Schedule J Form 1040 Income Averaging for Farmers 2022

What is the Schedule J Form 1040 Income Averaging For Farmers

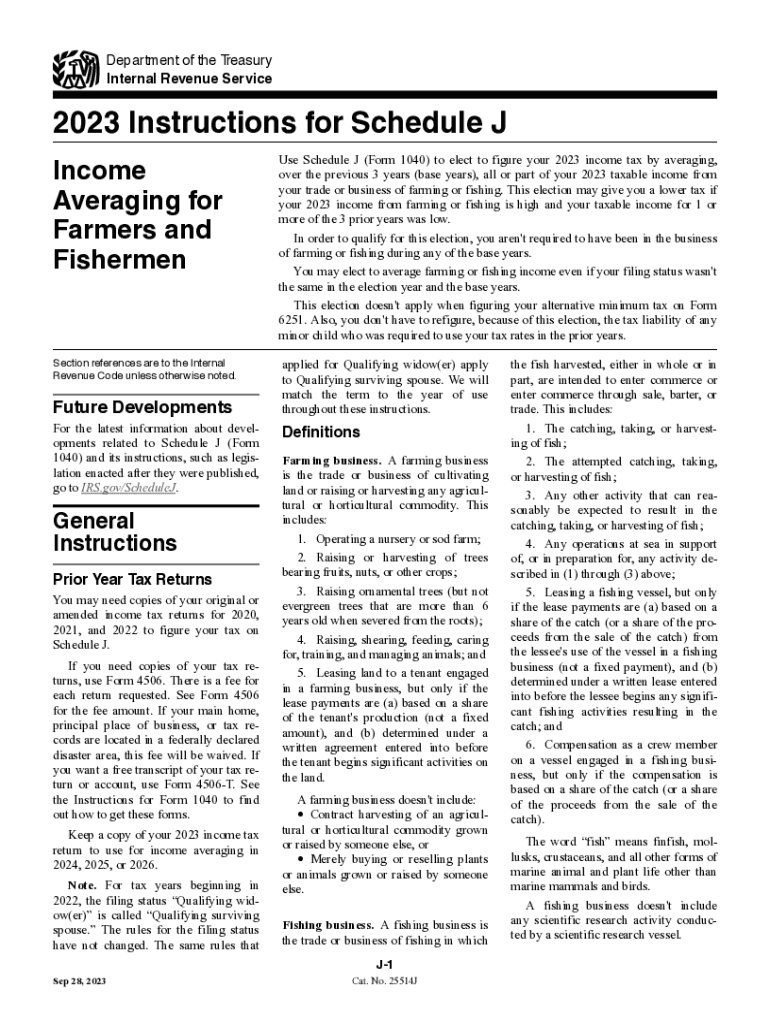

The Schedule J Form 1040 is a tax form specifically designed for farmers in the United States. It allows eligible farmers to average their income over a period of three years, which can help mitigate the impact of fluctuating income due to the seasonal nature of farming. By using this form, farmers can potentially lower their tax liability in years of high income by spreading it across multiple years, thus reducing their overall taxable income for any given year.

How to use the Schedule J Form 1040 Income Averaging For Farmers

To effectively use the Schedule J Form 1040, farmers must first determine their eligibility based on their income and farming activities. Once eligibility is confirmed, they need to gather their income records for the current year and the two preceding years. The form requires farmers to report their gross income from farming, which is then averaged over the three years. This average is used to calculate the appropriate tax liability, allowing farmers to take advantage of lower tax rates during leaner years.

Steps to complete the Schedule J Form 1040 Income Averaging For Farmers

Completing the Schedule J Form 1040 involves several key steps:

- Gather income documentation for the current year and the two previous years.

- Calculate total gross income from farming for each year.

- Determine the average income by adding the three years of gross income and dividing by three.

- Fill out the Schedule J form with the calculated average and any other required information.

- Attach the completed Schedule J to your Form 1040 when filing your taxes.

Eligibility Criteria

To qualify for using the Schedule J Form 1040, farmers must meet specific criteria. They must be engaged in farming as their primary business and have a significant portion of their income derived from agricultural activities. Additionally, the income must fluctuate significantly from year to year, making income averaging beneficial. Farmers must also ensure that they have reported their income accurately for the years involved in the averaging process.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the Schedule J Form 1040. These guidelines outline the eligibility requirements, the types of income that can be averaged, and the necessary documentation needed to support the claims. It is essential for farmers to review these guidelines carefully to ensure compliance and avoid potential issues during the filing process.

Filing Deadlines / Important Dates

Farmers must adhere to the standard tax filing deadlines when submitting the Schedule J Form 1040. Generally, individual tax returns are due by April fifteenth of each year. However, farmers may be eligible for extensions under certain circumstances. It is crucial to stay informed about any changes to deadlines or specific provisions that may apply to agricultural taxpayers.

Form Submission Methods (Online / Mail / In-Person)

The Schedule J Form 1040 can be submitted through various methods. Farmers have the option to file electronically using tax software, which can streamline the process and reduce errors. Alternatively, they can mail the completed form along with their Form 1040 to the appropriate IRS address. In-person filing is also available at designated IRS offices, although this option may require an appointment.

Quick guide on how to complete schedule j form 1040 income averaging for farmers

Complete Schedule J Form 1040 Income Averaging For Farmers effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without any delays. Handle Schedule J Form 1040 Income Averaging For Farmers on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Schedule J Form 1040 Income Averaging For Farmers with ease

- Find Schedule J Form 1040 Income Averaging For Farmers and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight essential parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to store your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious searches for forms, or errors that necessitate printing additional document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Alter and eSign Schedule J Form 1040 Income Averaging For Farmers and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form 1040 income averaging for farmers

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1040 income averaging for farmers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule J Form 1040 Income Averaging For Farmers?

Schedule J Form 1040 Income Averaging For Farmers allows farmers to average their taxable income over a three-year period, providing potential tax relief. This form is particularly beneficial for those with fluctuating income from farming activities, helping to smooth out their tax burden. By utilizing Schedule J, farmers can effectively plan their finances and potentially save money on taxes.

-

How can I fill out Schedule J Form 1040 Income Averaging For Farmers?

To fill out Schedule J Form 1040 Income Averaging For Farmers, gather your income and expenses from the past three years. The form consists of sections where you enter your income for each year, calculate the average, and report any additional information. Properly filling out this form can ensure you take advantage of tax savings, so consider consulting a tax professional if needed.

-

What are the benefits of using Schedule J Form 1040 Income Averaging For Farmers?

The primary benefits of using Schedule J Form 1040 Income Averaging For Farmers include reduced tax liability and smoother income stabilization over time. This averaging method can lead to lower overall tax rates, making it easier to manage cash flow during lean years. Additionally, farmers can benefit from strategic financial planning by understanding their tax responsibilities better through this form.

-

Is there a cost associated with using airSlate SignNow for Schedule J Form 1040 Income Averaging For Farmers?

Using airSlate SignNow to handle your Schedule J Form 1040 Income Averaging For Farmers is surprisingly cost-effective. We offer flexible pricing plans that cater to different business sizes and needs, ensuring you only pay for what you use. Plus, our service helps streamline the e-signature process, saving you time and resources.

-

What features does airSlate SignNow offer for Schedule J Form 1040 Income Averaging For Farmers?

airSlate SignNow provides a user-friendly interface for completing and eSigning documents, including Schedule J Form 1040 Income Averaging For Farmers. Key features include document templates, cloud storage for secure access, and real-time collaboration, making it easy to manage your tax forms efficiently. These features help save time and reduce the hassle associated with tax preparation.

-

Can airSlate SignNow integrate with other software for tax purposes?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax preparation software, enhancing your experience when working with Schedule J Form 1040 Income Averaging For Farmers. This integration helps to synchronize your documents effortlessly, allowing for easier data transfer and management. By using these tools together, you can streamline your financial operations.

-

Who should consider using Schedule J Form 1040 Income Averaging For Farmers?

Farmers who experience signNow variability in their income should definitely consider using Schedule J Form 1040 Income Averaging For Farmers. This form is ideal for those looking to mitigate the impact of fluctuating incomes on their tax returns. Additionally, it's beneficial for anyone involved in agriculture with the goal of optimizing their tax liabilities and overall financial planning.

Get more for Schedule J Form 1040 Income Averaging For Farmers

- Bumpy the frog form

- Club op fee installment program and cc auto debit form 12 30 docx

- Ancient rome questions and answers form

- Agency wide referral form doc

- China police clearance certificate shanghai form

- Commercial film permit application city of san clemente form

- Home occupation permit application the city of bellflower bellflower form

- Beat leas contract template form

Find out other Schedule J Form 1040 Income Averaging For Farmers

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now