Ar1000nr 2018

What is the AR1000NR?

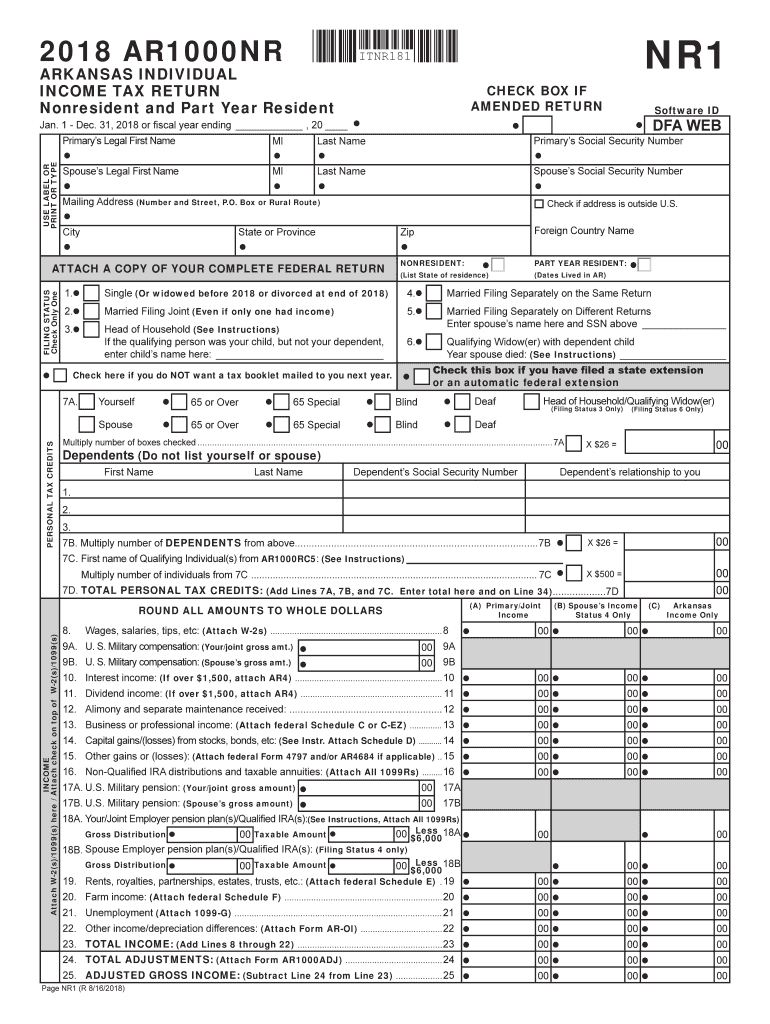

The AR1000NR is an Arkansas state income tax form specifically designed for non-residents who earn income in Arkansas. This form is essential for individuals who do not reside in Arkansas but have income sourced from the state. It allows non-residents to report their Arkansas income and calculate their tax liability accurately. Understanding the purpose of the AR1000NR is crucial for compliance with Arkansas tax laws.

Steps to Complete the AR1000NR

Completing the AR1000NR involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any deductions applicable to your situation. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Report your Arkansas-sourced income and any applicable deductions. Finally, review the form for completeness before signing and dating it. Ensure you keep a copy for your records.

Filing Deadlines / Important Dates

For the AR1000NR, the filing deadline typically aligns with the federal tax deadline, which is usually April fifteenth. However, it is essential to verify any specific state extensions or changes that may affect your filing date. Late submissions may incur penalties, so being aware of these deadlines is crucial for compliance.

Required Documents

When preparing to file the AR1000NR, certain documents are necessary to support your income claims and deductions. These may include W-2 forms, 1099 forms for other income types, and any documentation related to deductions you plan to claim. Having these documents organized will facilitate a smoother filing process and help ensure accuracy in your tax reporting.

Form Submission Methods

The AR1000NR can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online using approved e-filing services, which can expedite processing times. Alternatively, you can mail the completed form to the Arkansas Department of Finance and Administration or submit it in person at designated locations. Each method has its advantages, so consider which option best suits your needs.

Legal Use of the AR1000NR

The AR1000NR is legally recognized for reporting income and calculating tax liabilities for non-residents. It is essential to use this form correctly to comply with Arkansas tax regulations. Filing the AR1000NR ensures that you meet your tax obligations while also allowing you to take advantage of any applicable deductions. Understanding the legal framework surrounding this form can help prevent issues with the Arkansas Department of Revenue.

Quick guide on how to complete arkansas form arnr 2018 2019

Your assistance manual on how to prepare your Ar1000nr

If you’re curious about how to finalize and submit your Ar1000nr, here are some straightforward instructions to simplify the tax declaration process.

To begin, you simply need to set up your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, generate, and finish your tax forms with ease. Utilizing its editor, you can alternate between text, checkboxes, and eSignatures and revert to adjust information as necessary. Streamline your tax administration with enhanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to complete your Ar1000nr in moments:

- Create your account and start working on PDFs in minutes.

- Utilize our directory to obtain any IRS tax form; browse through variations and schedules.

- Select Get form to launch your Ar1000nr in our editor.

- Input the necessary fillable fields with your information (text, numerical data, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to electronically file your taxes with airSlate SignNow. Be aware that submitting in paper form can increase the likelihood of mistakes and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your location.

Create this form in 5 minutes or less

Find and fill out the correct arkansas form arnr 2018 2019

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

Create this form in 5 minutes!

How to create an eSignature for the arkansas form arnr 2018 2019

How to generate an electronic signature for your Arkansas Form Arnr 2018 2019 online

How to make an eSignature for the Arkansas Form Arnr 2018 2019 in Chrome

How to make an electronic signature for signing the Arkansas Form Arnr 2018 2019 in Gmail

How to generate an electronic signature for the Arkansas Form Arnr 2018 2019 from your smartphone

How to generate an electronic signature for the Arkansas Form Arnr 2018 2019 on iOS

How to create an electronic signature for the Arkansas Form Arnr 2018 2019 on Android OS

People also ask

-

What is the ar1000nr 2018 and how does it work?

The ar1000nr 2018 is a versatile document signing solution that allows businesses to send and eSign documents seamlessly. With its user-friendly interface, you can quickly upload documents, add signature fields, and send them for signing. This makes managing important paperwork more efficient and hassle-free.

-

What are the key features of the ar1000nr 2018?

The ar1000nr 2018 comes equipped with essential features such as real-time tracking, customizable templates, and secure cloud storage. It also supports multiple file formats and offers integration with popular apps, enhancing your document management capabilities. These features work together to streamline your workflows.

-

How much does the ar1000nr 2018 cost?

The pricing for the ar1000nr 2018 is designed to be cost-effective, catering to businesses of all sizes. You can choose from various plans based on your needs, ensuring that you only pay for what you use. Make sure to check for any special promotions or discounts that may be available.

-

What are the benefits of using the ar1000nr 2018?

Using the ar1000nr 2018 can signNowly reduce paperwork and administrative overhead, saving your business time and resources. With its secure eSignature capabilities, you ensure compliance while enhancing the speed of document turnaround. Additionally, it provides a professional image, which can help improve customer trust.

-

Can the ar1000nr 2018 integrate with other software?

Yes, the ar1000nr 2018 is designed to integrate seamlessly with various applications such as CRMs, project management tools, and cloud storage services. This capability allows you to automate workflows and enhance productivity. Check out our list of supported integrations to find the right tools for your business.

-

Is the ar1000nr 2018 secure for sending sensitive documents?

Absolutely, the ar1000nr 2018 prioritizes security, utilizing advanced encryption to protect your sensitive information during transmission and storage. Our platform is compliant with industry standards for data protection, giving you peace of mind when handling confidential documents. Your security is our top priority.

-

What types of documents can I sign with the ar1000nr 2018?

You can sign a wide range of documents with the ar1000nr 2018, including contracts, agreements, and consent forms. The platform supports various file formats, ensuring versatility in your document management. Whether you're handling simple forms or complex contracts, the ar1000nr 2018 has you covered.

Get more for Ar1000nr

- Bosch spark plug rebate form

- Das install move add change imac request form

- County of santa clara benefit enrollment amp change form sccgov

- Questionnaire pillar 5 sustainability of the natural and cultural form

- Santry gp form

- Statutory declaration form 238506417

- Canton fire department77 riverside drive canton ny 13617 form

- Employer agreement template form

Find out other Ar1000nr

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement