Form SS 8 Rev December Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding

Understanding Form SS-8: Determination of Worker Status

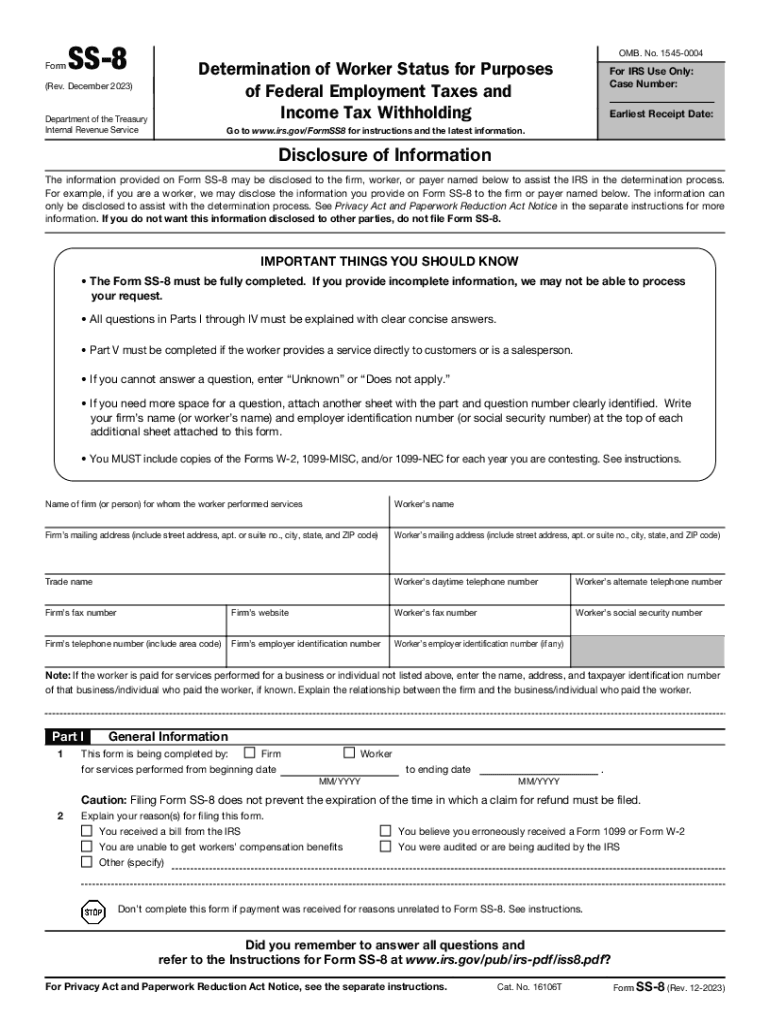

The Form SS-8 is a crucial tool for determining the worker status for federal employment taxes and income tax withholding. This form is used to resolve questions regarding whether a worker is an employee or an independent contractor. The classification impacts tax obligations and benefits eligibility. Employers and workers can submit this form to the IRS to obtain a formal determination of the worker's status, which helps ensure compliance with tax laws.

How to Complete Form SS-8

Completing Form SS-8 involves several steps to ensure accuracy and compliance. First, gather all relevant information about the worker and the working relationship. This includes details about the nature of the work, the degree of control exercised by the employer, and any written agreements. Next, fill out the form by providing the required information in each section, ensuring that all responses are clear and truthful. After completing the form, review it for any errors before submission.

Obtaining Form SS-8

Form SS-8 can be obtained directly from the IRS website. The form is available for download in PDF format, allowing users to print and complete it manually. Alternatively, individuals can request a paper copy by contacting the IRS directly. It is important to ensure that you are using the most current version of the form to avoid any issues during processing.

Key Elements of Form SS-8

Form SS-8 includes several key elements that are essential for determining worker status. These include:

- Worker Information: Name, address, and social security number of the worker.

- Employer Information: Name and address of the employer or business entity.

