By Indiana Code Form

What is the Indiana Exemption?

The Indiana exemption refers to specific tax exemptions available to individuals and businesses within the state of Indiana. These exemptions allow eligible taxpayers to avoid paying certain taxes, such as sales tax, on qualifying purchases or transactions. Understanding the Indiana exemption is crucial for ensuring compliance with state tax laws while maximizing potential savings.

Eligibility Criteria for Indiana Exemption

To qualify for the Indiana exemption, taxpayers must meet specific criteria outlined by the Indiana Department of Revenue. Generally, the exemption applies to certain types of purchases, including those made by non-profit organizations, government entities, and specific industries. It is essential for applicants to review the eligibility requirements carefully to determine if they qualify for the exemption.

Required Documents for Indiana Exemption

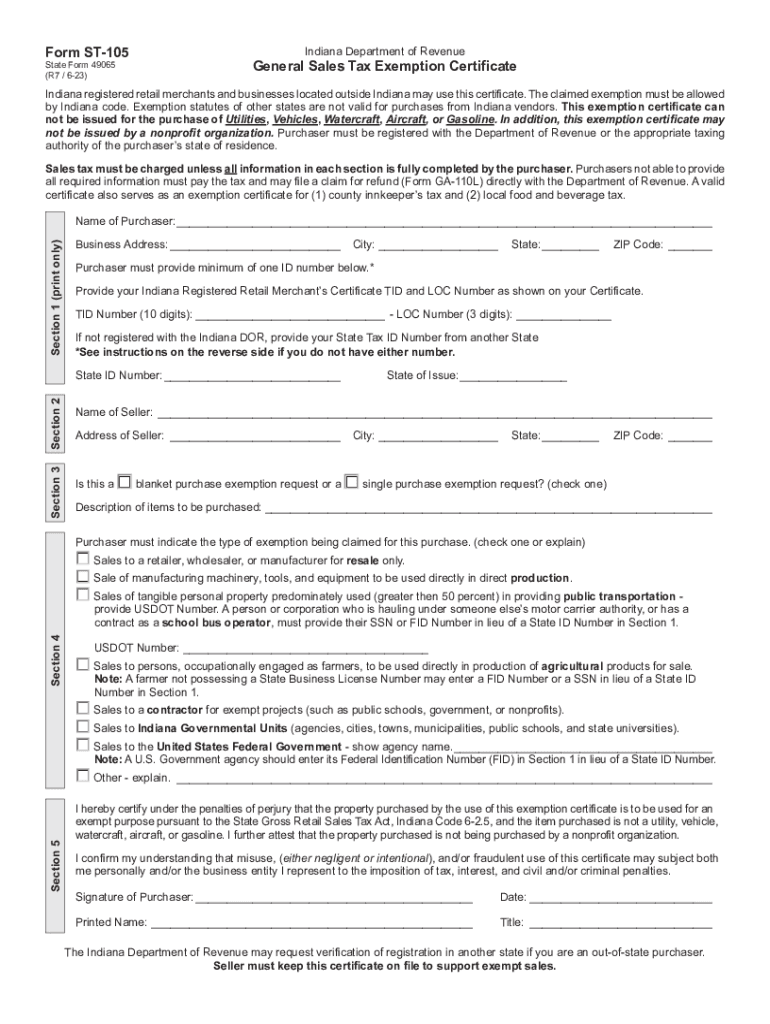

When applying for the Indiana exemption, taxpayers must submit specific documentation to support their claims. This includes the Indiana sales tax exemption form, commonly known as Form ST-105. Additionally, organizations must provide proof of their tax-exempt status, such as a letter from the IRS or other relevant documentation. Ensuring all required documents are submitted accurately can streamline the approval process.

Steps to Complete the Indiana Exemption Form

Completing the Indiana sales tax exemption form (ST-105) involves several straightforward steps:

- Obtain the ST-105 form from the Indiana Department of Revenue website or through authorized channels.

- Fill out the form with accurate information, including the purchaser's name, address, and tax identification number.

- Indicate the reason for the exemption, selecting from the options provided on the form.

- Sign and date the form to validate the request.

- Submit the completed form to the vendor or seller at the time of purchase.

Legal Use of the Indiana Exemption

The legal use of the Indiana exemption is governed by state tax laws. Taxpayers must ensure they are using the exemption for legitimate purposes, as misuse can lead to penalties or fines. It is advisable to maintain accurate records of all transactions where the exemption is applied, as this documentation may be required for audits or reviews by the Indiana Department of Revenue.

Form Submission Methods for Indiana Exemption

Taxpayers can submit the Indiana sales tax exemption form (ST-105) through various methods. The most common submission methods include:

- Presenting the completed form directly to the vendor at the time of purchase.

- Mailing the form to the Indiana Department of Revenue if required for specific transactions.

- In some cases, electronic submission may be available through authorized platforms.

Examples of Using the Indiana Exemption

There are numerous scenarios where the Indiana exemption can be applied. For instance, a non-profit organization purchasing office supplies may use the exemption to avoid sales tax. Similarly, a government agency acquiring equipment for public use can also apply the exemption. Understanding these examples can help eligible taxpayers recognize opportunities to utilize the Indiana exemption effectively.

Quick guide on how to complete by indiana code

Effortlessly Prepare By Indiana Code on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage By Indiana Code on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to Modify and eSign By Indiana Code with Ease

- Find By Indiana Code and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information using tools specifically designed for that by airSlate SignNow.

- Craft your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and then click on the Done button to save your edits.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors requiring new document printouts. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign By Indiana Code while ensuring outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the by indiana code

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Indiana exemption in the context of airSlate SignNow?

The Indiana exemption refers to specific legal provisions that allow businesses and individuals to benefit from simplified documentation processes using airSlate SignNow. By utilizing this platform, users can efficiently manage eSigning requirements while ensuring legal compliance in Indiana.

-

How can airSlate SignNow help with obtaining an Indiana exemption?

airSlate SignNow streamlines the process of applying for an Indiana exemption by providing templates and tools that simplify document preparation and submission. This enables users to focus on meeting the necessary requirements without getting bogged down in paperwork.

-

What features does airSlate SignNow offer for managing Indiana exemption documents?

airSlate SignNow offers features such as customizable templates, workflow automation, and secure eSigning that are particularly useful for managing Indiana exemption documents. These features ensure that all relevant information is captured accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for Indiana exemption applications?

Yes, airSlate SignNow operates on a subscription-based model, with various pricing tiers that cater to different business needs. Users can choose a plan that best fits their budget while still gaining access to the tools necessary for managing Indiana exemption applications.

-

How does airSlate SignNow ensure the security of my Indiana exemption documents?

airSlate SignNow employs robust security features such as encryption, access controls, and audit trails to protect your Indiana exemption documents. These measures ensure that your sensitive information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling Indiana exemptions?

Absolutely! airSlate SignNow offers integrations with various third-party applications, making it easy to manage Indiana exemption documents alongside your other business processes. This seamless integration helps enhance productivity and streamline workflows.

-

What benefits can my business gain by using airSlate SignNow for Indiana exemptions?

By using airSlate SignNow for Indiana exemptions, your business can save time and reduce paperwork through efficient eSigning processes. This not only improves operational efficiency but also enhances customer satisfaction by speeding up transaction times.

Get more for By Indiana Code

Find out other By Indiana Code

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple