PA Corporate Net Income Tax Declaration for a State E File Report PA 8453 C PA Department of Revenue Form

Understanding the PA Corporate Net Income Tax Declaration

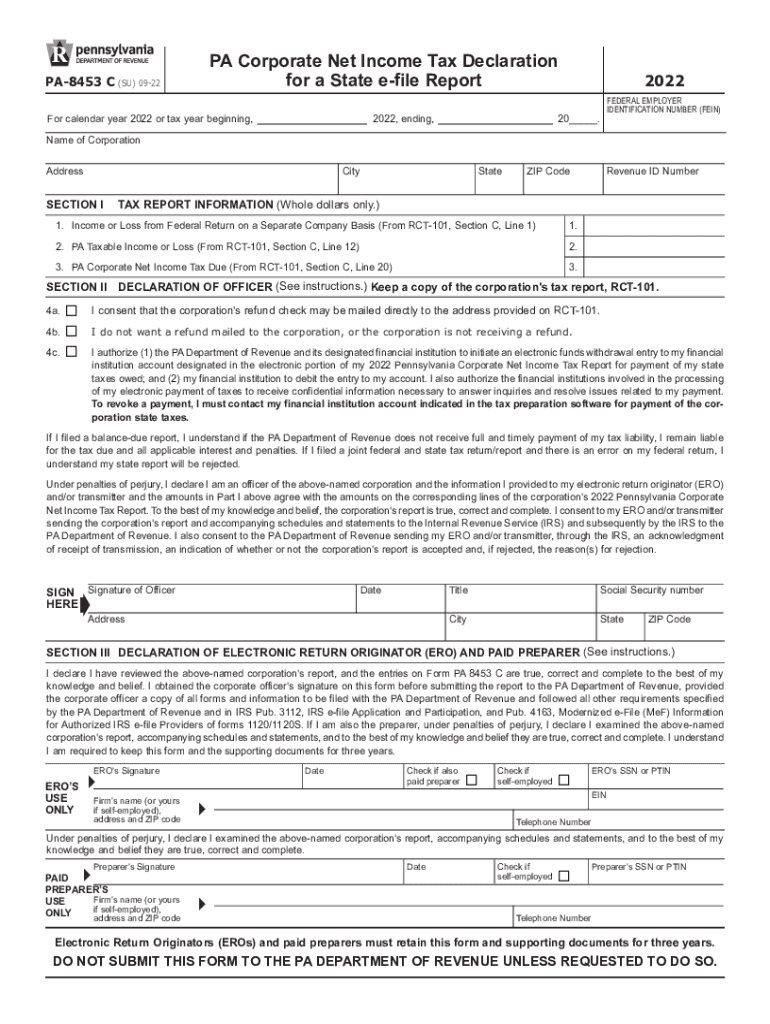

The PA Corporate Net Income Tax Declaration, specifically the PA 8453 C, serves as a crucial document for businesses operating in Pennsylvania. This form is used to declare corporate net income tax for entities that are required to file electronically. It is essential for ensuring compliance with state tax regulations and for accurately reporting income to the Pennsylvania Department of Revenue.

Steps to Complete the PA 8453 C

Completing the PA 8453 C involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports. Next, fill out the form with the required information, including your business name, federal employer identification number (EIN), and total income. After completing the form, review it for any errors before submitting it electronically. It is advisable to retain a copy for your records.

Required Documents for Filing

When preparing to file the PA Corporate Net Income Tax Declaration, certain documents are essential. These include:

- Federal tax return (Form 1120 or 1120-S)

- Financial statements (balance sheet and income statement)

- Supporting schedules and documentation for deductions and credits

Having these documents ready will facilitate a smoother filing process and help ensure that all information reported is accurate.

Filing Deadlines for PA 8453 C

Timely submission of the PA 8453 C is vital to avoid penalties. The filing deadline typically aligns with the federal tax return due date, which is usually the fifteenth day of the fourth month following the end of your tax year. For corporations operating on a calendar year, this means the deadline is April 15. However, if you are filing for an extension, be sure to submit the form by the extended deadline.

Legal Use of the PA 8453 C

The PA Corporate Net Income Tax Declaration is legally binding and must be completed accurately. Misrepresentation or failure to file can result in penalties, including fines or interest on unpaid taxes. It is important to understand the legal implications of the information provided on this form, as it is subject to review by the Pennsylvania Department of Revenue.

Who Issues the PA 8453 C

The PA 8453 C is issued by the Pennsylvania Department of Revenue. This state agency is responsible for administering tax laws, collecting taxes, and ensuring compliance among businesses operating within Pennsylvania. Understanding the role of this agency can help businesses navigate their tax obligations more effectively.

Quick guide on how to complete pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue

Easily Prepare PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, modify, and eSign your documents without complications. Manage PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-related tasks today.

How to Edit and eSign PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue Effortlessly

- Obtain PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue and click Get Form to initiate the process.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and has the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs within a few clicks from your preferred device. Edit and eSign PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of pa state income tax for businesses using airSlate SignNow?

Understanding pa state income tax is crucial for businesses operating in Pennsylvania. airSlate SignNow streamlines the documentation needed for tax purposes, helping you stay compliant while simplifying eSigning processes. This allows you to focus more on your business operations and less on paperwork related to pa state income tax.

-

How can airSlate SignNow help manage pa state income tax documents?

With airSlate SignNow, you can create, send, and eSign all your pa state income tax documents securely and efficiently. Our platform ensures that these documents are stored safely and accessible whenever you need them. This can signNowly reduce the hassle of managing tax documentation.

-

What features does airSlate SignNow offer for tracking pa state income tax forms?

airSlate SignNow offers robust features like real-time tracking to ensure all your pa state income tax forms are signed and submitted on time. You can also set reminders for important deadlines related to pa state income tax submissions. This keeps your business organized and compliant.

-

Is airSlate SignNow cost-effective for managing pa state income tax requirements?

Yes, airSlate SignNow is a cost-effective solution for managing your pa state income tax documentation. With flexible pricing plans, you can choose the option that fits your business needs without overspending. This is especially beneficial for small to medium-sized businesses navigating pa state income tax.

-

Can I integrate airSlate SignNow with other tools related to pa state income tax?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software that can help you manage your pa state income tax requirements. This ensures that your workflow remains efficient and all necessary documentation is handled within one ecosystem.

-

What are the benefits of using airSlate SignNow for pa state income tax submissions?

Using airSlate SignNow simplifies the entire process of submitting pa state income tax filings. With eSigning features, you can quickly get the necessary approvals from stakeholders, reducing delays and improving overall productivity. This means you can focus on what matters most—growing your business.

-

How does airSlate SignNow ensure security for sensitive pa state income tax information?

airSlate SignNow prioritizes the security of your sensitive data, including documents related to pa state income tax. Our platform uses advanced encryption methods and complies with industry standards to protect your information from unauthorized access. You can trust us to keep your tax information safe.

Get more for PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

Find out other PA Corporate Net Income Tax Declaration For A State E file Report PA 8453 C PA Department Of Revenue

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later