24416 Form 1 Net Operating Loss NOL Computation and

Understanding the California Form 3805Q

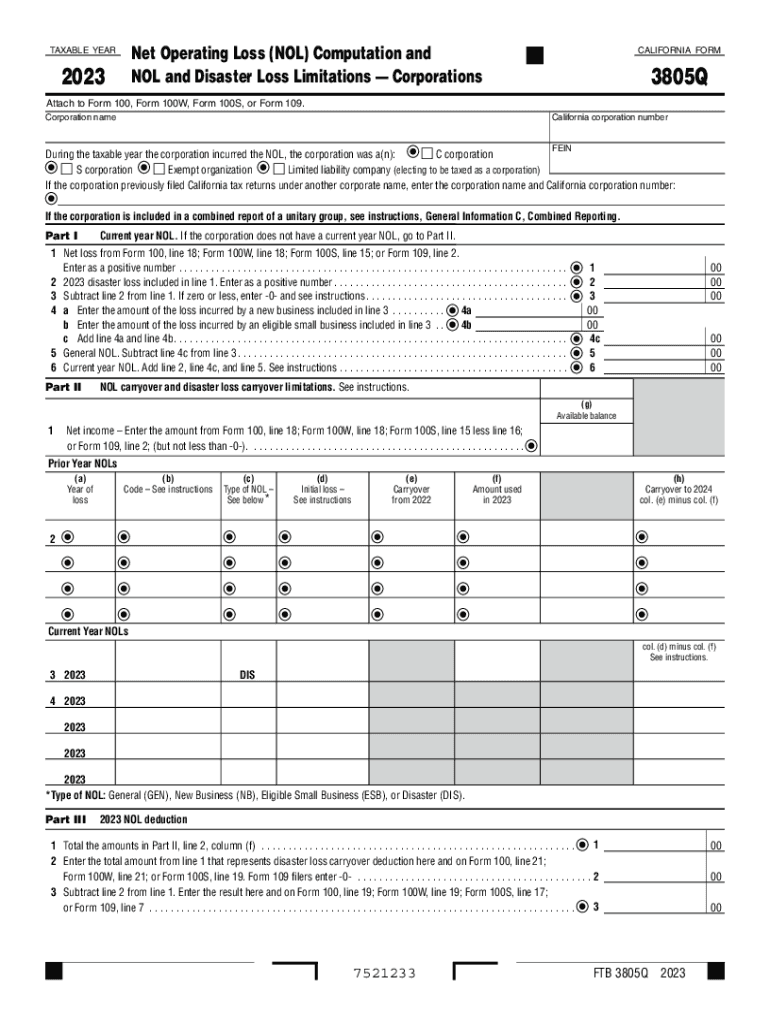

The California Form 3805Q is specifically designed for taxpayers to report their Net Operating Loss (NOL) for the current year. This form is essential for corporations that have incurred losses and wish to carry those losses forward to offset future taxable income. The form allows businesses to compute their NOL and apply it according to California tax regulations. Understanding how to properly fill out this form can significantly impact a corporation's tax liability and overall financial health.

Steps to Complete the California Form 3805Q

Completing the California Form 3805Q involves several critical steps:

- Gather Financial Information: Collect all relevant financial documents, including income statements and previous tax returns.

- Calculate NOL: Use the provided worksheets to determine the NOL amount for the current year, considering any applicable limitations.

- Fill Out the Form: Enter the calculated NOL in the appropriate sections of the form, ensuring accuracy in all figures.

- Review for Accuracy: Double-check all entries for errors or omissions before submission.

- Submit the Form: File the completed form with the California Franchise Tax Board by the specified deadline.

Eligibility Criteria for Using Form 3805Q

To utilize the California Form 3805Q, corporations must meet specific eligibility criteria. Primarily, the entity must have experienced a net operating loss in the current tax year. Additionally, the losses must be attributable to business operations within California, and the corporation must be subject to California corporate tax laws. Understanding these criteria is crucial for ensuring compliance and maximizing potential tax benefits.

Filing Deadlines for Form 3805Q

Timely filing of Form 3805Q is essential to avoid penalties. The form must be submitted by the due date of the corporation's tax return, which is typically the fifteenth day of the fourth month following the close of the taxable year. For corporations operating on a calendar year, this means the deadline is April 15. It is important to stay informed about any changes to filing deadlines that may occur due to state regulations or other factors.

