ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre Form

Understanding the ST 28F Agricultural Exemption Certificate

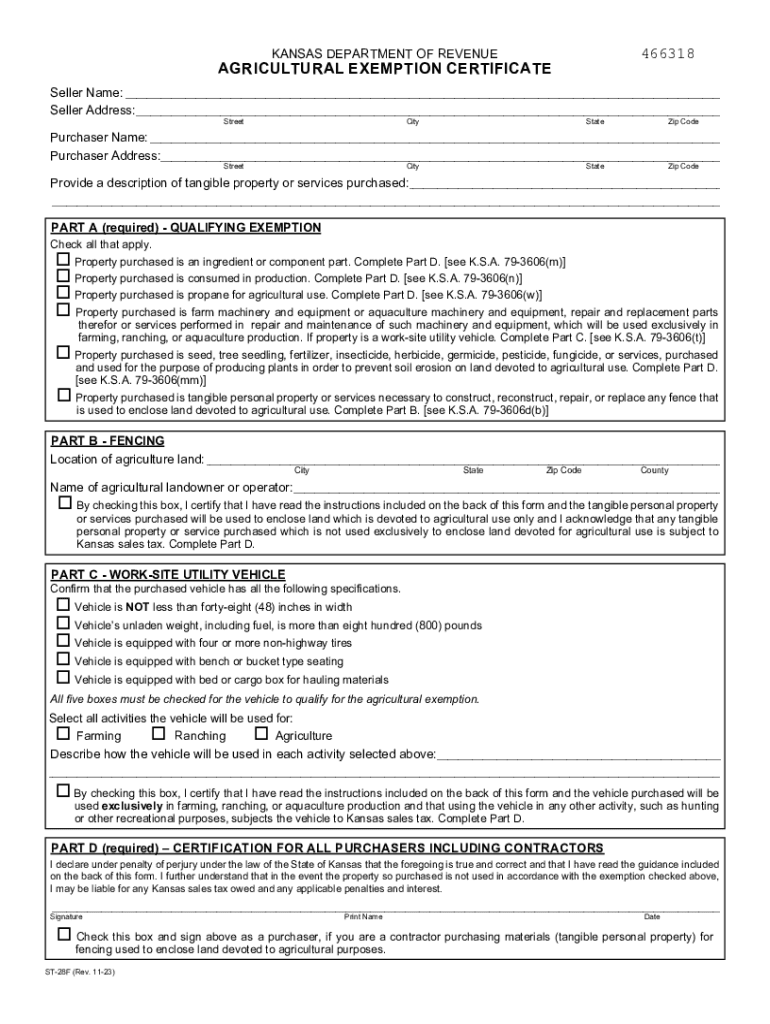

The ST 28F Agricultural Exemption Certificate, also known as the Agricultural Exemption Certificate Rev 8 22, is a crucial document for individuals and businesses engaged in farming, ranching, and related agricultural activities in the United States. This certificate allows eligible farmers, ranchers, feedlots, fisheries, grass farms, nurseries, Christmas tree farms, custom cutters, and crop dusters to purchase certain items without paying sales tax. The exemption is designed to support agricultural operations by reducing costs associated with purchasing necessary supplies and equipment.

How to Use the ST 28F Agricultural Exemption Certificate

To effectively use the ST 28F Agricultural Exemption Certificate, individuals must present it at the time of purchase. The certificate should be filled out completely, including the purchaser's name, address, and the nature of their agricultural business. It is essential to ensure that the items being purchased qualify for the exemption, as not all products may be eligible. This process helps streamline transactions and ensures compliance with state regulations regarding agricultural sales tax exemptions.

Steps to Complete the ST 28F Agricultural Exemption Certificate

Completing the ST 28F Agricultural Exemption Certificate involves several straightforward steps:

- Obtain the certificate form from an authorized source.

- Fill in the required information, including your name, address, and the type of agricultural business.

- Specify the items you are purchasing that qualify for the exemption.

- Sign and date the certificate to validate your claim for exemption.

- Present the completed certificate to the seller during the transaction.

Legal Use of the ST 28F Agricultural Exemption Certificate

Using the ST 28F Agricultural Exemption Certificate legally requires adherence to specific guidelines set by state tax authorities. The certificate must only be used for qualifying purchases related to agricultural activities. Misuse of the certificate, such as using it for personal items or non-agricultural purchases, can lead to penalties and legal repercussions. It is vital for users to understand their responsibilities and the legal implications of using the exemption certificate.

Eligibility Criteria for the ST 28F Agricultural Exemption Certificate

To qualify for the ST 28F Agricultural Exemption Certificate, applicants must meet certain criteria. Generally, individuals or businesses must be actively engaged in agricultural production or services. This includes farmers, ranchers, and those involved in aquaculture or other agricultural work. Additionally, the items purchased must be directly related to the agricultural operation. It is advisable to review state-specific eligibility requirements to ensure compliance.

Examples of Using the ST 28F Agricultural Exemption Certificate

Practical examples of using the ST 28F Agricultural Exemption Certificate include purchasing seeds, fertilizers, and farming equipment without incurring sales tax. For instance, a farmer buying a tractor for fieldwork can present the certificate to the dealer to exempt the sale from tax. Similarly, a nursery purchasing soil and plants for resale can utilize the certificate to reduce costs. These examples illustrate how the certificate facilitates cost savings for agricultural businesses.

Quick guide on how to complete st 28f agricultural exemption certificate rev 8 22 farmers ranchers feedlots fisheries grass farms nurseries christmas tree

Complete ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre easily on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and eSign your documents quickly without hindrances. Handle ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The simplest way to modify and eSign ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre effortlessly

- Obtain ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre and click Get Form to begin.

- Make use of the features we offer to complete your document.

- Emphasize important sections of the documents or conceal sensitive data with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your alterations.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the st 28f agricultural exemption certificate rev 8 22 farmers ranchers feedlots fisheries grass farms nurseries christmas tree

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 28f functionality in airSlate SignNow?

The st 28f functionality in airSlate SignNow allows users to electronically sign documents securely and efficiently. This feature enhances the document workflow, making it easy to send, receive, and manage signatures. With st 28f, businesses can streamline their processes and reduce paper waste.

-

How does pricing work for airSlate SignNow with st 28f?

airSlate SignNow offers a variety of pricing plans tailored to meet different business needs for st 28f. These plans provide access to essential features, including unlimited signing and document templates. The flexible pricing structure ensures that businesses can choose a plan that best fits their budget and usage.

-

What are the main benefits of using airSlate SignNow's st 28f?

The main benefits of using st 28f in airSlate SignNow include increased efficiency, reduced turnaround times, and enhanced security for document transactions. By implementing st 28f, businesses can expedite their document processes while maintaining compliance and safety. This ultimately leads to improved productivity and customer satisfaction.

-

Can airSlate SignNow's st 28f integrate with other software?

Yes, st 28f integrates seamlessly with a variety of business applications, enhancing your workflow efficiency. Popular integrations include CRM systems, ERP solutions, and cloud storage services. This feature allows users to leverage existing tools while benefiting from the capabilities of airSlate SignNow.

-

Is the st 28f feature user-friendly for non-technical users?

Absolutely! The st 28f feature in airSlate SignNow is designed to be user-friendly, making it accessible even for non-technical users. With an intuitive interface and straightforward navigation, anyone can easily send and manage eSignatures. This empowers teams to adopt digital signatures without extensive training.

-

What types of documents can be signed using st 28f?

With st 28f in airSlate SignNow, users can sign a variety of documents, including contracts, agreements, and forms. The platform supports numerous file types, ensuring versatility for different business needs. Whether you're dealing with simple forms or complex contracts, st 28f is equipped to handle it all.

-

Is there customer support available for st 28f users?

Yes, airSlate SignNow offers robust customer support for st 28f users. Support options include live chat, email, and comprehensive online resources. This ensures that users have access to assistance whenever needed, making their experience with st 28f even more seamless.

Get more for ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre

- Parent residency petition university of colorado boulder form

- Medication administration flow sheet log form

- Swine 4h online activities form

- University analysis form

- Cps media consent form

- Ferpa release form westchester community college sunywcc

- Everett community college worksheet form

- Video waver form

Find out other ST 28F Agricultural Exemption Certificate Rev 8 22 Farmers, Ranchers, Feedlots, Fisheries, Grass Farms, Nurseries, Christmas Tre

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple