Alabama A4 2014

What is the Alabama A4

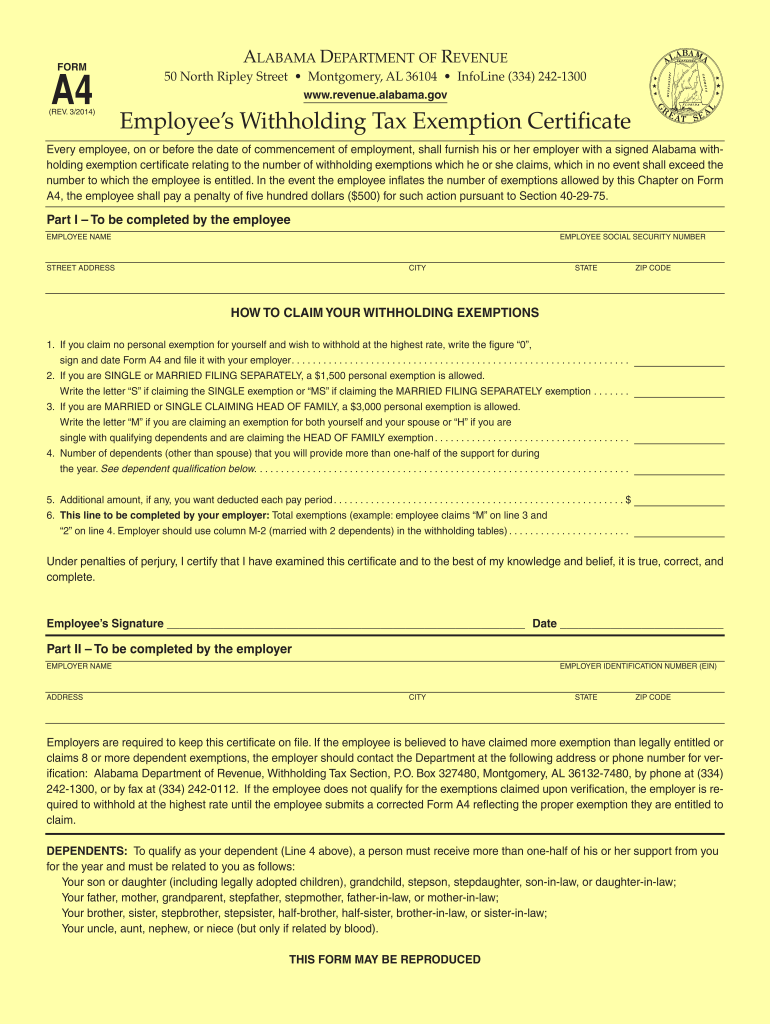

The Alabama A4 withholding tax form is an essential document used by employees in Alabama to indicate their withholding allowances for state income tax. This form allows employees to claim exemptions or allowances that can affect the amount of state tax withheld from their paychecks. By accurately completing the Alabama A4, employees can ensure that their tax withholdings align with their financial situation, potentially leading to a more favorable tax outcome.

How to use the Alabama A4

To use the Alabama A4 form, employees should first obtain the form from their employer or download it from a trusted source. After acquiring the form, employees need to fill it out by providing personal information such as their name, address, and Social Security number. Additionally, they should indicate the number of allowances they wish to claim based on their tax situation. Once completed, the form should be submitted to the employer, who will use it to adjust the employee's state tax withholdings accordingly.

Steps to complete the Alabama A4

Completing the Alabama A4 involves several straightforward steps:

- Obtain the Alabama A4 form from your employer or a reliable source.

- Fill in your personal details, including your name, address, and Social Security number.

- Determine the number of allowances you wish to claim based on your tax situation.

- Sign and date the form to certify that the information provided is accurate.

- Submit the completed form to your employer for processing.

Key elements of the Alabama A4

The Alabama A4 form includes several key elements that are crucial for accurate completion. These elements typically consist of:

- Personal Information: Name, address, and Social Security number.

- Allowances Claimed: The number of allowances the employee is claiming.

- Exemptions: Any applicable exemptions based on specific criteria.

- Signature: The employee's signature certifying the accuracy of the information.

Legal use of the Alabama A4

The Alabama A4 form is legally recognized as a valid document for determining state tax withholdings. Employers are required to honor the allowances claimed by employees, provided the form is completed accurately and submitted in a timely manner. It is important for employees to understand that providing false information on the A4 can lead to penalties, including fines or legal repercussions.

Form Submission Methods

The Alabama A4 can be submitted to employers through various methods. Typically, employees can submit the form in person, which allows for immediate processing. Alternatively, some employers may accept the form via email or fax, depending on their policies. It is advisable for employees to confirm the preferred submission method with their employer to ensure timely and accurate processing of their withholding allowances.

Quick guide on how to complete alabama a 4 2014 2019 form

Your assistance manual on how to prepare your Alabama A4

If you’re wondering how to create and submit your Alabama A4, here are some brief recommendations to simplify your tax declaration process.

To begin, you just need to set up your airSlate SignNow account to change the way you manage documents online. airSlate SignNow is a user-friendly and robust document solution that enables you to modify, compose, and finalize your tax forms with ease. With its editor, you can alternate between text, check boxes, and eSignatures, returning to update information as required. Enhance your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow these instructions to finish your Alabama A4 in just a few minutes:

- Create your account and start editing PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to access your Alabama A4 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if necessary).

- Examine your document and correct any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes electronically with airSlate SignNow. Keep in mind that paper submissions can increase the likelihood of errors and delay refunds. Of course, prior to e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct alabama a 4 2014 2019 form

FAQs

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out a W-4 form?

The main thing you need to put on your W-4 besides your name, address and social security number is whether you are married or single and the number of exemptions you wish to take to lower the amount of money with held for taxes from your paycheck. The number of exemptions refers to how many people you support, i. e. children. Say you are single and have 3 children, you can put down 4 exemptions, 1 for your self and 1 for each child. This means you will have more pay to take home because you aren’t having it with held from your paycheck. If you are single and have no children, you can either take 1 or 0 exemptions. If you make decent money, take 0 deductions, if you are barely making it you could probably take 1 exemption. Just realize that if you take exemptions, and not enough money is taken out of your check to pay your taxes, you will be liable for it come April 15th.If you are married and have no children and you make decent money, take 0 deductions. If you have children, only one spouse should take them as exemptions and it should be the one who makes the most money. For example, say your spouse is the major bread winner and you have 2 children, your spouse could take 4 exemptions (one for each member of the family) and then you would take 0 exemptions.Usually, it’s best to err on the side of caution and take the smaller amount of deductions so that you won’t owe a lot of money come tax time. If you’ve had too much with held it will come back to you as a refund.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

-

How can I fill out the BITSAT Application Form 2019?

BITSAT 2019 Application Forms are available online. Students who are eligible for the admission test can apply online before 20 March 2018, 5 pm.Click here to apply for BITSAT 2019Step 1: Follow the link given aboveStep 2: Fill online application formPersonal Details12th Examination DetailsTest Centre PreferencesStep 3: Upload scanned photograph (4 kb to 50 kb) and signature ( 1 kb to 30 kb).Step 4: Pay application fee either through online payment mode or through e-challan (ICICI Bank)BITSAT-2019 Application FeeMale Candidates - Rs. 3150/-Female Candidates - Rs. 2650/-Thanks!

-

How can I fill out the COMEDK 2019 application form?

COMEDK 2019 application is fully online based and there is no need to send the application by post or by any other method. Check the below-mentioned guidelines to register for the COMEDK 2019 exam:Step 1 Visit the official website of the COMEDK UGET- comedk.orgStep 2 Click on “Engineering Application”.Step 3 After that click on “Login or Register” button.Step 4 You will be asked to enter the Application SEQ Number/User ID and Password. But since you have not registered. You need to click on the “Click here for Registration”.Step 5 Fill in the required details like “Full Name”, “DOB”, “Unique Photo ID Proof”, “Photo ID Proof Number”, “Email ID” and “Mobile Number”.Step 6 Then click on the “Generate OTP”Step 7 After that you need to enter the captcha code and then an OTP will be sent to the mobile number that you have provided.Step 8 A new window having your previously entered registration details will open where you need to enter the OTP.Step 9 Re-check all the details, enter the captcha code and click on the “Register” button.Step 10 After that a page will appear where you will be having the User ID and all the details that you entered. Also, you will be notified that you have successfully registered yourself and a User ID and Password will be sent to your mobile number and email ID.COMEDK 2019 Notification | Steps To Apply For COMEDK UGET ExamCheck the below-mentioned guidelines to fill COMEDK Application Form after COMEDK Login.Step 1 Using your User ID and Password. Log in using the User ID and passwordStep 2 You will be shown that your application form is incomplete. So you need to go to the topmost right corner and click on the “Go to application” tab.Step 3 Go to the COMEDK official website and login with these credentials.Step 4 After that click on “Go to application form”.Step 5 Select your preferred stream and course.Step 6 Click on “Save and Continue”.Step 7 Carefully enter your Personal, Category and Academic details.Step 8 Upload your Photograph and Signature, Parents Signature, your ID Proof, and Declaration.Step 9 Enter your “Payment Mode” and “Amount”.Step 10 Enter “Security code”.Step 11 Tick the “I Agree” checkbox.Step 12 Click on the “Submit” button.

-

How do I fill up the ITR 4 form?

Guidance to File ITR 4Below are mentioned few common guidelines to consider while filing your ITR 4 form:If any schedule is not relevant/applicable to you, just strike it out and write —NA— across itIf any item/particular is not applicable/relevant to you, just write NA against itIndicate nil figures by writing “Nil” across it.Kindly, put a “-” sign prior to any negative figure.All figures shall be rounded off to the nearest one rupee except figures for total income/loss and tax payable. Those shall be rounded off to the nearest multiple of ten.If you are an Employer individual, then you must mark Government if you are a Central/State Government employee. You should tick PSU if you are working in a public sector company of the Central/State Government.Sequence to fill ITR 4 formThe easiest way to fill out your ITR-4 Form is to follow this order:Part AAll the schedulesPart BVerificationModes to file ITR 4 FormYou can submit your ITR-4 Form either online or offline. It is compulsory to file ITR in India electronically (either through Mode 3 or Mode 4) for the following assesses:Those whose earning exceeds Rs. 5 lakhs per yearThose possessing any assets outside the boundary of India (including financial interest in any entity) or signing authority in any account outside India.Those claiming relief under Section 90/90A/91 to whom Schedule FSI and Schedule TR applyOffline:By furnishing a return in a tangible l paper formBy furnishing a bar-coded returnThe Income Tax Department will issue you an acknowledgment as a form of response/reply at the time of submission of your tangible paper return.Online/Electronically:By furnishing the return electronically using digital signature certificate.By sending the data electronically and then submitting the confirmation of the return in Return Form ITR-VIf you submit your ITR-4 Form by electronic means under digital signature, the acknowledgment/response will be sent to your registered email id. You can even download it manually from the official income tax website. For this, you are first required to sign it and send it to the Income Tax Department’s CPC office in Bangalore within 120 days of e-filing.Keep in mind that ITR-4 is an annexure-less form. It means you don’t have to attach any documents when you send it.TaxRaahi is your income tax return filing online companion. Get complete assistance and tax saving tips from experts.

Create this form in 5 minutes!

How to create an eSignature for the alabama a 4 2014 2019 form

How to create an electronic signature for your Alabama A 4 2014 2019 Form online

How to generate an electronic signature for the Alabama A 4 2014 2019 Form in Chrome

How to generate an electronic signature for putting it on the Alabama A 4 2014 2019 Form in Gmail

How to make an eSignature for the Alabama A 4 2014 2019 Form right from your smartphone

How to create an electronic signature for the Alabama A 4 2014 2019 Form on iOS devices

How to make an electronic signature for the Alabama A 4 2014 2019 Form on Android OS

People also ask

-

What is Alabama A4 in the context of airSlate SignNow?

Alabama A4 refers to the specific document format and sizing supported by airSlate SignNow for electronic signatures and e-document management. This feature ensures that you can easily upload, send, and sign documents in the Alabama A4 format, streamlining your workflow and improving efficiency.

-

How does airSlate SignNow's pricing structure work for Alabama A4 users?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses working with Alabama A4 documents. Users can choose from various subscription levels that provide access to essential features, including unlimited eSignatures, secure document storage, and advanced integrations, ensuring a cost-effective solution.

-

What are the key features of airSlate SignNow that support Alabama A4 documents?

Key features of airSlate SignNow that support Alabama A4 documents include customizable templates, advanced signing workflows, and secure document tracking. These functionalities allow businesses to manage their Alabama A4 documents efficiently, ensuring compliance and enhancing productivity.

-

Can I integrate airSlate SignNow with other applications while using Alabama A4?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing your experience with Alabama A4 documents. Popular integrations include Google Drive, Dropbox, and CRM systems, making it easy to manage your workflow and documents without disrupting your existing processes.

-

What benefits does airSlate SignNow offer for businesses using Alabama A4?

Businesses using Alabama A4 with airSlate SignNow benefit from a streamlined document signing process, improved turnaround times, and enhanced security. This platform empowers teams to focus on core activities while ensuring that all document workflows are efficient and compliant.

-

Is airSlate SignNow easy to use for managing Alabama A4 documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it simple for anyone to manage Alabama A4 documents. The intuitive interface allows users to upload, send, and sign documents with just a few clicks, ensuring a smooth experience for all.

-

Are there any mobile capabilities for handling Alabama A4 documents with airSlate SignNow?

Yes, airSlate SignNow offers mobile capabilities that allow users to manage Alabama A4 documents on-the-go. With the mobile app, you can send, sign, and track documents from your smartphone or tablet, ensuring you stay productive no matter where you are.

Get more for Alabama A4

- Kids empathic development scale keds form

- Rajkot nagarik sahakari bank ltd form

- Western reserve life reinstatement forms

- Indian embassy new york form

- Patients vaccines for children program status doh wa form

- Employee severance agreement template form

- Employee settlement agreement template form

- Employee staff loan agreement template form

Find out other Alabama A4

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online