Form 4868 Sp Application for Automatic Extension of Time to File U S Individual Income Tax Return Spanish Version 2024-2026

What is the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

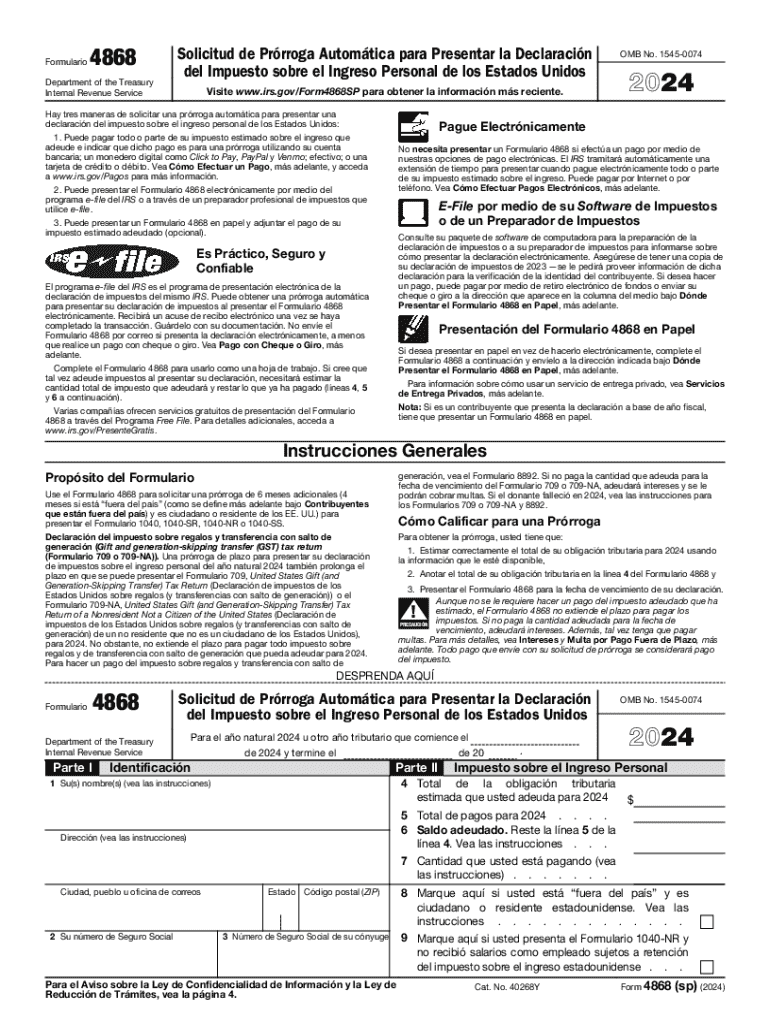

The Form 4868 sp is a crucial document for taxpayers in the United States who require additional time to file their individual income tax returns. This form allows individuals to request an automatic extension of time to file their federal tax return, providing an extra six months beyond the original deadline. The Spanish version of this form ensures accessibility for Spanish-speaking taxpayers, allowing them to understand and complete the application process effectively. By submitting this form, taxpayers can avoid late filing penalties, provided they pay any taxes owed by the original due date.

How to use the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Using the Form 4868 sp involves a straightforward process. Taxpayers should first download the form from the IRS website or obtain it from authorized sources. After acquiring the form, individuals need to fill in their personal information, including name, address, and Social Security number. It is essential to estimate the total tax liability and the amount of tax already paid to ensure accurate completion. Once filled out, the form can be submitted electronically or via mail to the IRS. Remember, while this form grants an extension for filing, it does not extend the time to pay any taxes owed.

Steps to complete the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

Completing the Form 4868 sp requires careful attention to detail. Follow these steps:

- Download the Form 4868 sp from the IRS website or acquire a printed copy.

- Provide your personal information, including your name, address, and Social Security number.

- Estimate your total tax liability for the year.

- Indicate the amount of tax you have already paid.

- Sign and date the form to certify the accuracy of the information provided.

- Submit the completed form electronically through e-filing software or mail it to the appropriate IRS address.

Legal use of the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

The Form 4868 sp is legally recognized by the IRS as a valid request for an extension of time to file individual income tax returns. It is important for taxpayers to understand that while the form provides an extension for filing, it does not extend the deadline for payment of taxes owed. Failure to pay taxes by the original due date may result in interest and penalties. Therefore, it is advisable to estimate and pay any owed taxes when submitting the form to avoid complications.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the Form 4868 sp is vital for compliance. The original deadline for filing individual income tax returns is typically April 15 each year. By submitting Form 4868 sp by this date, taxpayers can receive an automatic extension until October 15. It is crucial to remember that this extension applies only to the filing of the return, not to the payment of taxes, which must still be settled by the April deadline to avoid penalties.

Required Documents

When preparing to complete the Form 4868 sp, taxpayers should gather certain documents to ensure accurate information. Key documents include:

- Previous year’s tax return for reference.

- W-2 forms or 1099 forms for income reporting.

- Records of any estimated tax payments made during the year.

- Documentation of any deductions or credits that may apply.

Having these documents on hand can simplify the process and help ensure that the information provided on the form is accurate and complete.

Create this form in 5 minutes or less

Find and fill out the correct form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version 771104799

Create this form in 5 minutes!

How to create an eSignature for the form 4868 sp application for automatic extension of time to file u s individual income tax return spanish version 771104799

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version?

The Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is a document that allows individuals to request an automatic extension for filing their U.S. individual income tax return. This form is specifically designed for Spanish-speaking taxpayers, ensuring they can easily understand and complete their tax obligations.

-

How can airSlate SignNow help with the Form 4868 sp Application?

airSlate SignNow provides a user-friendly platform to electronically sign and send the Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. Our solution simplifies the process, allowing users to complete their tax extension requests quickly and securely.

-

Is there a cost associated with using airSlate SignNow for the Form 4868 sp Application?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our cost-effective solution ensures that you can manage your Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version without breaking the bank.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage, making it easy to manage your Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version. These tools streamline the process and enhance your overall document management experience.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various applications, including popular accounting and tax software. This allows you to seamlessly manage your Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version alongside your other financial documents.

-

What are the benefits of using airSlate SignNow for tax extensions?

Using airSlate SignNow for your Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version provides numerous benefits, including time savings, enhanced security, and ease of use. Our platform ensures that you can focus on your finances while we handle the paperwork.

-

Is airSlate SignNow secure for filing tax documents?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version is protected. We utilize advanced encryption and security protocols to safeguard your sensitive information throughout the signing process.

Get more for Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

- Aat level 2 bookkeeping transactions pdf form

- Research request form 418634108

- Mobile device management comparison chart form

- Pre employment medical template form

- Next of kin nok identification identification des plus proches form

- Bachelor of arts in music senior project proposal utm form

- Fillable online herentals attest voor het bestendig form

- Termination letter 321222963 form

Find out other Form 4868 sp Application For Automatic Extension Of Time To File U S Individual Income Tax Return Spanish Version

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now