State Conformity to Federal Bonus Depreciation

Understanding State Conformity to Federal Bonus Depreciation

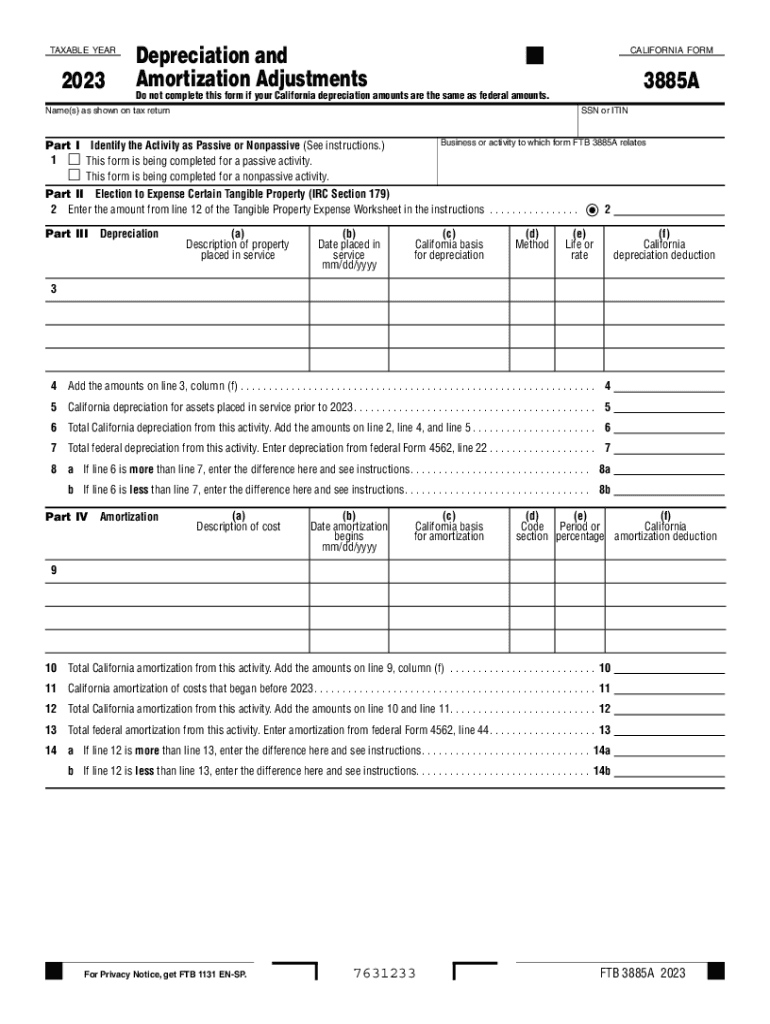

The 3885A form is essential for California taxpayers who want to claim state conformity to federal bonus depreciation. This conformity allows taxpayers to align their state tax calculations with federal guidelines regarding depreciation on qualified property. Understanding how California conforms to federal rules can significantly impact tax liabilities and financial strategies for businesses. The federal tax code allows for accelerated depreciation, which can lead to substantial tax savings. However, California has its own specific regulations that may differ from federal provisions, making it crucial to understand these nuances.

Steps to Complete the 3885A Form

Completing the 3885A form requires careful attention to detail. Here are the general steps to follow:

- Gather all necessary documentation, including details of the property for which you are claiming depreciation.

- Review the federal guidelines to determine the applicable depreciation methods and amounts.

- Fill out the 3885A form, ensuring that all sections are completed accurately. Pay special attention to the fields related to depreciation adjustments.

- Double-check your calculations to ensure accuracy in the claimed amounts.

- Submit the completed form along with your California tax return by the filing deadline.

Key Elements of the 3885A Form

The 3885A form includes several critical components that taxpayers must understand:

- Taxpayer Information: Basic details such as name, address, and taxpayer identification number.

- Property Details: Information regarding the property for which depreciation is being claimed, including acquisition date and cost.

- Depreciation Adjustments: Specific adjustments that reflect the differences between federal and state depreciation calculations.

- Signature: The form must be signed and dated by the taxpayer or an authorized representative.

Filing Deadlines for the 3885A Form

It is essential to be aware of the filing deadlines for the 3885A form to avoid penalties. Generally, the form must be submitted along with your California state tax return by the due date, which is typically April 15 for most taxpayers. If you file for an extension, ensure that the 3885A is included with your extended return. Keeping track of these deadlines helps maintain compliance with state tax regulations.

Eligibility Criteria for Using the 3885A Form

To utilize the 3885A form, certain eligibility criteria must be met:

- You must be a California taxpayer who has claimed federal bonus depreciation.

- The property for which you are claiming depreciation must qualify under California's specific guidelines.

- Your business must be in compliance with all relevant tax laws and regulations.

Legal Use of the 3885A Form

The 3885A form is legally recognized by the California Franchise Tax Board (FTB) as the official document for claiming state conformity to federal bonus depreciation. Proper use of this form ensures that taxpayers can take advantage of potential tax savings while remaining compliant with state laws. Misuse or incorrect filing can lead to penalties or audits, making it vital to follow the guidelines closely.

Quick guide on how to complete state conformity to federal bonus depreciation

Complete State Conformity To Federal Bonus Depreciation effortlessly on any device

Online document management has become widely embraced by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage State Conformity To Federal Bonus Depreciation on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process today.

How to modify and eSign State Conformity To Federal Bonus Depreciation with ease

- Locate State Conformity To Federal Bonus Depreciation and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign State Conformity To Federal Bonus Depreciation, ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state conformity to federal bonus depreciation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 3885a depreciation?

3885a depreciation refers to the specific guidelines set by the IRS for the depreciation of certain assets used in business. Understanding how to utilize 3885a depreciation can signNowly impact your tax deductions. By effectively applying these guidelines, businesses can maximize their financial benefits while ensuring compliance with tax regulations.

-

How can airSlate SignNow help with managing 3885a depreciation documentation?

airSlate SignNow provides seamless document management for important records related to 3885a depreciation. Users can easily eSign, send, and store these documents securely. This not only saves time but also ensures accountability and enhances operational efficiency for your business.

-

Is there a pricing model for using airSlate SignNow’s features related to 3885a depreciation?

Yes, airSlate SignNow offers flexible pricing plans tailored to fit various business needs. By choosing a suitable plan, users gain access to essential features for managing 3885a depreciation, including unlimited eSigning and document storage options. Investing in this solution can streamline your depreciation processes while being cost-effective.

-

What are the benefits of using airSlate SignNow for 3885a depreciation forms?

Using airSlate SignNow for 3885a depreciation forms automates the signing process and ensures that all necessary documents are completed quickly and accurately. This not only reduces the administrative burden but also minimizes the risk of errors. Having a reliable system enhances compliance and keeps your financial records organized.

-

Can airSlate SignNow integrate with accounting software for 3885a depreciation?

Absolutely! airSlate SignNow integrates with various accounting software platforms, making it easier to manage your 3885a depreciation alongside your financial records. This integration allows for seamless data transfer, helping to maintain accuracy and streamline the overall documentation process.

-

How does eSigning documents related to 3885a depreciation work?

eSigning documents related to 3885a depreciation using airSlate SignNow is straightforward and efficient. Users can upload their documents, add signers, and initiate the signing process with just a few clicks. The platform keeps track of the signing status in real-time, simplifying your workflow.

-

Is airSlate SignNow secure for handling 3885a depreciation documents?

Yes, airSlate SignNow prioritizes document security, offering robust encryption and secure cloud storage for your 3885a depreciation forms. This ensures that sensitive information is protected from unauthorized access. You can confidently manage your documentation with peace of mind about its security.

Get more for State Conformity To Federal Bonus Depreciation

Find out other State Conformity To Federal Bonus Depreciation

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement