Kentucky Income Tax Per KRS 141 2020

What is the Kentucky Income Tax Per KRS 141

The Kentucky Income Tax, as outlined in KRS 141, is a state tax imposed on the income of individuals and businesses. This tax is calculated based on the taxpayer's federal adjusted gross income, with specific adjustments made for state purposes. The rates are progressive, meaning that higher income levels are taxed at higher rates. Understanding this tax is essential for residents and businesses operating within Kentucky.

Steps to complete the Kentucky Income Tax Per KRS 141

Completing the Kentucky Income Tax involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your federal adjusted gross income, making any required adjustments for state-specific deductions.

- Apply the appropriate tax rates to your taxable income to calculate your state tax liability.

- Complete the Kentucky income tax form, ensuring all information is accurate and complete.

- Review your completed form for errors before submission.

Legal use of the Kentucky Income Tax Per KRS 141

The legal framework surrounding the Kentucky Income Tax is established by KRS 141, which outlines the obligations of taxpayers. Compliance with these regulations is crucial for avoiding penalties. Taxpayers must file their returns accurately and on time to ensure they meet legal requirements. Understanding the legal implications of this tax can help individuals and businesses navigate their responsibilities effectively.

Filing Deadlines / Important Dates

Filing deadlines for the Kentucky Income Tax are typically aligned with federal tax deadlines. Key dates include:

- April 15: Deadline for individual income tax returns.

- October 15: Extended deadline for filing if an extension is granted.

It is important to stay informed about any changes to these dates, as they can impact your filing obligations.

Required Documents

To file your Kentucky Income Tax, you will need the following documents:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income, such as rental income or dividends.

- Documentation for any deductions or credits you plan to claim.

Having these documents ready will streamline the filing process and help ensure accuracy.

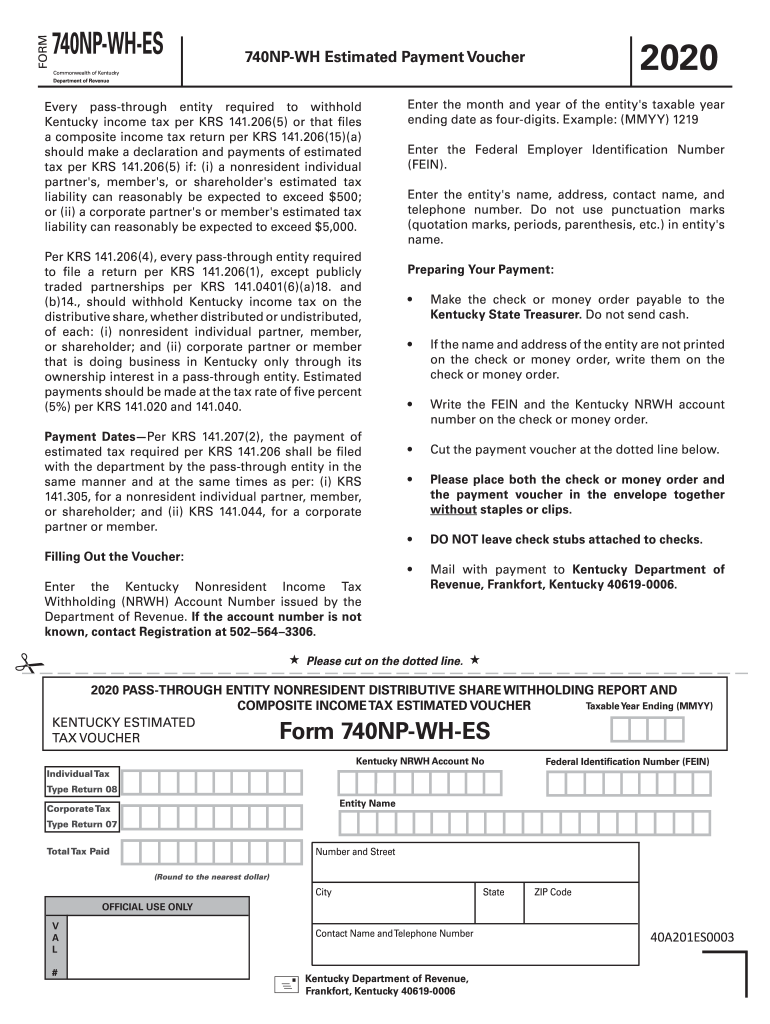

Who Issues the Form

The Kentucky Department of Revenue is responsible for issuing the income tax forms and providing guidance on the filing process. They also oversee compliance and enforcement of tax laws within the state. For any inquiries or assistance, taxpayers can reach out to the department directly.

Quick guide on how to complete kentucky income tax per krs 141

Easily Prepare Kentucky Income Tax Per KRS 141 on Any Device

Online document management has become increasingly favored by both companies and individuals. It serves as a fantastic environmentally friendly substitute to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage Kentucky Income Tax Per KRS 141 on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-focused process today.

How to Edit and eSign Kentucky Income Tax Per KRS 141 with Ease

- Obtain Kentucky Income Tax Per KRS 141 and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your edits.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Kentucky Income Tax Per KRS 141 and ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct kentucky income tax per krs 141

Create this form in 5 minutes!

How to create an eSignature for the kentucky income tax per krs 141

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

The best way to make an electronic signature for a PDF file on Android

People also ask

-

What is the wh es form download process with airSlate SignNow?

The wh es form download process using airSlate SignNow is straightforward. Users can easily upload their documents and use our intuitive interface to set up eSigning features. Once configured, the form can be downloaded in a secure format, ready for sharing.

-

How much does it cost to use airSlate SignNow for wh es form download?

airSlate SignNow offers competitive pricing for its services, including the wh es form download feature. We have different plans tailored for businesses of all sizes, ensuring you find the solution that fits your budget. With our cost-effective plans, your team can enjoy unlimited downloads and eSigning functionalities.

-

Can I integrate airSlate SignNow with other applications for wh es form download?

Yes, airSlate SignNow seamlessly integrates with various applications, making the wh es form download process even smoother. You can connect it to your CRM, cloud storage, and other tools to streamline your workflow. This interoperability ensures that your documents are easily accessible across platforms.

-

What features does airSlate SignNow offer for wh es form download?

airSlate SignNow provides a wide range of features that enhance the wh es form download experience. Key features include customizable templates, secure eSigning, real-time tracking, and mobile access. These tools allow you to manage your documents efficiently and securely.

-

Is the wh es form download feature suitable for all business types?

Absolutely! The wh es form download feature is designed to accommodate businesses of all sizes and industries. Whether you're a startup or an established enterprise, airSlate SignNow's tools will help you streamline your document management process effectively.

-

How secure is the wh es form download process with airSlate SignNow?

Security is a top priority at airSlate SignNow. The wh es form download process is safeguarded with advanced encryption technology to ensure that your documents remain confidential. We also comply with industry standards to protect your sensitive information.

-

Can I track my wh es form download activity?

Yes, you can easily track your wh es form download activity within the airSlate SignNow platform. Our tracking features provide real-time data on who accessed your documents and when. This transparency helps you manage your document workflow better.

Get more for Kentucky Income Tax Per KRS 141

- West virginia trust form

- Short form settlement

- West virginia lien form

- Quitclaim deed from individual to two individuals in joint tenancy west virginia form

- Joint tenant tenancy 497431596 form

- Notice of mechanics lien supplier to contractor or subcontractor individual west virginia form

- Quitclaim deed by two individuals to husband and wife west virginia form

- Warranty deed from two individuals to husband and wife west virginia form

Find out other Kentucky Income Tax Per KRS 141

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form