Vermont Tax Form Co 411 Dana and Rahman Tukan

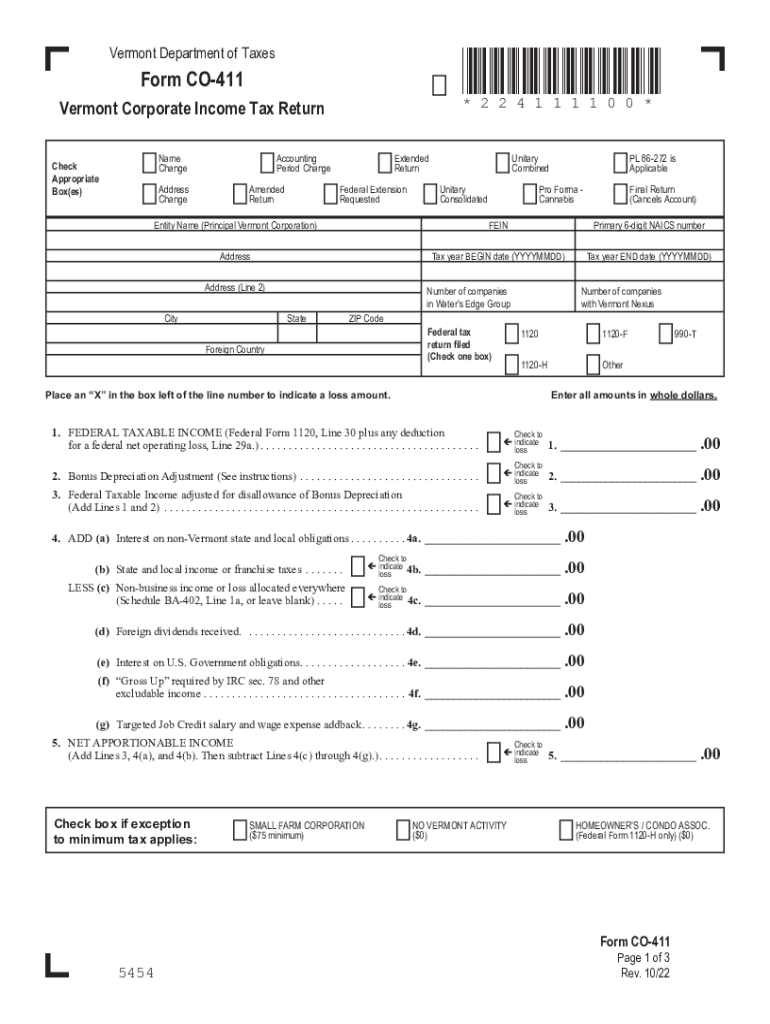

What is the Vermont Tax Form Co 411?

The Vermont Tax Form Co 411 is a specific tax document used by residents of Vermont to report certain tax information. This form is essential for individuals and businesses to ensure compliance with state tax regulations. It collects data necessary for the state to assess tax liabilities accurately and is part of the broader tax filing process in Vermont.

How to use the Vermont Tax Form Co 411

Using the Vermont Tax Form Co 411 involves several steps to ensure that all required information is accurately reported. Begin by gathering all necessary financial documents, including income statements and prior tax returns. Carefully fill out the form, ensuring that all sections are completed based on your specific tax situation. After completing the form, review it for accuracy before submission to avoid any potential issues with the state tax authority.

Steps to complete the Vermont Tax Form Co 411

Completing the Vermont Tax Form Co 411 requires a systematic approach:

- Gather all relevant financial documents, including W-2s and 1099s.

- Access the Co 411 form, which can be obtained online or through state tax offices.

- Fill in personal information, including your name, address, and Social Security number.

- Report income and deductions as required, ensuring all figures are accurate.

- Double-check all entries for completeness and correctness.

- Submit the form either electronically or by mail, following the guidelines provided.

Legal use of the Vermont Tax Form Co 411

The Vermont Tax Form Co 411 serves a legal purpose in the tax filing process. It is required by state law for individuals and entities that meet specific criteria. Proper use of this form ensures that taxpayers fulfill their legal obligations, helping to avoid penalties or legal issues associated with incorrect or incomplete tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the Vermont Tax Form Co 411 are crucial to ensure compliance with state tax laws. Generally, the form must be submitted by April 15th of each year for individual taxpayers. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to these dates to avoid late fees or penalties.

Form Submission Methods (Online / Mail / In-Person)

The Vermont Tax Form Co 411 can be submitted through various methods to accommodate different preferences. Taxpayers may choose to file online through the Vermont Department of Taxes website, which offers a streamlined process. Alternatively, forms can be printed and mailed to the appropriate tax office. In-person submissions may also be available at designated tax offices, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete vermont tax form co 411 dana and rahman tukan

Effortlessly Prepare Vermont Tax Form Co 411 Dana And Rahman Tukan on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources needed to create, adjust, and electronically sign your documents promptly without any holdups. Manage Vermont Tax Form Co 411 Dana And Rahman Tukan on any device using the airSlate SignNow mobile applications for Android or iOS and streamline any document-related task today.

How to Modify and Electronically Sign Vermont Tax Form Co 411 Dana And Rahman Tukan with Ease

- Find Vermont Tax Form Co 411 Dana And Rahman Tukan and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you would like to send your form: via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Vermont Tax Form Co 411 Dana And Rahman Tukan while ensuring clear communication throughout the form preparation stages using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vermont tax form co 411 dana and rahman tukan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the co411 tax online and how does it work?

The co411 tax online is a digital solution designed to simplify the filing of your tax returns. By using airSlate SignNow, you can easily fill out, sign, and submit your co411 tax online with just a few clicks, ensuring your submission is timely and accurate.

-

How much does it cost to file co411 tax online with airSlate SignNow?

Pricing for filing co411 tax online with airSlate SignNow is designed to be budget-friendly. We offer various pricing plans that cater to individuals and businesses alike, ensuring you find the right solution based on your needs without breaking the bank.

-

What features does airSlate SignNow offer for co411 tax online?

airSlate SignNow provides several features to enhance your co411 tax online experience. These include customizable templates, secure eSigning technology, and a user-friendly interface that streamlines the entire tax filing process.

-

What are the benefits of using airSlate SignNow for co411 tax online?

Using airSlate SignNow for co411 tax online has numerous benefits, including increased efficiency and reduced paperwork. Our platform not only speeds up the filing process but also ensures that your documents are securely stored and easily accessible whenever required.

-

Can I integrate airSlate SignNow with other software for co411 tax online?

Absolutely! airSlate SignNow offers numerous integrations with popular accounting and document management software for co411 tax online. This ensures a seamless workflow, allowing you to manage your finances and tax filings all from one place.

-

Is my data safe when filing co411 tax online with airSlate SignNow?

Yes, your data is safe when using airSlate SignNow for co411 tax online. We employ advanced encryption and security protocols to protect your sensitive information throughout the entire eSigning and filing process.

-

What if I encounter issues while filing co411 tax online?

If you encounter any issues while filing co411 tax online, our dedicated support team is here to help. We provide comprehensive customer service, guiding you through any challenges you may face and ensuring a smooth filing experience.

Get more for Vermont Tax Form Co 411 Dana And Rahman Tukan

- Form 8865pdffillercom 2018 2019

- 2019 form 1040 es form 1040 es estimated tax for individuals

- 2018 instructions for form 4562 instructions for form 4562 depreciation and amortization including information on listed

- 941 v 2017 2019 form

- 2018 instructions for form 1065 instructions for form 1065 us return of partnership income

- January 2019 form

- Form 433 f collection information statement irsgov

- Texas motion form civ 805 2014 2019

Find out other Vermont Tax Form Co 411 Dana And Rahman Tukan

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document