Form 3586 Fill Out & Sign Online

Understanding Form 3586

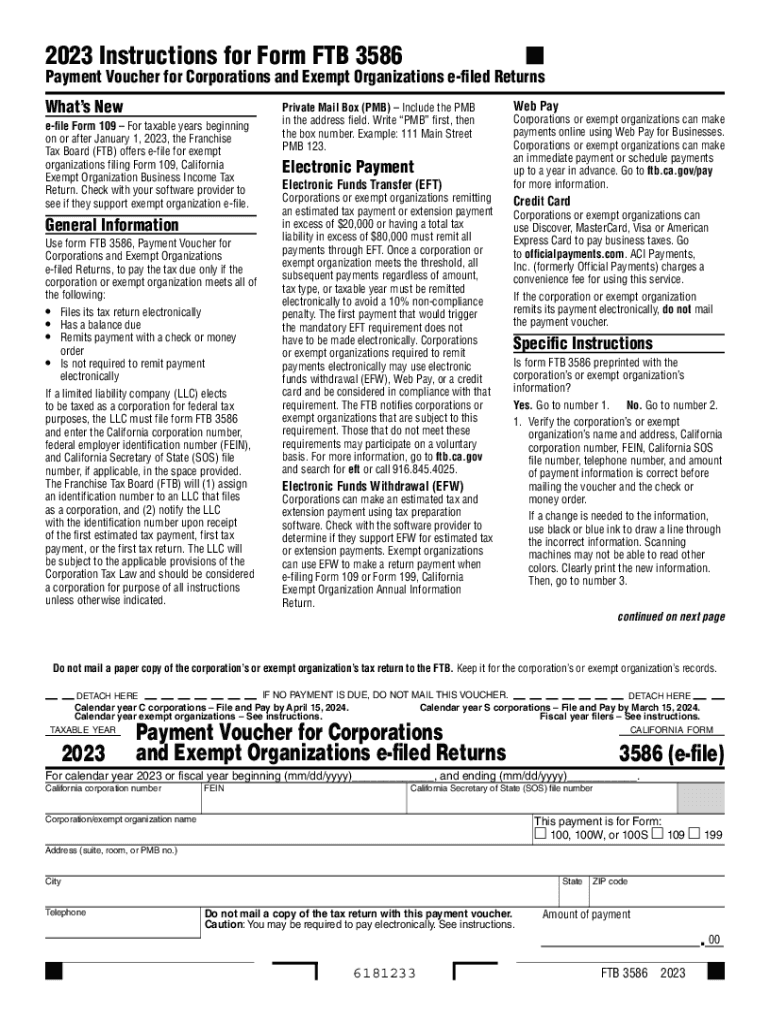

Form 3586, also known as the California payment voucher, is primarily used by organizations to remit payments to the California Franchise Tax Board (FTB). This form is essential for entities that need to make estimated tax payments or other types of payments to the state. It is particularly relevant for exempt organizations, as it helps ensure compliance with California tax regulations.

Steps to Complete Form 3586

Completing Form 3586 involves several straightforward steps:

- Gather necessary information, including your organization’s name, address, and taxpayer identification number.

- Determine the payment amount based on your organization’s tax obligations or estimates.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Choose your submission method: online, by mail, or in-person.

Obtaining Form 3586

Form 3586 can be obtained directly from the California Franchise Tax Board website. It is available in both PDF format for printing and an online fillable version. Ensure you are using the most current version of the form for your submissions, as outdated forms may not be accepted.

Legal Use of Form 3586

Using Form 3586 correctly is crucial for compliance with California tax laws. Organizations must ensure that they are eligible to use this form and that they are making the appropriate payments. Incorrect use of the form can lead to penalties or delays in processing payments.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with Form 3586. Typically, payments are due quarterly, and specific dates may vary based on the type of organization and its fiscal year. Keeping track of these deadlines helps avoid late fees and ensures timely compliance with state regulations.

Examples of Using Form 3586

Form 3586 is commonly used by various types of organizations, including non-profits and charitable entities, to remit their tax payments. For instance, a non-profit organization may use this form to submit its estimated tax payments for the year, ensuring it remains in good standing with the FTB.

Quick guide on how to complete form 3586 fill out ampamp sign online

Complete Form 3586 Fill Out & Sign Online effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow offers all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Form 3586 Fill Out & Sign Online on any platform using airSlate SignNow Android or iOS applications and streamline any document-related operation today.

The simplest way to modify and electronically sign Form 3586 Fill Out & Sign Online with ease

- Find Form 3586 Fill Out & Sign Online and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your requirements in document management with just a few clicks from your chosen device. Modify and electronically sign Form 3586 Fill Out & Sign Online and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 3586 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3586 and how can it be used?

Form 3586 is a versatile document used for various administrative purposes, including applications and records. With airSlate SignNow, you can efficiently create, send, and eSign form 3586, streamlining your workflow and ensuring compliance.

-

How does airSlate SignNow simplify the process of filling out form 3586?

airSlate SignNow allows users to fill out form 3586 electronically, reducing the need for paper documents. Features like customizable templates and auto-fill options help users complete the form quickly and accurately.

-

Is there a cost associated with using airSlate SignNow for form 3586?

Yes, airSlate SignNow offers various pricing plans that provide access to features for managing documents like form 3586. The plans are designed to be cost-effective and scalable, ensuring you only pay for what you need.

-

What key features does airSlate SignNow offer for managing form 3586?

AirSlate SignNow provides essential features such as eSignature capabilities, document tracking, and cloud storage for form 3586. These tools enhance efficiency and security, making it easier to manage your forms.

-

Can I integrate form 3586 with other applications using airSlate SignNow?

Absolutely! airSlate SignNow offers seamless integrations with popular applications, allowing for enhanced functionality with form 3586. You can connect your workflows and synchronize data across different platforms effortlessly.

-

What benefits does airSlate SignNow provide for form 3586 users?

Using airSlate SignNow for form 3586 offers numerous benefits, including faster processing times, decreased paperwork, and improved accuracy. These advantages help organizations save time and resources, allowing them to focus on more important tasks.

-

How secure is my information when using airSlate SignNow for form 3586?

Security is a top priority for airSlate SignNow. When managing form 3586, your data is protected with encryption, and robust compliance measures are in place to ensure that your information remains safe and confidential.

Get more for Form 3586 Fill Out & Sign Online

- Form 9423 2017

- 2016 instructions for form 1099 cap internal revenue service

- Form 9423 2018 2019

- Form 1120 l 2015

- 2014 form company tax

- Form 1120 schedule l 2013

- Sc 224 response to declaration of defaultin payment of judgmentsmall claims judicial council forms

- Church extension partnership grant application form

Find out other Form 3586 Fill Out & Sign Online

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form