Publication 3598 Rev 11 What You Should Know About the Audit Reconsideration Process 2015-2026

Understanding Publication 3598

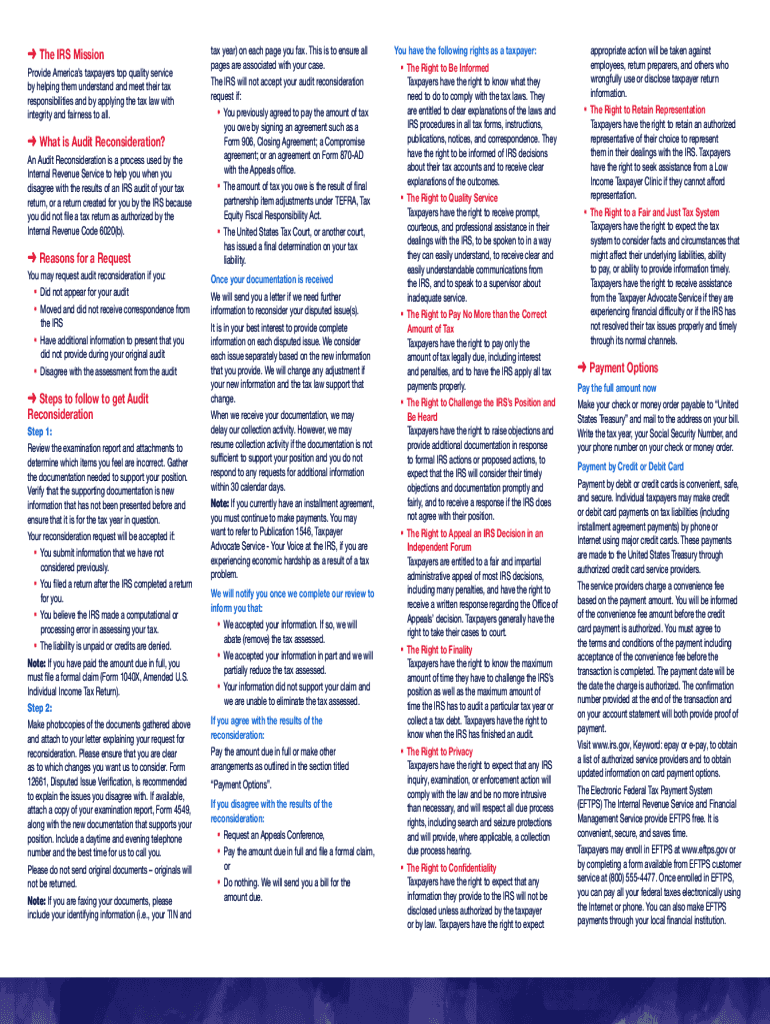

Publication 3598, also known as IRS Publication 3598, provides essential guidance for taxpayers undergoing the audit reconsideration process. This document outlines the steps necessary for individuals and businesses to request a review of their audit results. It is crucial for taxpayers to understand the criteria and procedures involved in this process to ensure a fair assessment of their tax situation.

How to Utilize Publication 3598

To effectively use Publication 3598, taxpayers should first familiarize themselves with its content. The publication details the necessary forms and documentation required for an audit reconsideration request. It is important to gather all relevant information, including prior audit results and any new evidence that may support the request. Following the guidelines in this publication can help streamline the process and improve the chances of a favorable outcome.

Steps for Completing Publication 3598

Completing the audit reconsideration process outlined in Publication 3598 involves several key steps:

- Review the audit findings and identify any discrepancies.

- Gather supporting documentation that may impact the audit outcome.

- Complete the necessary forms as specified in the publication.

- Submit the request for reconsideration along with all supporting materials.

- Monitor the status of the request and respond to any inquiries from the IRS.

Key Elements of Publication 3598

Publication 3598 includes several key elements that are vital for taxpayers to understand:

- The eligibility criteria for audit reconsideration.

- The types of documentation that can be submitted to support the request.

- Important deadlines and timelines associated with the reconsideration process.

- Contact information for IRS representatives who can provide assistance.

Required Documents for Publication 3598

When preparing to submit a request for audit reconsideration using Publication 3598, taxpayers must collect specific documents, including:

- Copies of the original tax returns that were audited.

- Correspondence from the IRS regarding the audit findings.

- Any new evidence or information that supports the request for reconsideration.

- Completed forms as outlined in the publication.

Filing Deadlines and Important Dates

Publication 3598 highlights critical deadlines that taxpayers must adhere to when submitting their audit reconsideration requests. It is essential to be aware of these dates to avoid delays or potential penalties. Taxpayers should ensure that all forms and supporting documents are submitted within the specified time frames to facilitate a prompt review by the IRS.

Quick guide on how to complete publication 3598 rev 11 what you should know about the audit reconsideration process

Complete Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process smoothly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without holdups. Manage Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest way to alter and electronically sign Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process effortlessly

- Find Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your files or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your needs in document management with just a few clicks from a device of your choice. Modify and electronically sign Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process and ensure exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct publication 3598 rev 11 what you should know about the audit reconsideration process

Create this form in 5 minutes!

How to create an eSignature for the publication 3598 rev 11 what you should know about the audit reconsideration process

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 3598 and how is it used?

Form 3598 is a document that can be utilized for various purposes within the airSlate SignNow platform. This form allows users to efficiently manage and track signatures, making it a critical tool for businesses looking to streamline their document signing processes.

-

How does airSlate SignNow simplify the management of form 3598?

airSlate SignNow simplifies the management of form 3598 by providing user-friendly templates and automated workflows. This allows users to fill out, send, and sign the form quickly, saving valuable time and reducing errors in the documentation process.

-

Is there a cost associated with using form 3598 on airSlate SignNow?

The use of form 3598 on airSlate SignNow is included in various pricing plans that cater to different business needs. These plans provide access to a range of features, making it a cost-effective solution for organizations looking to manage their documents efficiently.

-

What features does airSlate SignNow offer for form 3598?

airSlate SignNow offers several features for form 3598, including electronic signatures, customizable fields, and document tracking. These features enhance the overall user experience, ensuring your form is processed quickly and securely.

-

Can I integrate form 3598 with other applications?

Yes, airSlate SignNow allows you to integrate form 3598 with various applications such as CRM systems, cloud storage solutions, and other productivity tools. This seamless integration improves workflow efficiency and enables easier access to your documents.

-

What benefits can businesses expect from using form 3598 with airSlate SignNow?

By using form 3598 with airSlate SignNow, businesses can expect increased efficiency, reduced turnaround times, and improved compliance with electronic record-keeping regulations. This ultimately leads to a more productive environment and quicker deal closures.

-

How secure is airSlate SignNow for handling form 3598?

airSlate SignNow prioritizes security when handling form 3598, employing robust encryption and compliance with industry standards. This ensures that your documents are kept confidential and safe from unauthorized access.

Get more for Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process

- 2019 delaware form

- Njdpmc form

- Nhs pensions form sd502

- Grade change request form elementary schools option 2 2

- Pension credit claim form govuk

- Aw8p pension claim form

- Certificate of name not given in baptism application form

- If you would like braille british sign language a hearing loop translations large print audio or something else form

Find out other Publication 3598 Rev 11 What You Should Know About The Audit Reconsideration Process

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple