Tax and Fee ReportingWashington State Liquor and 2022

What is the Tax And Fee Reporting Washington State Liquor And

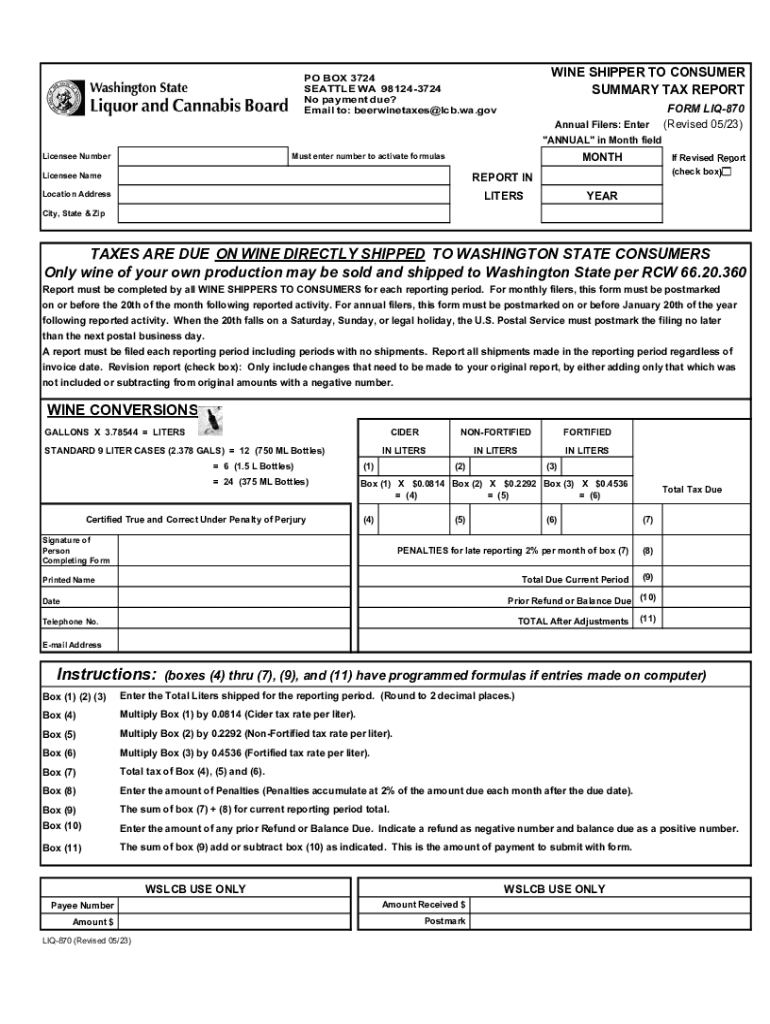

The Tax and Fee Reporting for Washington State Liquor refers to the mandatory documentation that businesses involved in the sale of liquor must submit to the state. This form is essential for reporting various taxes and fees associated with liquor sales, ensuring compliance with state regulations. It includes details about sales volumes, tax calculations, and any applicable fees that businesses must remit to the state government.

How to use the Tax And Fee Reporting Washington State Liquor And

Using the Tax and Fee Reporting for Washington State Liquor involves several steps. First, businesses must gather all relevant sales data for the reporting period. This includes total sales, returns, and any discounts applied. Next, businesses need to accurately calculate the taxes owed based on the applicable rates. Once the calculations are complete, the form should be filled out with the necessary information and submitted according to state guidelines.

Steps to complete the Tax And Fee Reporting Washington State Liquor And

Completing the Tax and Fee Reporting for Washington State Liquor involves a systematic approach:

- Collect sales data for the reporting period.

- Determine the applicable tax rates for liquor sales.

- Calculate total taxes owed based on sales figures.

- Fill out the reporting form with accurate information.

- Review the form for completeness and accuracy.

- Submit the form by the designated deadline.

Required Documents

To complete the Tax and Fee Reporting for Washington State Liquor, businesses must have several key documents on hand. These include sales receipts, invoices, and any records of returns or discounts. Additionally, businesses should maintain documentation that supports tax calculations, such as previous tax filings and any correspondence with the state regarding liquor sales.

Filing Deadlines / Important Dates

Filing deadlines for the Tax and Fee Reporting for Washington State Liquor are crucial for compliance. Typically, businesses must submit their reports on a monthly or quarterly basis, depending on their sales volume. It is important to check the specific deadlines set by the Washington State Liquor and Cannabis Board to avoid penalties.

Penalties for Non-Compliance

Failure to comply with the Tax and Fee Reporting requirements for Washington State Liquor can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against the business. It is essential for businesses to adhere to all reporting requirements and deadlines to avoid these consequences.

Quick guide on how to complete tax and fee reportingwashington state liquor and

Effortlessly Prepare Tax And Fee ReportingWashington State Liquor And on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as a perfect sustainable substitute for traditional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to draft, modify, and eSign your documents quickly without delays. Manage Tax And Fee ReportingWashington State Liquor And on any device with the airSlate SignNow applications for Android or iOS and streamline any document-based procedure today.

How to Modify and eSign Tax And Fee ReportingWashington State Liquor And with Ease

- Obtain Tax And Fee ReportingWashington State Liquor And and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Craft your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost files, endless form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Tax And Fee ReportingWashington State Liquor And to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax and fee reportingwashington state liquor and

Create this form in 5 minutes!

How to create an eSignature for the tax and fee reportingwashington state liquor and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Tax And Fee ReportingWashington State Liquor And?

Tax And Fee ReportingWashington State Liquor And is a specialized service designed to assist businesses in compliance with Washington state regulations regarding liquor tax and fee reporting. It streamlines the process, ensuring accurate calculations and timely submissions, thereby reducing the risk of penalties.

-

How does airSlate SignNow assist with Tax And Fee ReportingWashington State Liquor And?

airSlate SignNow offers tools that simplify the eSigning and document management processes for Tax And Fee ReportingWashington State Liquor And. With our platform, businesses can easily prepare, send, and manage compliance documents securely and efficiently.

-

What are the pricing options for using airSlate SignNow for Tax And Fee ReportingWashington State Liquor And?

airSlate SignNow provides various pricing plans to accommodate different business needs for Tax And Fee ReportingWashington State Liquor And. Our plans are designed to be cost-effective while offering advanced features that enhance document workflow efficiency.

-

What features are included in the airSlate SignNow platform for Tax And Fee ReportingWashington State Liquor And?

The airSlate SignNow platform includes features such as customizable templates, automated reminders, and secure eSignatures, all tailored to facilitate Tax And Fee ReportingWashington State Liquor And. These features help streamline document management and ensure compliance.

-

How can airSlate SignNow improve the compliance process for Tax And Fee ReportingWashington State Liquor And?

By utilizing airSlate SignNow, businesses can automate and simplify the compliance process for Tax And Fee ReportingWashington State Liquor And. The platform ensures that all necessary documents are completed correctly, reducing the risk of errors that can lead to compliance issues.

-

Are there integrations available for airSlate SignNow when handling Tax And Fee ReportingWashington State Liquor And?

Yes, airSlate SignNow offers integrations with various accounting and tax software to enhance the management of Tax And Fee ReportingWashington State Liquor And. These integrations allow seamless data transfer, making your compliance process more efficient and accurate.

-

Can airSlate SignNow help with the audit process for Tax And Fee ReportingWashington State Liquor And?

Absolutely, airSlate SignNow provides a robust documentation trail that is invaluable during audits related to Tax And Fee ReportingWashington State Liquor And. With easy access to signed documents and an organized workflow, audits can be managed more effectively.

Get more for Tax And Fee ReportingWashington State Liquor And

Find out other Tax And Fee ReportingWashington State Liquor And

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement

- How To Sign Illinois Sales Invoice Template

- How Do I Sign Indiana Sales Invoice Template

- Sign North Carolina Equipment Sales Agreement Online

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release