Payment of Estimated Tax, Ky Rev Stat 141 207 2023

Understanding the Payment of Estimated Tax

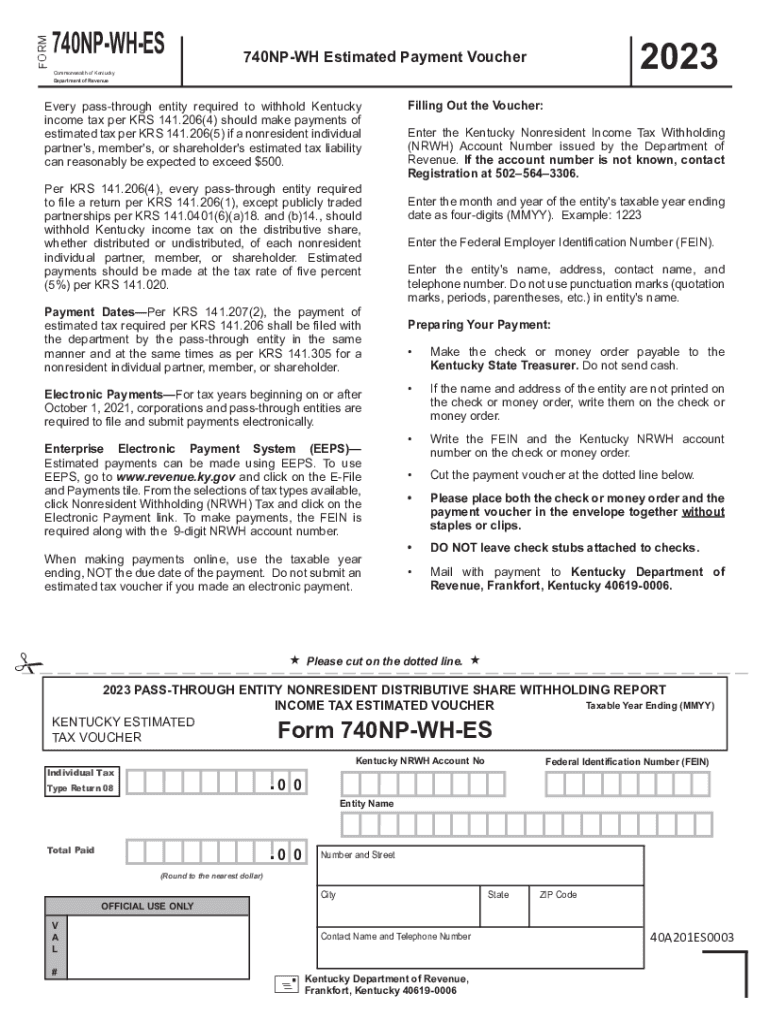

The Payment of Estimated Tax under Ky Rev Stat 141.207 is a requirement for individuals and businesses that expect to owe a certain amount in taxes for the year. This payment system is designed to ensure that taxpayers pay their tax obligations in a timely manner, thereby avoiding penalties and interest that may accrue from underpayment. Typically, individuals and businesses must make estimated tax payments if they expect to owe at least one thousand dollars in tax after subtracting withholding and refundable credits.

How to Use the Payment of Estimated Tax

To utilize the Payment of Estimated Tax, taxpayers should first calculate their expected tax liability for the year. This involves estimating income, deductions, and credits. Once the estimated tax is determined, payments can be made in four equal installments throughout the year. These payments are due on specific dates, which are typically April 15, June 15, September 15, and January 15 of the following year. Taxpayers can submit their payments electronically or by mail, depending on their preference.

Steps to Complete the Payment of Estimated Tax

Completing the Payment of Estimated Tax involves several key steps:

- Estimate your total income for the year, including wages, self-employment income, and any other sources.

- Calculate deductions and credits to determine your taxable income.

- Use the appropriate tax tables or software to determine your estimated tax liability.

- Divide your estimated tax liability by four to determine your quarterly payment amount.

- Submit your payment by the due dates using your preferred method (online or by mail).

Filing Deadlines and Important Dates

It is crucial to adhere to the filing deadlines for the Payment of Estimated Tax to avoid penalties. The key dates are:

- First Payment: April 15

- Second Payment: June 15

- Third Payment: September 15

- Fourth Payment: January 15 of the following year

Filing on time helps maintain compliance with tax obligations and prevents additional charges.

Required Documents for Payment of Estimated Tax

When preparing to make the Payment of Estimated Tax, certain documents may be necessary:

- Previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Documentation of any deductions or credits you plan to claim

Having these documents readily available can streamline the process and ensure accuracy in your calculations.

Penalties for Non-Compliance

Failing to make the required estimated tax payments can lead to penalties. The IRS may impose a penalty if you do not pay enough tax throughout the year, either through withholding or estimated payments. This penalty is typically calculated based on the amount of underpayment and the length of time the payment is overdue. To avoid penalties, it is advisable to stay informed about your tax obligations and make timely payments.

Quick guide on how to complete payment of estimated tax ky rev stat 141 207

Effortlessly finalize Payment Of Estimated Tax, Ky Rev Stat 141 207 on any device

Digital document management has become highly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without any holdups. Manage Payment Of Estimated Tax, Ky Rev Stat 141 207 on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to edit and electronically sign Payment Of Estimated Tax, Ky Rev Stat 141 207 with ease

- Locate Payment Of Estimated Tax, Ky Rev Stat 141 207 and click on Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes merely seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to record your modifications.

- Select your preferred method to deliver your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misfiled documents, tedious form-finding, or errors that require new copies to be printed. airSlate SignNow efficiently addresses your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Payment Of Estimated Tax, Ky Rev Stat 141 207 while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct payment of estimated tax ky rev stat 141 207

Create this form in 5 minutes!

How to create an eSignature for the payment of estimated tax ky rev stat 141 207

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Kentucky composite voucher?

A Kentucky composite voucher is a specific document used for reporting and paying various tax liabilities in Kentucky. It allows taxpayers to consolidate multiple tax payments into one single form, simplifying the filing process. This voucher is essential for ensuring accurate tax compliance in the state.

-

How can airSlate SignNow assist with Kentucky composite vouchers?

airSlate SignNow streamlines the signing and sending process for Kentucky composite vouchers, making it easy to manage these documents digitally. With our eSigning feature, you can obtain signatures quickly, reducing the turnaround time for tax submissions. This fosters efficiency and accuracy while dealing with your tax affairs.

-

What are the pricing options for using airSlate SignNow for Kentucky composite vouchers?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes looking to manage their Kentucky composite vouchers. You can choose from various subscription tiers that best fit your needs, ensuring you have access to essential features without overspending. Visit our pricing page for detailed information on costs.

-

Are there any specific features for Kentucky composite voucher management?

Yes, airSlate SignNow includes several features tailored for efficient management of Kentucky composite vouchers. Users can create templates, track document status, and set reminders for deadlines, providing a comprehensive solution for tax documentation. This enhances organization and ensures that you never miss a filing deadline.

-

What benefits does airSlate SignNow provide for handling Kentucky composite vouchers?

Using airSlate SignNow for Kentucky composite vouchers offers numerous benefits, including improved efficiency, reduced paperwork, and enhanced security. The platform allows you to manage all your tax-related documents in one place, simplifying communication and collaboration. Additionally, your data is protected by advanced encryption measures, ensuring compliance and confidentiality.

-

Can I integrate airSlate SignNow with other software for Kentucky composite vouchers?

Absolutely! airSlate SignNow seamlessly integrates with various software and tools, making it ideal for managing Kentucky composite vouchers. Whether you need to connect with accounting software or document management systems, integration options are available to further enhance your workflow. This versatility helps in centralizing your tax documentation process.

-

Is there customer support available for issues related to Kentucky composite vouchers?

Yes, airSlate SignNow provides robust customer support for any issues you may encounter related to Kentucky composite vouchers. Our dedicated support team is available to assist you via chat, email, or phone, ensuring you receive timely help. We are committed to ensuring you have a smooth experience while using our platform.

Get more for Payment Of Estimated Tax, Ky Rev Stat 141 207

- Dental services western dental insurance amp orthodontics form

- Individual application for insurance license individual application for insurance license form

- Authorization for use and ordisclosure of memberpatient health information

- If you see something fill and sign printable template form

- Patient information form sfvimaging com

- 1 daniel burnham court 330c san francisco ca 94109 415668 0888 form

- 45 cfr164 508 uses and disclosures for which anguidance on hipaa and individual authorization of uses andauthorization for use form

- Criminal background clearance transfer request form

Find out other Payment Of Estimated Tax, Ky Rev Stat 141 207

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later