paperwork, allowing you to find the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without hindrances. Manage Types Of Statements, Form 700 Years And on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Types Of Statements, Form 700 Years And with Ease

- Find Types Of Statements, Form 700 Years And and click on Get Form to begin.

- Utilize the tools we supply to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Types Of Statements, Form 700 Years And and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the types of statements form 700 years and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is il 700 and how does airSlate SignNow relate to it?

The il 700 is a popular form for reporting income in various business scenarios. With airSlate SignNow, you can easily eSign and manage your il 700 documents digitally, streamlining your business processes for efficiency and accuracy.

-

Can I use airSlate SignNow for multiple il 700 forms?

Absolutely! airSlate SignNow allows you to handle multiple il 700 forms seamlessly. You can create templates, reuse existing documents, and ensure that all your forms are securely signed and stored.

-

How much does airSlate SignNow cost for processing il 700 forms?

airSlate SignNow offers various pricing plans based on usage and features. Generally, using airSlate SignNow for il 700 forms is cost-effective, providing excellent value by eliminating paper clutter and optimizing the signing process.

-

What features make airSlate SignNow ideal for handling il 700 documents?

airSlate SignNow includes features such as secure eSigning, customizable templates, and document tracking, making it perfect for managing il 700 documents. These tools enhance workflow efficiency and ensure compliance with relevant regulations.

-

Are there integrations available for airSlate SignNow with other tools when working with il 700?

Yes, airSlate SignNow integrates with various applications, enabling you to manage your il 700 processes effectively. You can connect it with CRM systems, project management tools, and cloud storage services to streamline your document management further.

-

Is airSlate SignNow secure for sending il 700 documents?

Security is a top priority for airSlate SignNow. When sending il 700 documents, you benefit from encryption, secure access controls, and audit trails, ensuring that your sensitive financial information remains protected.

-

How can airSlate SignNow improve the efficiency of submitting il 700 documentation?

By using airSlate SignNow, you can signNowly cut down the time spent on submitting il 700 documentation. The ability to eSign documents instantly and route them to relevant parties automates the workflow, ensuring faster approvals and submission.

Get more for Types Of Statements, Form 700 Years And

Find out other Types Of Statements, Form 700 Years And

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy