is it Necessary to File New Mexico Form Pte as Well as Form Rpd 2022

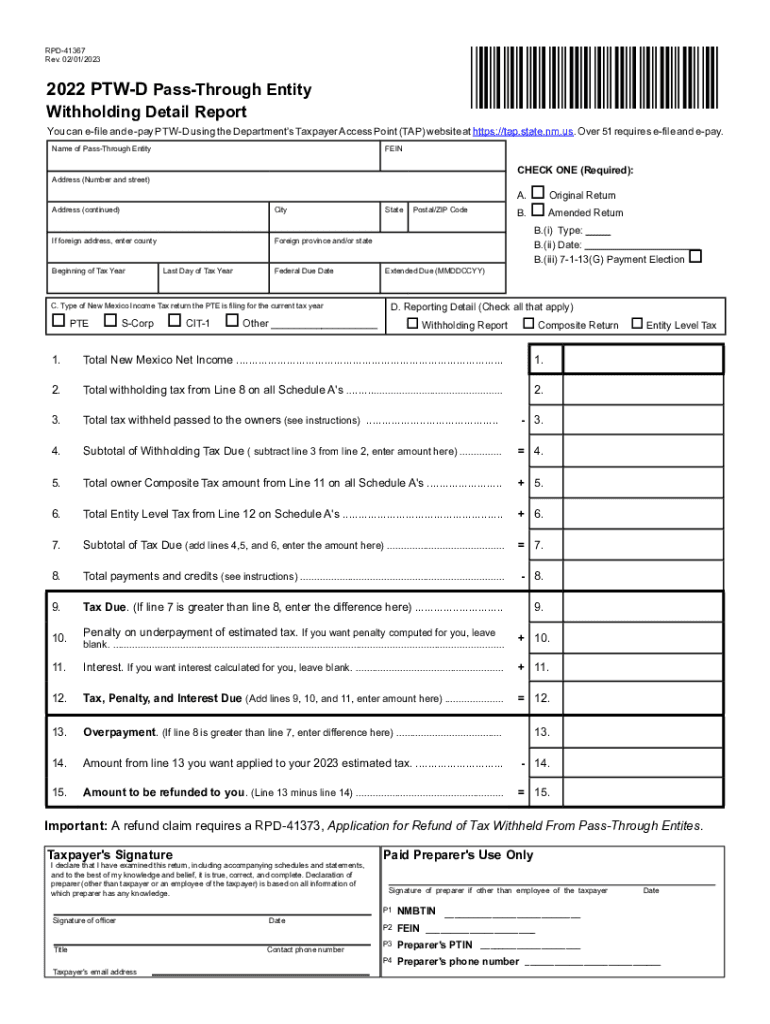

What is New Mexico Form RPD-41367?

New Mexico Form RPD-41367 is a tax form used by individuals and businesses to report specific income and deductions to the New Mexico Taxation and Revenue Department. This form is essential for taxpayers who need to comply with state tax regulations, ensuring accurate reporting of income earned within the state.

Steps to Complete New Mexico Form RPD-41367

Completing the New Mexico Form RPD-41367 involves several key steps:

- Gather necessary documents, including income statements and any relevant deductions.

- Fill out personal information, including your name, address, and Social Security number.

- Report income earned during the tax year, ensuring accuracy in amounts reported.

- Claim any eligible deductions to reduce your taxable income.

- Review the completed form for accuracy before submission.

Filing Deadlines for Form RPD-41367

It is crucial to be aware of the filing deadlines associated with New Mexico Form RPD-41367. Typically, the form must be submitted by April 15 of the following year after the tax year ends. Be mindful of any extensions that may apply and check for any updates from the New Mexico Taxation and Revenue Department.

Form Submission Methods

New Mexico Form RPD-41367 can be submitted in various ways:

- Online submission through the New Mexico Taxation and Revenue Department's website.

- Mailing the completed form to the appropriate address provided in the instructions.

- In-person submission at designated tax offices across New Mexico.

Key Elements of New Mexico Form RPD-41367

Understanding the key elements of Form RPD-41367 is vital for accurate completion. Important sections include:

- Personal identification information.

- Income details, including wages, interest, and dividends.

- Deductions that can be claimed, such as retirement contributions and educational expenses.

- Signature and date to certify the accuracy of the information provided.

Penalties for Non-Compliance

Failing to file New Mexico Form RPD-41367 or submitting inaccurate information can result in penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest on unpaid taxes accruing from the original due date.

- Potential legal action for continued non-compliance.

Eligibility Criteria for Filing Form RPD-41367

To file New Mexico Form RPD-41367, you must meet specific eligibility criteria. Generally, you need to:

- Be a resident of New Mexico or have income sourced from New Mexico.

- Have a certain level of income that requires filing a tax return.

- Provide accurate documentation to support claims made on the form.

Quick guide on how to complete is it necessary to file new mexico form pte as well as form rpd

Effortlessly Prepare Is It Necessary To File New Mexico Form Pte As Well As Form Rpd on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Is It Necessary To File New Mexico Form Pte As Well As Form Rpd on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-centric workflow today.

How to Modify and Electronically Sign Is It Necessary To File New Mexico Form Pte As Well As Form Rpd with Ease

- Obtain Is It Necessary To File New Mexico Form Pte As Well As Form Rpd and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to preserve your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Is It Necessary To File New Mexico Form Pte As Well As Form Rpd to guarantee outstanding communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct is it necessary to file new mexico form pte as well as form rpd

Create this form in 5 minutes!

How to create an eSignature for the is it necessary to file new mexico form pte as well as form rpd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How can airSlate SignNow help with the new mexico form rpd 41367 instructions 2022?

AirSlate SignNow simplifies the process of submitting the new mexico form rpd 41367 instructions 2022 by providing electronic signatures and document management features. With our solution, you can easily send, eSign, and store your documents securely, improving efficiency and reducing paperwork.

-

Are there any costs associated with using airSlate SignNow for new mexico form rpd 41367 instructions 2022?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs and budgets. Depending on the features you require for managing new mexico form rpd 41367 instructions 2022 and other documents, you can choose a plan that suits your business best, ensuring you get the most value.

-

What features does airSlate SignNow offer for completing the new mexico form rpd 41367 instructions 2022?

AirSlate SignNow provides a range of features such as customizable templates, customizable workflows, and secure electronic signatures that are ideal for completing the new mexico form rpd 41367 instructions 2022. These tools make it easier to ensure accuracy and streamline the submission process.

-

Can I integrate airSlate SignNow with other applications while using new mexico form rpd 41367 instructions 2022?

Absolutely! AirSlate SignNow seamlessly integrates with a variety of applications, enabling you to manage your documents like the new mexico form rpd 41367 instructions 2022 alongside other business tools. This integration enhances productivity by allowing data sharing and collaboration across platforms.

-

What are the benefits of using airSlate SignNow for the new mexico form rpd 41367 instructions 2022?

Using airSlate SignNow for the new mexico form rpd 41367 instructions 2022 provides several benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows businesses to automate document workflows and stay compliant with state requirements effortlessly.

-

Is there customer support available for those using airSlate SignNow with new mexico form rpd 41367 instructions 2022?

Yes, airSlate SignNow offers dedicated customer support to assist users with any questions or issues related to the new mexico form rpd 41367 instructions 2022. Our support team is available through various channels to ensure you receive timely help whenever you need it.

-

How does the eSigning process work for new mexico form rpd 41367 instructions 2022?

The eSigning process for the new mexico form rpd 41367 instructions 2022 using airSlate SignNow is straightforward and user-friendly. Once you've uploaded your document, you can designate signers, add signature fields, and send it out for signing, all in a matter of minutes.

Get more for Is It Necessary To File New Mexico Form Pte As Well As Form Rpd

- Cheerleadind sing up sheet printable form

- Field trip curriculum form

- Student information sheet buncombe county schools buncombe k12 nc

- Form excused

- Letter of recommendation for promotion for physician form

- Year 4 rotation evaluation form away electives ttuhsc

- Albany medical center financial aid forms

- Uniform violation

Find out other Is It Necessary To File New Mexico Form Pte As Well As Form Rpd

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free