- Working Relationship: A detailed description of the work performed, including the level of control and independence.

- Supporting Documentation: Any relevant contracts or agreements that outline the working relationship.

Filing Methods for Form SS-8

Form SS-8 can be submitted to the IRS through various methods. The primary method is by mail, where the completed form should be sent to the appropriate IRS address indicated in the form instructions. Additionally, while electronic submission is not available for this form, ensuring it is mailed promptly can help avoid delays in processing. It is advisable to keep a copy of the submitted form for your records.

Legal Use of Form SS-8

The legal use of Form SS-8 is significant for both employers and workers. By obtaining a determination from the IRS, parties can clarify their tax responsibilities and avoid potential penalties for misclassification. This form serves as a protective measure, ensuring that the worker's status is recognized officially, which can be beneficial in disputes or audits. Understanding the legal implications of the classification can help both parties navigate their rights and obligations effectively.

Quick guide on how to complete form ss 8 rev december determination of worker status for purposes of federal employment taxes and income tax withholding

Effortlessly Prepare Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without inconvenience. Manage Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Easiest Method to Edit and Electronically Sign Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding with Ease

- Find Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to store your changes.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes necessitating new hard copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ss 8 rev december determination of worker status for purposes of federal employment taxes and income tax withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is redetermination in the context of airSlate SignNow?

Redetermination refers to the reassessment of documents and records within airSlate SignNow. This feature allows users to update or modify existing agreements for accuracy and compliance. By ensuring proper redetermination, businesses can manage their documents effectively without starting from scratch.

-

How does airSlate SignNow's redetermination feature benefit my business?

The redetermination feature in airSlate SignNow streamlines the process of updating contracts and agreements. This enhances efficiency and minimizes errors by allowing users to revise documents seamlessly. Ultimately, this leads to better management of your business documents and fosters trust with your clients.

-

What pricing plans does airSlate SignNow offer for redetermination features?

airSlate SignNow provides various pricing plans tailored to fit different business needs. Each plan includes the redetermination feature, ensuring that all users have access to this important functionality. You can choose a plan based on your expected volume and specific requirements, ensuring cost-effectiveness.

-

Can I integrate airSlate SignNow with other platforms for seamless redetermination?

Yes, airSlate SignNow offers integrations with a variety of platforms, enhancing the redetermination process. This allows users to synchronize data and improve workflows across different systems. Popular integrations include CRM tools and project management software, facilitating a more cohesive document management experience.

-

Is it easy to implement the redetermination process in airSlate SignNow?

Implementing the redetermination process in airSlate SignNow is designed to be user-friendly. The intuitive interface guides users through updating and revising documents seamlessly. With minimal training, your team can quickly adopt this feature, reaping the benefits of efficient document management.

-

What types of documents can be redetermined using airSlate SignNow?

airSlate SignNow supports redetermination for a wide range of document types, including contracts, agreements, and forms. This flexibility allows businesses to manage various legal and operational documents efficiently. No matter the type of document, the redetermination feature ensures they stay up-to-date and compliant.

-

How does airSlate SignNow ensure the security of documents during redetermination?

Security is a top priority for airSlate SignNow during the redetermination process. The platform employs advanced encryption protocols and secure cloud storage to protect your documents. This ensures that all sensitive information remains confidential and secure throughout the redetermination and eSigning processes.

Get more for Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding

- Wrecker monthly report 2014 2019 form

- Hrng 525 2015 2019 form

- Shoreline exemption application pdf whatcom county form

- Limited liability company information x business licensing service bls dor wa 6962560

- Po box 68671 seattle wa 98168 phone 206 241 2083 scr air form

- Health district clearance form 2016 2019

- Retailer receiving direct shipments summary report liq wa form

- Sbd 5204 e fillable 2013 2019 form

Find out other Form SS 8 Rev December Determination Of Worker Status For Purposes Of Federal Employment Taxes And Income Tax Withholding

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure