RMT Tax Return Ver02 AO2016 66 Prep4nonfillable PDF 2016

What is the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

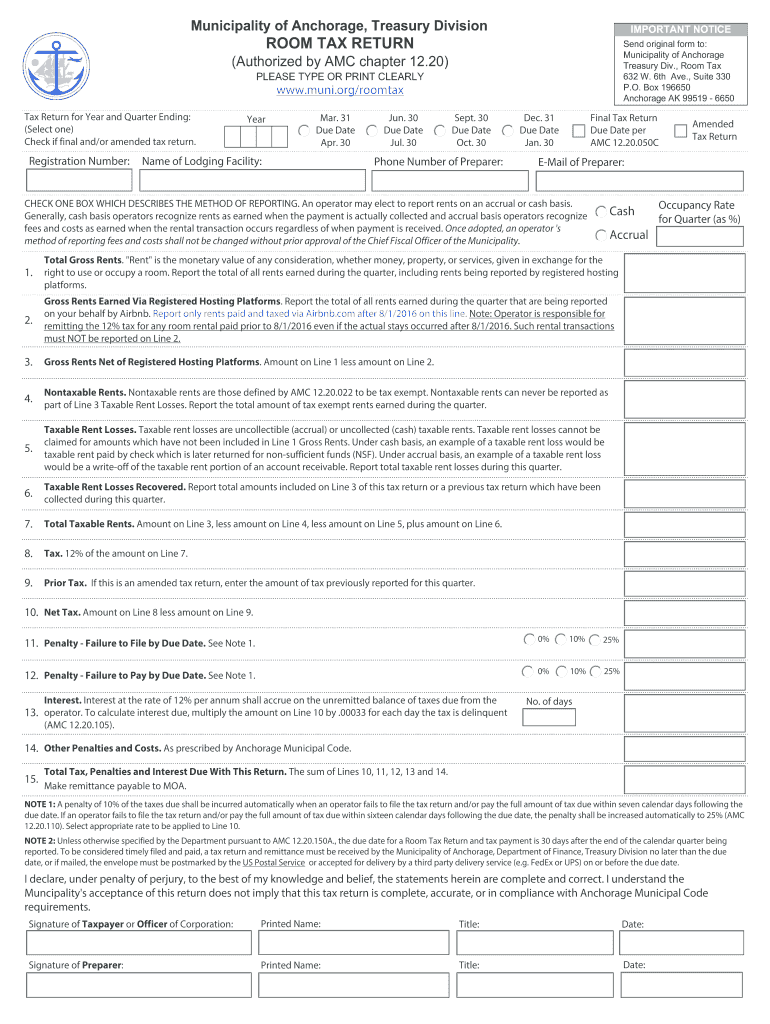

The RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf is a specific tax document designed for individuals and businesses to report their income and calculate their tax obligations. This form is essential for ensuring compliance with federal tax regulations. It includes various fields where taxpayers can input their financial information, deductions, and credits, ultimately determining their tax liability. Understanding this form is crucial for accurate tax reporting and avoiding potential penalties.

How to use the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

Using the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf involves several steps. First, obtain the form from a reliable source. Once you have the document, carefully read the instructions provided to understand the required information. Fill in the necessary fields with accurate financial data, ensuring that all calculations are correct. After completing the form, review it thoroughly for any errors before submitting it to the appropriate tax authority.

Steps to complete the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

Completing the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf requires a systematic approach:

- Gather all necessary financial documents, including W-2s, 1099s, and other relevant records.

- Download or print the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf form.

- Follow the instructions on the form to fill in your personal information and financial details.

- Double-check all entries for accuracy, ensuring that totals and calculations are correct.

- Sign and date the form as required.

- Submit the completed form electronically or by mail, depending on your preference and the guidelines provided.

Legal use of the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

The RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf must be used in accordance with IRS regulations to ensure its legal validity. This includes using the form for its intended purpose, providing accurate information, and adhering to submission deadlines. Taxpayers should be aware that any discrepancies or inaccuracies may lead to penalties or audits. Utilizing an eSignature for submission is acceptable under current IRS guidelines, enhancing the form's legal standing.

Required Documents

To accurately complete the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf, several documents are typically required:

- W-2 forms from employers documenting wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as medical costs or business expenses.

- Records of any other income sources, including interest and dividends.

- Previous year’s tax return for reference.

Filing Deadlines / Important Dates

Filing deadlines for the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf are crucial for compliance. Typically, individual tax returns are due by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions they may file for additional time to submit their returns. Staying informed about these dates helps avoid late filing penalties.

Quick guide on how to complete rmt tax return ver02 ao2016 66 prep4nonfillablepdf

Your assistance manual on how to prepare your RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

If you’re looking to find out how to generate and submit your RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf, here are some brief guidelines on how to simplify the tax filing process.

To begin, you only need to create your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, generate, and complete your tax forms with ease. With its editor, you can navigate through text, check boxes, and eSignatures, and return to modify answers as needed. Streamline your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow these guidelines to complete your RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf in a matter of minutes:

- Create your account and start working on PDFs in no time.

- Utilize our library to find any IRS tax form; explore versions and schedules.

- Click Get form to access your RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf in our editor.

- Fill in the necessary fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to incorporate your legally-recognized eSignature (if needed).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, send it to your recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper may increase return errors and delay refunds. Naturally, before e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct rmt tax return ver02 ao2016 66 prep4nonfillablepdf

Create this form in 5 minutes!

How to create an eSignature for the rmt tax return ver02 ao2016 66 prep4nonfillablepdf

How to generate an eSignature for your Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf online

How to make an electronic signature for your Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf in Google Chrome

How to create an eSignature for putting it on the Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf in Gmail

How to generate an electronic signature for the Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf from your mobile device

How to make an electronic signature for the Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf on iOS

How to create an electronic signature for the Rmt Tax Return Ver02 Ao2016 66 Prep4nonfillablepdf on Android OS

People also ask

-

What is the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf?

The RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf is a specific tax form designed for individual taxpayers in Australia. This form allows users to efficiently prepare and submit their tax returns, ensuring compliance with the Australian Taxation Office's guidelines.

-

How does airSlate SignNow facilitate the completion of the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf?

airSlate SignNow streamlines the process of completing the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf by providing a user-friendly interface. Users can easily import their data, fill out the necessary fields, and electronically sign the document for submission, simplifying tax preparation.

-

Is the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf free to use?

While airSlate SignNow offers various pricing plans, access to the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf specifically may be included in some plans. It's advisable to check the website for the most current pricing information and features related to tax document management.

-

What are the benefits of using airSlate SignNow for tax documents?

Using airSlate SignNow for tax documents like the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf provides several advantages. It enhances efficiency through digital document handling, reduces postal delays, and ensures secure electronic signatures for compliance purposes.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Yes, airSlate SignNow offers integration capabilities with various software applications, enhancing your tax preparation process. You can easily connect it with accounting software or other productivity tools to seamlessly manage your RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf and related documents.

-

How secure is my data when using airSlate SignNow for tax returns?

airSlate SignNow prioritizes data security and employs advanced encryption to protect your information when handling documents like the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf. This ensures that your sensitive tax information remains confidential and secure throughout the process.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including template creation, real-time collaboration, and electronic signatures. These features make it easy to manage forms like the RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf efficiently and effectively.

Get more for RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

- Iffco tokio general insurance form

- Transcript request form edinboro university edinboro

- Accessible space housing application form

- Weekly homework sheet answer key 433229860 form

- Csi bmac harvestingprp consent form docx

- Us probation report forms greeneville tn

- Due diligence review contract template form

Find out other RMT Tax Return Ver02 AO2016 66 Prep4nonfillable pdf

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document