PARTNER'S INSTRUCTIONS for SCHEDULE K 1 2022-2026

Understanding the Partner's Instructions for Schedule K-1

The Partner's Instructions for Schedule K-1 provide essential guidance for partners in a partnership regarding how to report income, deductions, and credits on their tax returns. This document is crucial for ensuring accurate tax reporting and compliance with IRS regulations. It outlines the specific information that must be reported, including the partner's share of income, losses, and other tax-related items. Understanding these instructions is vital for partners to correctly complete their tax filings and avoid potential penalties.

Steps to Complete the Partner's Instructions for Schedule K-1

Completing the Partner's Instructions for Schedule K-1 involves several key steps:

- Gather all relevant financial documents related to the partnership.

- Review the income, deductions, and credits allocated to you as a partner.

- Fill out the K-1 form accurately, ensuring all amounts reflect your share of the partnership's financial results.

- Consult the instructions for any specific reporting requirements or additional information needed.

- Submit the completed K-1 form along with your personal tax return.

Legal Use of the Partner's Instructions for Schedule K-1

The Partner's Instructions for Schedule K-1 are legally binding and must be adhered to by all partners in a partnership. These instructions provide the framework for how income and deductions are reported to the IRS. Failure to follow these guidelines can result in discrepancies in tax filings, leading to potential audits or penalties. It is essential for partners to maintain accurate records and ensure compliance with all legal requirements outlined in the instructions.

Filing Deadlines and Important Dates

Filing deadlines for the Partner's Instructions for Schedule K-1 typically align with the tax return deadlines for partnerships. Generally, partnerships must file their tax returns by March fifteenth, which means that K-1 forms should be provided to partners by this date. Partners must then include the information from their K-1 on their personal tax returns, usually due by April fifteenth. Staying aware of these deadlines is crucial for timely and compliant tax filings.

Who Issues the Partner's Instructions for Schedule K-1

The Partner's Instructions for Schedule K-1 are issued by the Internal Revenue Service (IRS). These instructions are part of the IRS's efforts to provide clear guidance to taxpayers on how to report partnership income and other tax-related items. The IRS updates these instructions periodically to reflect changes in tax laws and regulations, so it is important for partners to refer to the most current version when preparing their tax returns.

Examples of Using the Partner's Instructions for Schedule K-1

Using the Partner's Instructions for Schedule K-1 can be illustrated through various scenarios:

- A partner receives a K-1 that reports a share of the partnership's income, which must be reported on their personal tax return.

- If a partner has incurred business expenses, they can use the K-1 to claim deductions based on the instructions provided.

- Partners in different tax brackets may need to adjust their reporting based on the income reported on the K-1, following the guidelines in the instructions.

Quick guide on how to complete partners instructions for schedule k 1

Quickly complete PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1 on any device

Web-based document management has gained traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your papers promptly without interruptions. Manage PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1 on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-centric task today.

The easiest method to modify and electronically sign PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1 without hassle

- Locate PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize signNow sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct partners instructions for schedule k 1

Create this form in 5 minutes!

How to create an eSignature for the partners instructions for schedule k 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

