State of Emergency Tax Relief CDTFA CA Gov Form

Understanding the State of Emergency Tax Relief

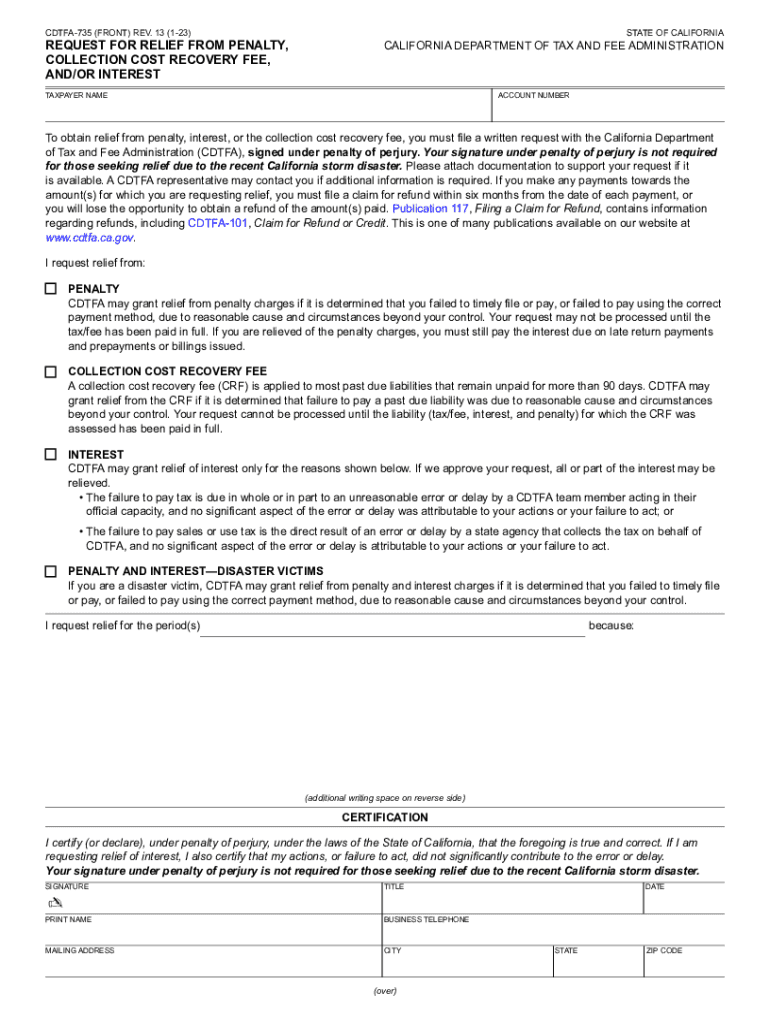

The State of Emergency Tax Relief provided by the California Department of Tax and Fee Administration (CDTFA) is designed to assist taxpayers during extraordinary circumstances. This relief can include waivers on penalties, interest, and fees related to tax obligations. It is essential for businesses and individuals to comprehend the specific provisions and eligibility criteria associated with this relief to effectively navigate their tax responsibilities during challenging times.

Eligibility Criteria for Relief

To qualify for the State of Emergency Tax Relief, taxpayers must meet specific conditions outlined by the CDTFA. Generally, eligibility includes being affected by the declared state of emergency, which may encompass natural disasters or significant public health crises. Taxpayers should review the official guidelines to ensure they meet all necessary criteria before applying for relief.

Steps to Apply for Relief

Applying for the State of Emergency Tax Relief involves several key steps:

- Identify your eligibility based on the criteria set by the CDTFA.

- Gather all required documentation, including tax returns and any relevant correspondence.

- Complete the necessary forms, such as the CDTFA-735, which may be required for penalty relief applications.

- Submit your application through the designated channels, which can include online submission or mailing your documents to the CDTFA.

Required Documents for Application

When applying for the State of Emergency Tax Relief, taxpayers must provide certain documentation to support their claims. Commonly required documents include:

- Completed CDTFA-735 form, if applicable.

- Proof of the state of emergency impact, such as notices from local government agencies.

- Previous tax returns to establish compliance history.

- Any additional documentation requested by the CDTFA during the application process.

Form Submission Methods

Taxpayers have several options for submitting their applications for the State of Emergency Tax Relief. These methods include:

- Online submission through the CDTFA's official website, which is often the fastest option.

- Mailing physical copies of the application and supporting documents to the appropriate CDTFA office.

- In-person submissions at designated CDTFA locations, where available.

Penalties for Non-Compliance

Failing to comply with tax obligations, even during a state of emergency, can result in penalties and interest charges. It is crucial for taxpayers to understand the implications of non-compliance, which may include:

- Increased penalties based on the amount owed.

- Accrual of interest on unpaid balances.

- Potential legal actions taken by the CDTFA to recover owed amounts.

Quick guide on how to complete state of emergency tax relief cdtfa ca gov

Finalize State Of Emergency Tax Relief CDTFA CA gov effortlessly on any device

Digital document management has become immensely popular among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents promptly without delays. Manage State Of Emergency Tax Relief CDTFA CA gov across any platform with airSlate SignNow's Android or iOS applications and enhance your document-centered workflow today.

The simplest method to modify and electronically sign State Of Emergency Tax Relief CDTFA CA gov effortlessly

- Obtain State Of Emergency Tax Relief CDTFA CA gov and click Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign State Of Emergency Tax Relief CDTFA CA gov and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of emergency tax relief cdtfa ca gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's role in tax relief collection?

airSlate SignNow facilitates the tax relief collection process by providing a platform for businesses to send and eSign necessary documents securely. With its easy-to-use interface, tax professionals can streamline their workflow, ensuring compliance and efficiency throughout the tax relief collection process.

-

How does airSlate SignNow help in managing tax relief collection documents?

With airSlate SignNow, you can easily manage tax relief collection documents in one centralized location. The platform allows for secure storage, fast document sharing, and efficient eSignatures, which simplifies managing tax-related paperwork and enhances overall organizational efficiency.

-

Is there a cost associated with using airSlate SignNow for tax relief collection?

airSlate SignNow offers a variety of pricing plans to suit different business needs. Investing in a cost-effective solution for tax relief collection can ultimately save time and enhance productivity, making it a worthy consideration for any organization handling tax matters.

-

What features does airSlate SignNow provide for tax relief collection?

airSlate SignNow includes features such as customizable templates, multiple signing options, and real-time tracking, all of which are essential for effective tax relief collection. These functionalities help ensure that all parties can quickly and efficiently complete their documentation.

-

Can airSlate SignNow integrate with other tools for tax relief collection?

Yes, airSlate SignNow integrates seamlessly with popular tools and platforms, enhancing your tax relief collection process. Integrations with CRM systems and accounting software help maintain accurate financial records and provide a smoother overall experience for users.

-

What are the benefits of using airSlate SignNow for tax relief collection?

The primary benefits of using airSlate SignNow for tax relief collection include increased efficiency, reduced paperwork, and enhanced compliance. By digitizing the signing and document management process, businesses can focus more on client satisfaction and less on administrative tasks.

-

Is airSlate SignNow secure for handling tax relief collection documents?

Absolutely. airSlate SignNow prioritizes security, employing advanced encryption methods to protect all documents related to tax relief collection. This commitment to data security ensures that sensitive information remains confidential and safe from unauthorized access.

Get more for State Of Emergency Tax Relief CDTFA CA gov

- Fema form 90 123 2019

- Cbp form instruction 2012 2019

- I 601a 2015 form

- Form i 601a application for provisional unlawful presence uscis

- Form waiver rights 2015

- Form waiver rights 2017 2019

- Application advance 2016 2019 form

- Form i 918 supplement a petition for qualifying family member of u 1 recipient

Find out other State Of Emergency Tax Relief CDTFA CA gov

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy