PLEASE READ the LATEST UPDATE on ISF 10 2 on the Form

Understanding the PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

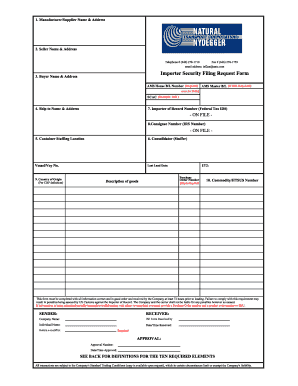

The ISF 10 2 is a crucial document used in international shipping, specifically for importing goods into the United States. This form, also known as the Importer Security Filing, is mandated by U.S. Customs and Border Protection (CBP). It requires importers to provide specific information about their shipments before they arrive in the U.S. The latest updates to this form may include changes in data requirements, submission deadlines, or compliance guidelines, which are essential for avoiding penalties and ensuring smooth customs processing.

Steps to Complete the PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

Completing the ISF 10 2 involves several key steps to ensure compliance with U.S. customs regulations. First, gather all necessary shipment details, including the bill of lading, manufacturer information, and product descriptions. Next, accurately fill out the form with the required data, ensuring that all information is complete and correct. After completing the form, submit it electronically to CBP at least 24 hours before the cargo is loaded onto the vessel. This proactive approach helps prevent delays at the port and potential fines.

Key Elements of the PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

Several key elements must be included in the ISF 10 2. These include the Importer of Record number, consignee details, and the country of origin for each product. Additionally, the form requires information about the manufacturer, the product's Harmonized Tariff Schedule (HTS) number, and the estimated arrival date in the U.S. Each of these components plays a significant role in ensuring that the shipment complies with U.S. customs regulations and facilitates efficient processing.

Legal Use of the PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

The legal use of the ISF 10 2 is governed by U.S. customs laws, which mandate that importers must file this form to ensure the security of shipments entering the country. Failure to submit the ISF 10 2 can result in significant penalties, including fines and delays in cargo release. It is essential for businesses to understand the legal implications of this form and stay updated on any changes to avoid non-compliance.

Filing Deadlines / Important Dates

Timely submission of the ISF 10 2 is critical for compliance. Importers must file the form at least 24 hours before the cargo is loaded onto the vessel. Additionally, it is important to stay informed about any updates from CBP regarding changes in deadlines or requirements, as these can impact the shipping process. Being aware of these timelines helps ensure that shipments are processed smoothly and without unnecessary delays.

Penalties for Non-Compliance

Non-compliance with ISF 10 2 requirements can lead to severe penalties. The U.S. Customs and Border Protection can impose fines for late submissions, incomplete forms, or failure to file altogether. These penalties can reach thousands of dollars per violation, making it crucial for importers to adhere to the regulations. Understanding the risks associated with non-compliance can motivate businesses to prioritize accurate and timely filing of the ISF 10 2.

Quick guide on how to complete please read the latest update on isf 10 2 on the

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained popularity among companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily access the necessary forms and securely keep them online. airSlate SignNow equips you with all the resources required to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage [SKS] on any device using airSlate SignNow apps available for Android and iOS, and enhance any document-related workflow today.

The most efficient way to edit and electronically sign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

Create this form in 5 minutes!

How to create an eSignature for the please read the latest update on isf 10 2 on the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the latest update on ISF 10 2?

The latest update on ISF 10 2 outlines crucial guidelines for shipping documentation. Businesses must stay informed regarding the specifications as they can signNowly impact compliance and operations. Please read the latest update on ISF 10 2 on the airSlate SignNow platform for complete details.

-

How does airSlate SignNow support ISF 10 2 compliance?

airSlate SignNow provides tools designed to streamline document management, ensuring all necessary paperwork, including ISF 10 2 forms, is completed accurately. Our platform supports compliance by offering templates and automated alerts. For the latest information, please read the latest update on ISF 10 2 on the airSlate SignNow site.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes. We provide various subscription options to ensure you find a plan that fits your needs and budget. Please read the latest update on ISF 10 2 on our landing page to discover how our pricing can help your compliance efforts.

-

What features does airSlate SignNow offer for document signing?

Our platform features eSigning, document templates, and real-time tracking to enhance your document workflow. With a user-friendly interface, you can manage signatures and approvals effortlessly. For further insights, please read the latest update on ISF 10 2 on the airSlate SignNow website.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow seamlessly integrates with popular software applications to enhance your workflow. Connections to platforms like Salesforce and Google Drive ensure all your tools work together efficiently. To learn more about our integrations, please read the latest update on ISF 10 2 on our landing page.

-

How does airSlate SignNow improve team collaboration?

With airSlate SignNow, teams can collaborate on documents in real-time, ensuring everyone stays aligned throughout the signing process. Features like shared templates and status tracking help streamline operations. Please read the latest update on ISF 10 2 on the airSlate SignNow site for more collaboration tips.

-

What are the benefits of using airSlate SignNow for businesses?

airSlate SignNow empowers businesses to speed up processes, reduce paper usage, and ensure compliance with regulations. It provides a cost-effective solution that simplifies document management. For the latest changes and benefits, please read the latest update on ISF 10 2 on our platform.

Get more for PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

Find out other PLEASE READ THE LATEST UPDATE ON ISF 10 2 ON THE

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free