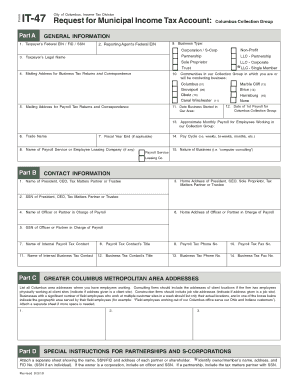

Request for Municipal Income Tax Account Columbus Collection Form

What is the Request For Municipal Income Tax Account Columbus Collection

The Request For Municipal Income Tax Account Columbus Collection is a form used by residents and businesses in Columbus, Ohio, to establish or update their municipal income tax accounts. This form is essential for ensuring compliance with local tax regulations and allows the city to accurately assess and collect income taxes from individuals and entities operating within its jurisdiction. It serves as an official request to the local tax authority for the necessary account setup or modifications, facilitating proper tax administration.

How to use the Request For Municipal Income Tax Account Columbus Collection

To effectively use the Request For Municipal Income Tax Account Columbus Collection, individuals must first obtain the form from the appropriate municipal tax office or online resource. Once acquired, users should fill out the required fields, which typically include personal identification information, business details if applicable, and any relevant financial information. After completing the form, it can be submitted through designated channels, ensuring that all information is accurate to avoid delays in processing.

Steps to complete the Request For Municipal Income Tax Account Columbus Collection

Completing the Request For Municipal Income Tax Account Columbus Collection involves several key steps:

- Obtain the form from the Columbus municipal tax office or official website.

- Fill in your personal information, including name, address, and Social Security number or Employer Identification Number (EIN).

- If applicable, provide details about your business, such as the type of business entity and its location.

- Review the form for accuracy, ensuring all required fields are completed.

- Submit the form either online, by mail, or in person at the local tax office.

Required Documents

When submitting the Request For Municipal Income Tax Account Columbus Collection, certain documents may be required to support your application. These typically include:

- A valid form of identification, such as a driver's license or state ID.

- Proof of residency or business location, such as a utility bill or lease agreement.

- Any previous tax documents if applicable, to assist in establishing your account.

Form Submission Methods

The Request For Municipal Income Tax Account Columbus Collection can be submitted through various methods to accommodate different preferences:

- Online submission via the official Columbus municipal tax website.

- Mailing the completed form to the designated tax office address.

- In-person submission at the local tax office during business hours.

Penalties for Non-Compliance

Failing to properly submit the Request For Municipal Income Tax Account Columbus Collection can result in penalties. Individuals and businesses may face fines or interest on unpaid taxes, which can accumulate over time. Additionally, non-compliance may lead to legal action by the city to recover owed taxes. It is crucial to adhere to local tax regulations to avoid these potential consequences.

Quick guide on how to complete request for municipal income tax account columbus collection

Effortlessly Manage [SKS] on Any Device

Web-based document management has become increasingly favored by both businesses and individuals. It offers an excellent eco-conscious alternative to conventional printed and signed documents, as you can easily find the necessary form and securely maintain it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for this task.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and press the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow efficiently addresses your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] while ensuring exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Request For Municipal Income Tax Account Columbus Collection

Create this form in 5 minutes!

How to create an eSignature for the request for municipal income tax account columbus collection

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to Request For Municipal Income Tax Account Columbus Collection?

To Request For Municipal Income Tax Account Columbus Collection, users can easily complete the online form provided by the city tax department. Make sure to fill in all required fields accurately to avoid delays. Once submitted, you will receive confirmation of your request.

-

Are there any fees associated with the Request For Municipal Income Tax Account Columbus Collection?

Yes, there may be fees applicable when you Request For Municipal Income Tax Account Columbus Collection. These charges can vary depending on the services rendered. It’s advisable to check the official Columbus tax website or contact customer support for detailed pricing information.

-

What features does airSlate SignNow offer for managing my Municipal Income Tax documents?

airSlate SignNow offers multiple features for managing your Municipal Income Tax documents, including electronic signatures, templates, and secure storage. These features simplify the process and enhance efficiency when you Request For Municipal Income Tax Account Columbus Collection. Moreover, the user-friendly interface ensures that you can navigate easily through your documents.

-

How does airSlate SignNow help streamline my tax-related workflow?

airSlate SignNow helps streamline your tax-related workflow by automating document processes and enabling electronic signatures. This allows you to quickly Request For Municipal Income Tax Account Columbus Collection without the hassle of traditional paperwork. Integrating these features saves time and reduces the risk of errors.

-

Can I integrate airSlate SignNow with accounting software for tax management?

Absolutely! airSlate SignNow can be integrated with various accounting software to enhance your tax management capabilities. By integrating your tools, you can streamline your workflow further when you Request For Municipal Income Tax Account Columbus Collection, ensuring that all your data is seamlessly connected and accessible.

-

What benefits can I expect from using airSlate SignNow for municipal tax documents?

Using airSlate SignNow for municipal tax documents provides numerous benefits, including enhanced security, faster processing times, and reduced administrative costs. When you Request For Municipal Income Tax Account Columbus Collection, you’ll appreciate the simplicity and convenience offered through our platform.

-

Is airSlate SignNow suitable for small businesses handling municipal tax requests?

Yes, airSlate SignNow is highly suitable for small businesses that need to handle municipal tax requests efficiently. Its cost-effective solution allows small businesses to Request For Municipal Income Tax Account Columbus Collection without incurring signNow expenses. The user-friendly interface ensures that even users with minimal technical expertise can navigate the platform easily.

Get more for Request For Municipal Income Tax Account Columbus Collection

- Pre work hazard assessment form sms

- Motor vehicle services affidavit of assembly and ownership form

- Maryland nonresident instructions for filing personal income form

- Ia 148 tax credits schedule 41 148 iowa department of revenue form

- Individual income tax instructions and formsdepartment of

- Form 761a affidavit of assemble and ownership for automobiletrucktravel trailer

- Maryland latent tuberculosis infection ltbi reporting form

- Kansas partnership tax return form

Find out other Request For Municipal Income Tax Account Columbus Collection

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free