Form 4868 Sp Application for Automatic Extension of Time to File U S Individual Income Tax Return Spanish Version 2023

What is the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

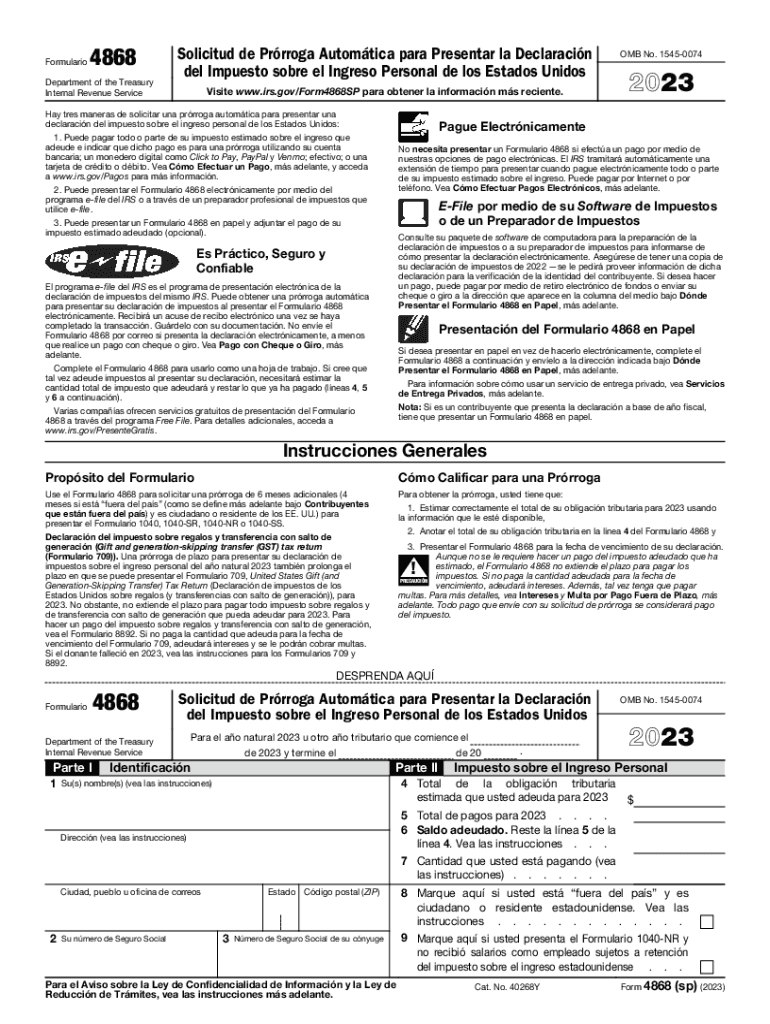

The Form 4868 sp is a crucial document for taxpayers seeking an automatic extension to file their U.S. Individual Income Tax Return. This Spanish version is specifically designed for Spanish-speaking individuals who need additional time to prepare their tax returns. By submitting this form, taxpayers can extend their filing deadline by six months, allowing them to gather necessary documents and ensure accurate reporting of their income and deductions. It is important to note that this extension applies only to the filing of the return, not to the payment of any taxes owed.

How to use the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Using the Form 4868 sp is straightforward. Taxpayers must fill out the form with their personal information, including name, address, and Social Security number. It is essential to estimate the total tax liability and any payments already made. After completing the form, it can be submitted electronically or by mail. If filing electronically, ensure that the chosen method supports the submission of Form 4868 sp. For those opting to mail the form, it should be sent to the appropriate IRS address based on the taxpayer's location.

Steps to complete the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Completing the Form 4868 sp involves several key steps:

- Gather necessary personal and financial information.

- Fill in your name, address, and Social Security number accurately.

- Estimate your total tax liability for the year.

- Indicate any payments already made towards your tax obligation.

- Review the completed form for accuracy before submission.

Once completed, submit the form electronically through an approved e-filing service or mail it to the designated IRS address.

Filing Deadlines / Important Dates

The deadline for submitting the Form 4868 sp is typically April 15 for most taxpayers. However, if this date falls on a weekend or holiday, the deadline may be adjusted. It is crucial to submit the form by this date to ensure the extension is granted. The extended deadline for filing the actual tax return will then be October 15, providing additional time to prepare and submit the return without incurring penalties.

Required Documents

To complete the Form 4868 sp, taxpayers should have the following documents ready:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Records of any other income sources.

- Documentation of any deductions or credits being claimed.

Having these documents on hand will facilitate accurate completion of the form and help in estimating tax liability.

Penalties for Non-Compliance

Failing to file a tax return by the original deadline without submitting Form 4868 sp can result in significant penalties. The IRS typically imposes a failure-to-file penalty, which can be a percentage of the unpaid taxes for each month the return is late. Additionally, interest accrues on any unpaid taxes from the original due date until payment is made. It is advisable to file the extension form to avoid these penalties, even if the tax payment cannot be made in full.

Quick guide on how to complete form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version

Effortlessly prepare Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly without complications. Manage Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version with ease

- Find Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight essential sections of your documents or redact sensitive information using the tools specifically designed by airSlate SignNow for such tasks.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and hit the Done button to save your changes.

- Choose how you would like to share your form, whether via email, SMS, an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version

Create this form in 5 minutes!

How to create an eSignature for the form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

The Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is a form that allows taxpayers to request an automatic extension of time to file their U.S. individual income tax return. This version is specifically designed for Spanish-speaking individuals, ensuring clarity and accessibility in the filing process.

-

How can I access the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version through airSlate SignNow?

You can easily access the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version by signing up for airSlate SignNow. Our platform provides a user-friendly interface to find, fill out, and eSign the form securely and efficiently.

-

What features does airSlate SignNow offer for filing the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

AirSlate SignNow offers features such as easy document sharing, eSignature capabilities, and comprehensive tracking for the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. These features streamline the filing process and ensure all documents are signed and submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

Yes, airSlate SignNow offers various pricing plans to fit different needs and budgets. The cost will depend on the features you choose, but rest assured, we provide a cost-effective solution for processing the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version.

-

Can I integrate airSlate SignNow with other applications for filing the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

Absolutely! AirSlate SignNow supports seamless integrations with numerous applications, making it easy to file the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version alongside your preferred tools. This flexibility enhances your document management workflow signNowly.

-

What benefits come with using airSlate SignNow for the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

Using airSlate SignNow for the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version simplifies the filing process, reduces paperwork, and improves efficiency. Additionally, our secure eSigning feature ensures that your documents are legally binding and easily accessible.

-

Is support available in Spanish for the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return?

Yes, airSlate SignNow offers support in Spanish to assist users with the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. Our team is available to answer any questions you may have and guide you through the process.

Get more for Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Find out other Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF