William D Ford Federal Direct Loan Program Direct Subsidized Form

What is the William D Ford Federal Direct Loan Program Direct Subsidized

The William D Ford Federal Direct Loan Program Direct Subsidized is a federal financial aid option designed to assist eligible students in covering educational expenses. This loan type is offered directly by the U.S. Department of Education and is specifically aimed at undergraduate students who demonstrate financial need. The key feature of Direct Subsidized Loans is that the federal government pays the interest while the student is enrolled at least half-time in an eligible program, during the grace period, and during any deferment periods.

Eligibility Criteria

To qualify for the William D Ford Federal Direct Loan Program Direct Subsidized, students must meet several criteria. Applicants must be U.S. citizens or eligible non-citizens, enrolled at least half-time in an eligible degree or certificate program, and demonstrate financial need through the Free Application for Federal Student Aid (FAFSA). Additionally, students must maintain satisfactory academic progress as defined by their institution to retain eligibility.

How to Obtain the William D Ford Federal Direct Loan Program Direct Subsidized

Obtaining a Direct Subsidized Loan involves a few straightforward steps. First, students need to complete the FAFSA to determine their eligibility and financial need. Once the FAFSA is processed, schools will send students a financial aid offer, which may include the Direct Subsidized Loan. Students must then accept the loan offer through their school's financial aid office. After acceptance, they will need to complete entrance counseling and sign a Master Promissory Note (MPN) to finalize the loan agreement.

Steps to Complete the William D Ford Federal Direct Loan Program Direct Subsidized

Completing the process for the Direct Subsidized Loan involves several steps:

- Complete the FAFSA to assess financial need.

- Review the financial aid offer provided by your school.

- Accept the Direct Subsidized Loan through the financial aid office.

- Complete entrance counseling to understand loan responsibilities.

- Sign the Master Promissory Note (MPN) to agree to the loan terms.

Key Elements of the William D Ford Federal Direct Loan Program Direct Subsidized

Several key elements define the Direct Subsidized Loan. These include:

- Interest Rates: Interest rates are fixed and set by the federal government.

- Repayment Terms: Borrowers have a six-month grace period after graduation before repayment begins.

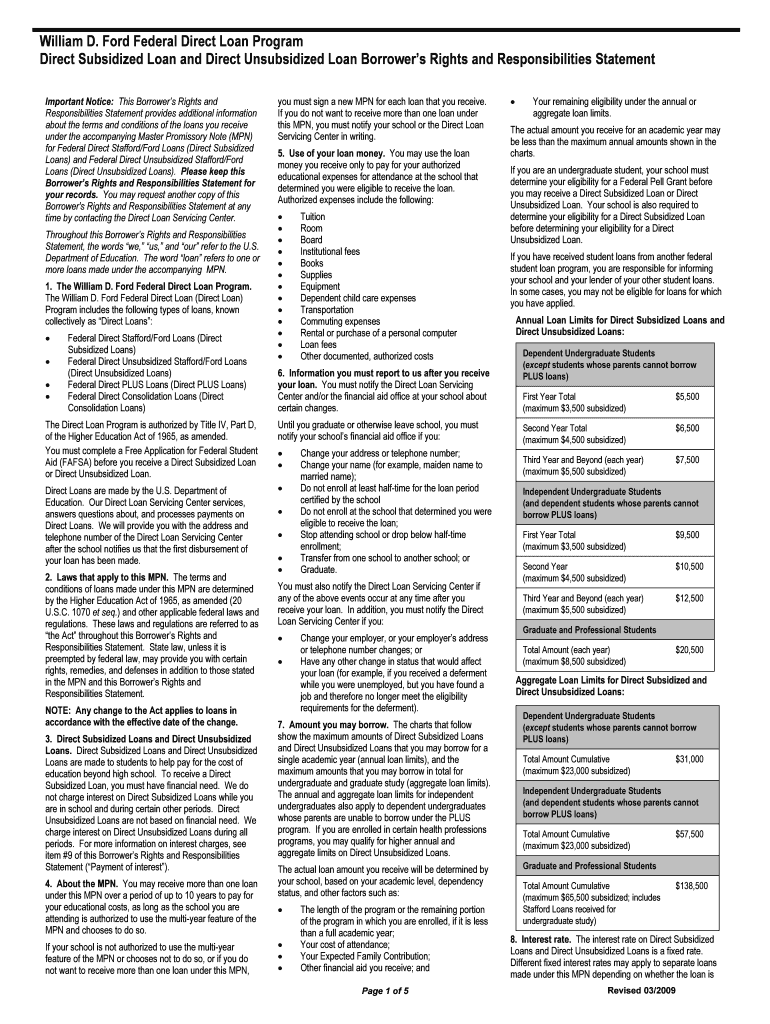

- Loan Limits: Annual borrowing limits vary based on the student's year in school and dependency status.

- Subsidy Benefits: The government pays interest during specific periods, reducing the overall cost of the loan.

Legal Use of the William D Ford Federal Direct Loan Program Direct Subsidized

The legal use of funds from the Direct Subsidized Loan is strictly for educational expenses. This includes tuition, fees, room and board, books, supplies, and other necessary costs associated with attending college. Misuse of loan funds can lead to penalties, including the requirement to repay the loan immediately. It is essential for borrowers to use the funds responsibly and in accordance with federal regulations.

Quick guide on how to complete william d ford federal direct loan program direct subsidized

Complete [SKS] effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It serves as an excellent environmentally friendly option to conventional printed and signed documents, as you can easily access the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important parts of the documents or obscure private information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure clear communication at any point in your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to William D Ford Federal Direct Loan Program Direct Subsidized

Create this form in 5 minutes!

How to create an eSignature for the william d ford federal direct loan program direct subsidized

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the William D Ford Federal Direct Loan Program Direct Subsidized?

The William D Ford Federal Direct Loan Program Direct Subsidized is a federal student loan designed to help undergraduate students pay for college. This program offers benefits such as interest coverage while you are in school, making it an appealing option for those who qualify.

-

Who is eligible for the William D Ford Federal Direct Loan Program Direct Subsidized?

To be eligible for the William D Ford Federal Direct Loan Program Direct Subsidized, you must be an undergraduate student enrolled at least half-time and demonstrate financial need. Additionally, you must complete the FAFSA to determine your eligibility and the amount you can borrow.

-

What are the benefits of choosing the William D Ford Federal Direct Loan Program Direct Subsidized?

The benefits of the William D Ford Federal Direct Loan Program Direct Subsidized include no interest charges while you're in school, and the potential for lower overall debt due to the government covering your interest during your studies. This can signNowly ease your financial burden as you focus on earning your degree.

-

How does the William D Ford Federal Direct Loan Program Direct Subsidized differ from unsubsidized loans?

Unlike unsubsidized loans, the William D Ford Federal Direct Loan Program Direct Subsidized does not accumulate interest while you are in school or during deferment periods. This makes it a more financially attractive option for those who qualify, helping students save money in the long run.

-

What is the interest rate for the William D Ford Federal Direct Loan Program Direct Subsidized?

The interest rate for the William D Ford Federal Direct Loan Program Direct Subsidized is fixed and may vary each year, so it's important to check the most recent rates. As of the latest academic year, the rate is typically lower than many private loans, offering an affordable borrowing option for students.

-

Are there any fees associated with the William D Ford Federal Direct Loan Program Direct Subsidized?

Yes, there are fees associated with the William D Ford Federal Direct Loan Program Direct Subsidized, typically a small percentage of the loan amount. These fees may be deducted from the loan proceeds, so it's essential to understand your total loan amount after fees are applied.

-

Can I use the William D Ford Federal Direct Loan Program Direct Subsidized for any educational expenses?

Yes, you can use the William D Ford Federal Direct Loan Program Direct Subsidized for various educational expenses, including tuition, fees, room and board, and necessary supplies. This flexibility allows you to cover the wide array of costs associated with pursuing your education.

Get more for William D Ford Federal Direct Loan Program Direct Subsidized

- Profex result list of passers form

- Quarter allotment form

- Nyimbo za injili pdf download form

- Childrens walk sponsored form template

- Dispensing licence application form

- Malabon ahon blue card registration online form

- Cengage electrostatics and current electricity pdf form

- Age estimation medical form hockey india

Find out other William D Ford Federal Direct Loan Program Direct Subsidized

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement