Tax Return Form Municipality of Anchorage Muni 2010

What is the Tax Return Form Municipality Of Anchorage Muni

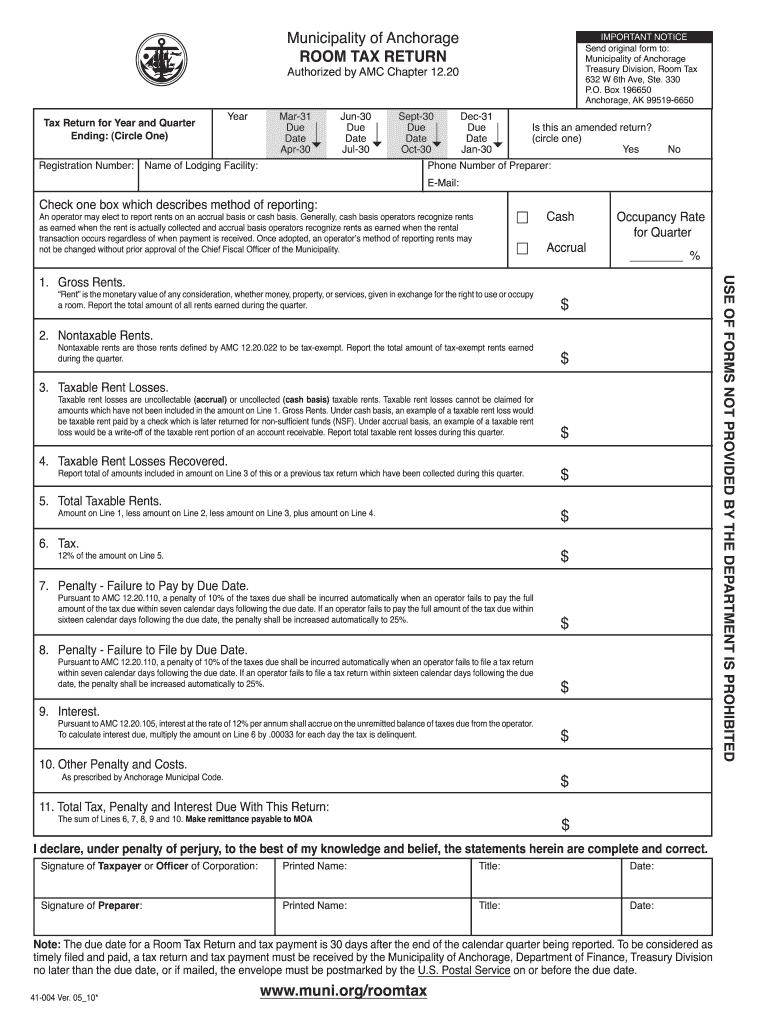

The Tax Return Form Municipality Of Anchorage Muni is a specific document used by residents of Anchorage, Alaska, to report their income and calculate their municipal tax obligations. This form is essential for ensuring compliance with local tax laws and regulations. It is designed to capture various financial details, including income sources, deductions, and credits applicable to residents. By accurately completing this form, taxpayers contribute to the funding of local services and infrastructure.

How to use the Tax Return Form Municipality Of Anchorage Muni

Using the Tax Return Form Municipality Of Anchorage Muni involves several steps to ensure accurate reporting. First, gather all necessary financial documents, such as W-2s, 1099s, and any receipts for deductible expenses. Next, access the form through the official municipal website or other authorized sources. Fill out the form carefully, providing accurate information in each section. After completing the form, review it for any errors before submission to avoid delays or penalties.

Steps to complete the Tax Return Form Municipality Of Anchorage Muni

Completing the Tax Return Form Municipality Of Anchorage Muni requires a systematic approach. Follow these steps:

- Collect all relevant financial documents, including income statements and expense receipts.

- Download or access the tax return form from the official Anchorage municipal website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- List any deductions or credits you are eligible for, ensuring you have documentation to support these claims.

- Calculate your total tax liability based on the information provided.

- Sign and date the form, ensuring all required fields are completed.

Legal use of the Tax Return Form Municipality Of Anchorage Muni

The Tax Return Form Municipality Of Anchorage Muni is legally binding and must be filled out in accordance with local tax laws. It is essential for residents to ensure that the information provided is accurate and truthful, as any discrepancies may lead to penalties or legal consequences. The form serves as an official record of income and tax obligations, making it crucial for compliance with municipal regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Return Form Municipality Of Anchorage Muni are typically set by the municipality and may vary each year. It is important for taxpayers to be aware of these dates to avoid late fees. Generally, the deadline for filing is aligned with the federal tax return deadline, which is usually April 15. However, specific dates may change, so checking the official municipal website for the most current information is advisable.

Form Submission Methods (Online / Mail / In-Person)

Residents can submit the Tax Return Form Municipality Of Anchorage Muni through various methods, ensuring flexibility for taxpayers. Options typically include:

- Online Submission: Many municipalities offer an online portal for electronic filing, which is often the quickest method.

- Mail: Taxpayers can print the completed form and send it via postal mail to the designated municipal tax office.

- In-Person: Residents may also choose to deliver their forms directly to the municipal office, allowing for immediate confirmation of receipt.

Quick guide on how to complete tax return form municipality of anchorage muni

Your assistance manual on how to prepare your Tax Return Form Municipality Of Anchorage Muni

If you’re curious about how to generate and submit your Tax Return Form Municipality Of Anchorage Muni, here are a few concise recommendations on making tax processing simpler.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to edit, create, and finalize your tax forms effortlessly. With its editor, you can toggle between text, check boxes, and eSignatures and navigate back to modify answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and straightforward sharing.

Adhere to the steps below to complete your Tax Return Form Municipality Of Anchorage Muni in no time:

- Create your profile and start editing PDFs in just minutes.

- Utilize our directory to find any IRS tax form; explore different versions and schedules.

- Click Get form to access your Tax Return Form Municipality Of Anchorage Muni in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkboxes).

- Employ the Sign Tool to add your legally-recognized eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save your changes, print your version, submit it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that submitting in paper form can lead to more errors and cause delays in refunds. Be sure to check the IRS website for submission guidelines specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct tax return form municipality of anchorage muni

FAQs

-

How can I fill out the details of my PPF and LIC in income tax return along with Form 16 details?

PPF contribution and LIC premium paid is shown under section 80C deductions ( chapter VIA deduction) in ITR.However total limit under 80C is 1.5L.( I am assuming that you have referred to investments made -ppf/LIC and not withdrawals (income)from the same).Regards.

-

How can you contact someone that is experienced in filling out a transcript of Tax Return Form 4506-T?

You can request a transcript online at Get Transcript. That should be easier and quicker than filling out the form. Otherwise any US tax professional should be able to help you.

-

Is it okay to submit a Form 67 after filling out my tax return?

As per the law, Form 67 is required for claiming Foreign Tax Credits by an assessee and it should be done along with the return of income.It is possible to file Form 67 before filing the return.The question is whether the Form can be filed after filing the return of income. While the requirement is procedural, a return may be termed as incomplete if the form is not filed along with the returns and an officer can deny foreign tax credits.However, for all intents and purposes if you file Form 67 before the completion of assessment or even with an application u/s 154 once the assessment is completed, it cannot be denied if the facts have been already disclosed in the return and teh form in itself is only completing a process.However, to avoid adventures with the department and unwanted litigation, it is always prudent to file the form with the return of income so that it is not missed out or forgotten.

-

How do I fill the income tax return form of India?

you can very easily file your income tax return online, but decide which return to file generally salaried individual files ITR 1 and businessmen files ITR 4S as both are very easy to file. First Fill the Details on First Page Name, Address, mobile no, PAN Number, Date of Birth and income from salary and deduction you are claiming under 80C and other sections. Then fill the details of TDS deduction which can be check from Form 16 as well as Form 26AS availbale online. Then complete the details on 3rd page like bank account number, type of account(saving), Bank MICR code(given on cheque book), father name. Then Click and Validate button and if there is any error it will automatically show. recity those error Then click on calculate button and finally click on generate button and save .xml file which you have to upload on income tax. This website I really found very good for income tax related problem visit Income Tax Website for Efiling Taxes, ITR Forms, etc. for more information.

-

What tax transcript form should I fill out to find my old W2 forms to file for a tax return? -I have not filed before and I'm 53.?

I guess this link answers to your question: Transcript or Copy of Form W-2

-

How can I fill out the income tax return of the year 2016-17 in 2018?

There is no option to file online return but you can prepare an offline return and went to the officer of your jurisdiction income tax commissioner and after his permission you can file the return with his office.

-

For the amended tax return, the only thing I needed to correct was the filing status. Do I still need to fill out the rest of the form involving income, etc.?

Yes, it depends what kind of income. For social security incomes, there is a different threshold amount for single and Married Filing joint. Different filing status have a certain treatment and that tax rates are different for every filing status. The filing status change goes on the very top of the 1040X. When I was a Tax Auditor for the IRS, the 1040X was one of the hardest thing to calculate. Just a few years ago, the IRS decided to change but with disastrous results- people were more confused than the original. So IRS changed the 1040X to its original. Follow your program’s instruction or go to an Enrolled Agent. I found out throughout my career that a good majority of CPA’s do not know the mechanics of the 1040X. Chances are you may need to send the returns by mail.

Create this form in 5 minutes!

How to create an eSignature for the tax return form municipality of anchorage muni

How to create an eSignature for your Tax Return Form Municipality Of Anchorage Muni online

How to generate an eSignature for the Tax Return Form Municipality Of Anchorage Muni in Chrome

How to generate an eSignature for putting it on the Tax Return Form Municipality Of Anchorage Muni in Gmail

How to make an electronic signature for the Tax Return Form Municipality Of Anchorage Muni right from your mobile device

How to generate an eSignature for the Tax Return Form Municipality Of Anchorage Muni on iOS devices

How to create an eSignature for the Tax Return Form Municipality Of Anchorage Muni on Android

People also ask

-

What is the Tax Return Form Municipality Of Anchorage Muni?

The Tax Return Form Municipality Of Anchorage Muni is a required form for individuals or businesses to report their income and calculate the taxes owed to the municipality. Completing this form accurately is essential to ensure compliance with local tax regulations.

-

How can airSlate SignNow help with submitting the Tax Return Form Municipality Of Anchorage Muni?

airSlate SignNow simplifies the process of submitting the Tax Return Form Municipality Of Anchorage Muni by allowing users to prepare, sign, and send their documents electronically. This streamlines the workflow, reducing the time and effort needed to ensure that your tax return is submitted on time.

-

What features does airSlate SignNow offer for the Tax Return Form Municipality Of Anchorage Muni?

airSlate SignNow offers several features tailored to the Tax Return Form Municipality Of Anchorage Muni, including templates for quick customization, secure eSignature options, and the ability to collect multiple signatures. These features help ensure that your tax return is completed accurately and efficiently.

-

Is there a cost associated with using airSlate SignNow for the Tax Return Form Municipality Of Anchorage Muni?

Yes, while airSlate SignNow offers competitive pricing for its eSigning services, the cost may vary based on the plan you choose. We recommend examining the available pricing options to find the best fit for your needs related to the Tax Return Form Municipality Of Anchorage Muni.

-

Can I integrate airSlate SignNow with other software for the Tax Return Form Municipality Of Anchorage Muni?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting and document management software, making it easy to manage the entire process of the Tax Return Form Municipality Of Anchorage Muni. This feature enhances productivity by allowing you to utilize your existing tools alongside eSigning capabilities.

-

What are the benefits of using airSlate SignNow for tax return forms?

Using airSlate SignNow for your tax return forms, including the Tax Return Form Municipality Of Anchorage Muni, provides numerous benefits such as improved efficiency, reduced paperwork, and enhanced security. With easy document tracking and the ability to sign from anywhere, you can focus more on your finances and less on paperwork.

-

How can I ensure my Tax Return Form Municipality Of Anchorage Muni is secure when using airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Tax Return Form Municipality Of Anchorage Muni. All documents are encrypted, and the platform complies with industry security standards, ensuring that your sensitive information is safe throughout the signing process.

Get more for Tax Return Form Municipality Of Anchorage Muni

- Fsis 9540 1 form

- Primerica flyers form

- Form 886 a worksheet

- Wc incident report form

- Download fillable form for spa clients

- Homelet individual application form tim martin timmartin co

- Film form and narrative suzanne speidel routledge

- Accommodating children with special dietary needs in the school nutrition programs form

Find out other Tax Return Form Municipality Of Anchorage Muni

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document