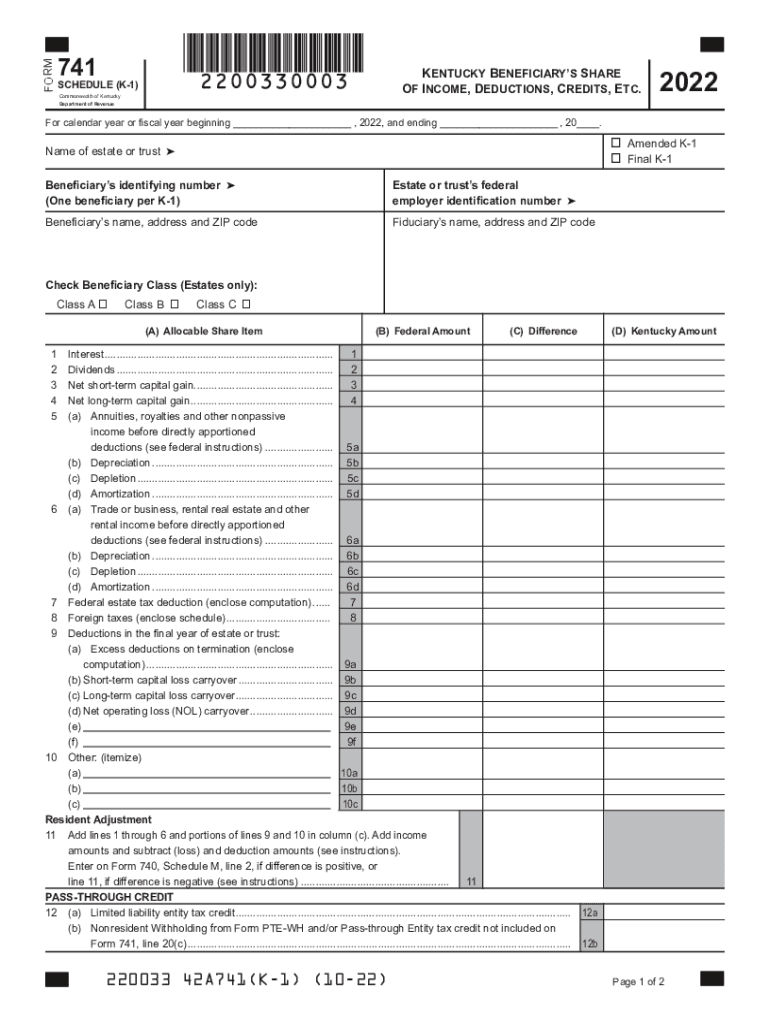

What is the Kentucky K 1 schedule?

The Kentucky K 1 schedule is a vital document used by business owners and partners to report income, losses, and credits from partnerships to the state. This schedule outlines the individual shares of income for each partner involved. Understanding and accurately completing the Kentucky K 1 schedule is essential for proper tax filings.

-

How can airSlate SignNow help with the Kentucky K 1 schedule?

airSlate SignNow streamlines the process of completing and signing the Kentucky K 1 schedule digitally. Our platform allows users to easily fill out the necessary forms, eSign them, and send them directly to partners or tax professionals. This simplifies your tax preparation, ensuring that deadlines are met efficiently.

-

Is airSlate SignNow cost-effective for managing the Kentucky K 1 schedule?

Yes, airSlate SignNow offers a cost-effective solution for managing the Kentucky K 1 schedule. Our pricing plans are designed to suit businesses of all sizes, making it affordable to access essential document signing and management features. With our service, you can save time and reduce costs associated with paper-based processes.

-

What features does airSlate SignNow provide for the Kentucky K 1 schedule?

airSlate SignNow provides a range of features specifically beneficial for the Kentucky K 1 schedule, including template creation, online signing, and document tracking. These features allow users to easily manage their schedules, maintain compliance, and access documents anytime, anywhere. Additionally, our intuitive interface ensures a seamless user experience.

-

Are there integrations available with airSlate SignNow for handling the Kentucky K 1 schedule?

Absolutely! airSlate SignNow integrates with popular accounting and tax software, facilitating better management of the Kentucky K 1 schedule. These integrations enable easy data transfer, ensuring your financial records are synchronized and up-to-date. Leveraging these tools can further streamline your tax filing process.

-

How secure is airSlate SignNow when dealing with the Kentucky K 1 schedule?

Security is a top priority for airSlate SignNow, especially when managing critical documents like the Kentucky K 1 schedule. Our platform employs advanced encryption technologies to protect your data and ensure that your sensitive information remains confidential. We comply with industry standards to safeguard your documents during the signing process.

-

Can I customize templates for the Kentucky K 1 schedule in airSlate SignNow?

Yes, airSlate SignNow allows users to create customizable templates for the Kentucky K 1 schedule. This feature enables you to tailor each document based on specific needs, making the process of completion faster and more efficient. Custom templates help ensure consistency and accuracy across all submissions.

Get more for PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1

- Board of appeals epetition center business tax e services form

- Schedule a form 1040 itemized deductions

- Federal worksheet fill out and auto calculatecomplete form

- City of philadelphia net profits tax form

- Pa corporate net income tax declaration for a state e file report pa 8453 c pa department of revenue form

- Web 1 23 gas 1200 motor fuels claim for refund no form

- Personal income tax forms pa department of revenue 632608091

- Wage tax refund form commissioned employees phila gov

Find out other PARTNER'S INSTRUCTIONS FOR SCHEDULE K 1

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form