Key Elements of the California Form 3805Q

The California Form 3805Q includes several key elements that taxpayers must understand:

- Identification Information: Basic details about the corporation, including name, address, and tax identification number.

- NOL Computation: Sections dedicated to calculating the NOL, including adjustments for prior years.

- Carryforward Information: Instructions on how to apply the NOL to future taxable years.

- Signature Section: A place for authorized representatives to sign and date the form, certifying its accuracy.

Common Mistakes to Avoid When Filing Form 3805Q

When completing the California Form 3805Q, it is important to avoid common mistakes that could lead to delays or penalties:

- Incorrect Calculations: Ensure all calculations are accurate, particularly when determining the NOL amount.

- Missing Information: Double-check that all required fields are filled out completely.

- Late Submission: Be mindful of filing deadlines to avoid late fees.

- Failure to Keep Records: Maintain copies of the submitted form and related documentation for future reference.

Quick guide on how to complete 24416 form 1 net operating loss nol computation and

Complete 24416 Form 1 Net Operating Loss NOL Computation And effortlessly on any gadget

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage 24416 Form 1 Net Operating Loss NOL Computation And on any device with the airSlate SignNow Android or iOS applications and streamline any document-centered process today.

The easiest way to modify and eSign 24416 Form 1 Net Operating Loss NOL Computation And with ease

- Locate 24416 Form 1 Net Operating Loss NOL Computation And and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or black out sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would prefer to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside concerns about lost or misfiled documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from your device of choice. Modify and eSign 24416 Form 1 Net Operating Loss NOL Computation And and guarantee excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 24416 form 1 net operating loss nol computation and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CA Form 3805Q instructions?

The CA Form 3805Q instructions provide detailed guidelines on how to complete the 3805Q form for California tax purposes. This includes information on what data you need to gather, how to report your income, and where to send the completed form. Understanding these instructions is essential for accurate tax reporting.

-

How can airSlate SignNow help with CA Form 3805Q?

airSlate SignNow simplifies the process of completing and electronically signing forms like the CA Form 3805Q. Our platform enables users to fill out, sign, and send documents securely online, ensuring you stay compliant with filing deadlines. By providing easy access to your documents, airSlate SignNow makes tax preparation more efficient.

-

What is the cost of using airSlate SignNow for CA Form 3805Q instructions?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you’re an individual, a small business, or a large corporation, you can find a plan that works for you. Our cost-effective solutions make it easy to manage your CA Form 3805Q instructions without breaking the bank.

-

Are there any features specific to CA Form 3805Q in airSlate SignNow?

Yes, airSlate SignNow is equipped with features that support the completion of CA Form 3805Q instructions. These include auto-fill options, cloud storage for easy access, and a step-by-step guide to ensure all necessary information is included. This makes compliance easier and more efficient for users.

-

Can I integrate airSlate SignNow with other tools for managing CA Form 3805Q?

Absolutely! airSlate SignNow offers integrations with various business applications, allowing you to streamline your workflow. This means you can connect your existing software for enhanced document management and ensure that all aspects of your CA Form 3805Q instructions are covered seamlessly.

-

Is airSlate SignNow suitable for businesses with complex CA Form 3805Q needs?

Yes, airSlate SignNow is designed to accommodate businesses of all sizes, including those with complex CA Form 3805Q needs. Our platform provides customizable templates and advanced features, enabling you to tailor the signing and document management process according to your specific requirements.

-

What benefits does airSlate SignNow offer for completing CA Form 3805Q instructions?

Using airSlate SignNow for your CA Form 3805Q instructions offers numerous benefits, such as increased efficiency, reduced manual errors, and enhanced security. With our electronic signing and document management capabilities, you can ensure that your forms are completed accurately and submitted on time, giving you peace of mind.

Get more for 24416 Form 1 Net Operating Loss NOL Computation And

- Volunteer waiver form template

- Satisfactory academic progress appeal form pdf radford radford

- Authorization to release confidential information university of unlv

- Csi carroll and milton petrie student emergency grant program application form

- The dr james h mcelhinney annual scholarship ball state form

- Campus security report frank phillips college annual security form

- Bow tie application form

- Fbi honors internship program program terms acknowledgement form

Find out other 24416 Form 1 Net Operating Loss NOL Computation And

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy