Form NP 1 Sales and Use Tax Exemption Application for 2022

What is the Form NP-1 Sales And Use Tax Exemption Application For

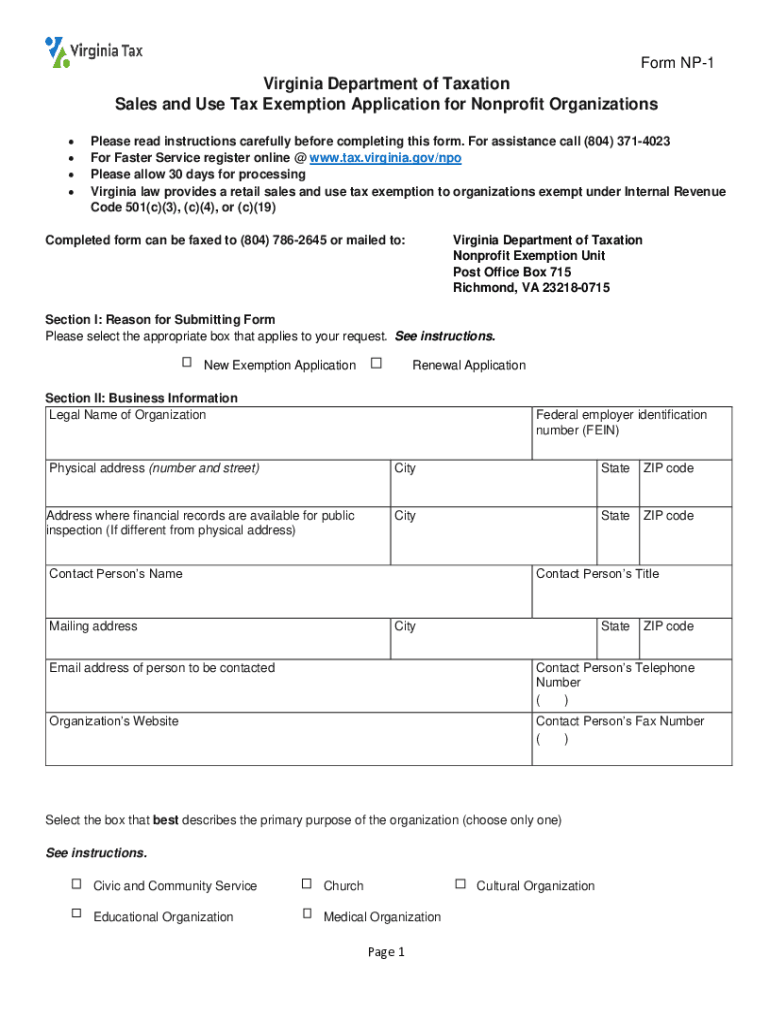

The Form NP-1 Sales And Use Tax Exemption Application is a crucial document used by businesses in the United States to apply for sales and use tax exemptions. This form is typically utilized by entities that qualify for tax exemptions based on their operational status or the nature of their purchases. Common applicants include non-profit organizations, government agencies, and certain educational institutions. By submitting this form, eligible entities can avoid paying sales tax on specific purchases, thereby reducing their overall operational costs.

Steps to Complete the Form NP-1 Sales And Use Tax Exemption Application For

Completing the Form NP-1 requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps:

- Gather Required Information: Collect all necessary documentation, including your organization's tax identification number and proof of eligibility for the exemption.

- Fill Out the Form: Provide accurate details in each section of the form, including the applicant's name, address, and the type of exemption being requested.

- Review the Application: Double-check all entries for accuracy and completeness to prevent delays in processing.

- Submit the Form: Follow the specified submission methods, whether online, by mail, or in-person, as outlined in the guidelines.

Eligibility Criteria

To qualify for the sales and use tax exemption using Form NP-1, applicants must meet specific eligibility criteria. Generally, these include:

- The applicant must be a recognized non-profit organization, government entity, or educational institution.

- Purchases must be directly related to the exempt purpose of the organization, such as providing services or educational programs.

- The organization must have a valid tax identification number and be in good standing with state tax authorities.

Required Documents

When applying for an exemption with the Form NP-1, certain documents are typically required to support the application. These may include:

- A copy of the organization's IRS determination letter confirming non-profit status.

- Proof of the organization's tax identification number.

- Any additional documentation that demonstrates eligibility for the exemption, such as financial statements or program descriptions.

Form Submission Methods

The Form NP-1 can be submitted through various methods, depending on the state’s regulations. Common submission methods include:

- Online Submission: Many states offer an online portal where applicants can fill out and submit the form electronically.

- Mail: Applicants can print the completed form and send it via postal mail to the designated tax authority.

- In-Person: Some applicants may choose to deliver the form directly to the local tax office for immediate processing.

Application Process & Approval Time

The application process for the Form NP-1 typically involves several steps, including submission, review, and approval. After submission, the processing time can vary by state but generally ranges from a few weeks to several months. It is advisable to follow up with the tax authority if there are any delays or if additional information is requested.

Quick guide on how to complete form np 1 sales and use tax exemption application for

Effortlessly Prepare Form NP 1 Sales And Use Tax Exemption Application For on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and sign your documents quickly without delays. Manage Form NP 1 Sales And Use Tax Exemption Application For on any device using the airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to Modify and eSign Form NP 1 Sales And Use Tax Exemption Application For with Ease

- Find Form NP 1 Sales And Use Tax Exemption Application For and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, SMS, an invitation link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Edit and eSign Form NP 1 Sales And Use Tax Exemption Application For and ensure seamless communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form np 1 sales and use tax exemption application for

Create this form in 5 minutes!

How to create an eSignature for the form np 1 sales and use tax exemption application for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form NP 1 Sales And Use Tax Exemption Application For?

The Form NP 1 Sales And Use Tax Exemption Application For is a document used by businesses to apply for exemption from sales and use tax. It must be completed accurately to ensure your application is processed efficiently. airSlate SignNow offers an easy-to-use platform to manage and eSign this application seamlessly.

-

How does airSlate SignNow facilitate the completion of the Form NP 1 Sales And Use Tax Exemption Application For?

airSlate SignNow provides an intuitive interface that allows users to fill out the Form NP 1 Sales And Use Tax Exemption Application For digitally. With features like drag-and-drop templates and real-time collaboration, preparing your application becomes a straightforward process.

-

Are there any costs associated with using airSlate SignNow for the Form NP 1 Sales And Use Tax Exemption Application For?

airSlate SignNow offers various pricing plans suitable for different business needs. While there are costs associated with premium features, the platform remains cost-effective, especially compared to manual processes for the Form NP 1 Sales And Use Tax Exemption Application For.

-

What benefits does airSlate SignNow offer for managing tax exemption applications like Form NP 1?

Using airSlate SignNow to manage applications like the Form NP 1 Sales And Use Tax Exemption Application For not only streamlines the submission process but also enhances security. The platform ensures that your documents are protected and easily retrievable, allowing for better organization and compliance.

-

Can airSlate SignNow integrate with other software for the Form NP 1 Sales And Use Tax Exemption Application For?

Yes, airSlate SignNow integrates with numerous software applications, enabling businesses to efficiently manage their Form NP 1 Sales And Use Tax Exemption Application For alongside other workflows. This integration capability ensures that your tax exemption application process is efficient and cohesive with your existing systems.

-

Is the Form NP 1 Sales And Use Tax Exemption Application For easy to eSign with airSlate SignNow?

Absolutely! airSlate SignNow is designed for user-friendliness, making it easy to eSign the Form NP 1 Sales And Use Tax Exemption Application For. The platform guides users through the signing process, ensuring a smooth experience without the hassle of printing or scanning documents.

-

What features of airSlate SignNow support the use of the Form NP 1 Sales And Use Tax Exemption Application For?

airSlate SignNow offers features such as customizable templates, secure cloud storage, and comprehensive tracking for the Form NP 1 Sales And Use Tax Exemption Application For. These tools enhance the efficiency and organization of the application process, making it easier for businesses to manage their tax paperwork.

Get more for Form NP 1 Sales And Use Tax Exemption Application For

- Tcu application form

- Franciscan university tuition waiver form

- Issue resolution policy and forms indiana university south bend iusb

- Subway donation request canada form

- Georgia tech procurement card request form this form must be

- 10 reasons to ban pens and pencils in the classroomkqed form

- Non degree office of admissionsthe university of new form

- Raritan depedent verification worksheet form

Find out other Form NP 1 Sales And Use Tax Exemption Application For

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template