Schedule J Form and Instructions Income Tax Pro 2024-2026

Understanding the Schedule J Form and Instructions for Income Tax Professionals

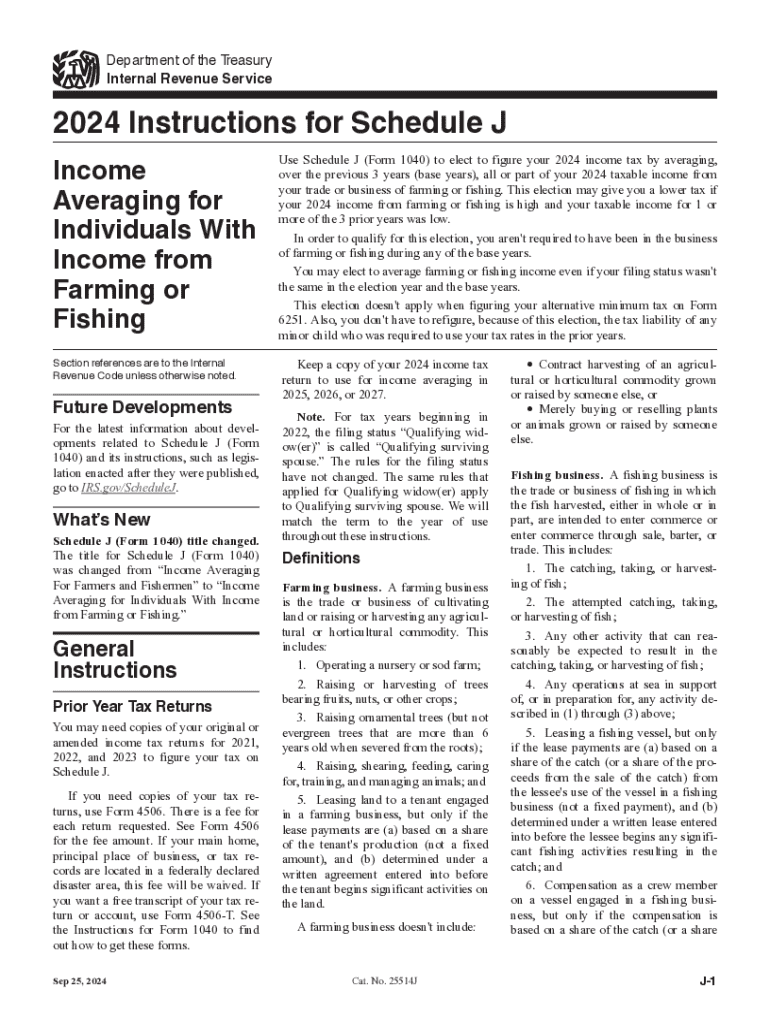

The Schedule J Form is a crucial document used by income tax professionals to report income from farming or fishing activities. It allows taxpayers to average their income over a three-year period, which can help mitigate the impact of fluctuating income levels. This form is particularly beneficial for those in industries where income can vary significantly from year to year, providing a more accurate representation of a taxpayer's financial situation.

Steps to Complete the Schedule J Form

Completing the Schedule J Form involves several key steps:

- Gather necessary financial documents, including income statements and expense reports related to farming or fishing activities.

- Calculate the average income over the last three years, which will be reported on the form.

- Fill out the form accurately, ensuring all income and expenses are reported clearly.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the Schedule J Form

The Schedule J Form can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is important to ensure that you are using the most current version of the form, as tax laws and requirements can change annually.

IRS Guidelines for Schedule J Form

The IRS provides specific guidelines for the use of the Schedule J Form. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Eligibility requirements for using the form, including income thresholds and types of income that qualify.

- Instructions on how to report income and expenses accurately.

- Details on how to submit the form, whether electronically or via mail.

Filing Deadlines for Schedule J Form

It is essential to be aware of the filing deadlines associated with the Schedule J Form. Typically, the form must be submitted by the tax return due date, including any extensions. Missing the deadline can result in penalties, so it is advisable to plan ahead and complete the form in a timely manner.

Legal Use of the Schedule J Form

The Schedule J Form is legally recognized by the IRS for reporting purposes. Taxpayers must ensure that they are using the form correctly to avoid issues with compliance. This includes understanding the legal implications of averaging income and accurately reporting all relevant financial data.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form and instructions income tax pro

Create this form in 5 minutes!

How to create an eSignature for the schedule j form and instructions income tax pro

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule J Form And Instructions Income Tax Pro?

The Schedule J Form And Instructions Income Tax Pro is a tax form used by farmers and fishermen to report income and expenses. It allows for the averaging of income over a three-year period, which can help in managing tax liabilities. Understanding this form is crucial for accurate tax reporting and compliance.

-

How can airSlate SignNow assist with the Schedule J Form And Instructions Income Tax Pro?

airSlate SignNow provides a seamless platform for electronically signing and sending the Schedule J Form And Instructions Income Tax Pro. Our user-friendly interface ensures that you can complete and submit your tax documents efficiently. This saves time and reduces the risk of errors in your tax filings.

-

What are the pricing options for using airSlate SignNow for the Schedule J Form And Instructions Income Tax Pro?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and enterprises. Each plan includes features that simplify the process of managing the Schedule J Form And Instructions Income Tax Pro. You can choose a plan that fits your budget while ensuring you have the necessary tools for effective document management.

-

Are there any integrations available for the Schedule J Form And Instructions Income Tax Pro?

Yes, airSlate SignNow integrates with various applications to enhance your workflow when dealing with the Schedule J Form And Instructions Income Tax Pro. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document management. These integrations help you maintain organization and efficiency in your tax preparation process.

-

What features does airSlate SignNow offer for managing the Schedule J Form And Instructions Income Tax Pro?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the Schedule J Form And Instructions Income Tax Pro. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, our platform provides reminders and notifications to keep you on track.

-

How does airSlate SignNow ensure the security of the Schedule J Form And Instructions Income Tax Pro?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your Schedule J Form And Instructions Income Tax Pro and other sensitive documents. Our compliance with industry standards ensures that your information remains confidential and secure throughout the signing process.

-

Can I access the Schedule J Form And Instructions Income Tax Pro on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access the Schedule J Form And Instructions Income Tax Pro from your smartphone or tablet. This flexibility enables you to manage your documents on the go, making it easier to complete your tax filings anytime, anywhere.

Get more for Schedule J Form And Instructions Income Tax Pro

- Evaluating functions independent practice worksheet answers key form

- Statement of claim and notice of trial massachusetts form

- Nccer ironworker test answers form

- Thika institute of technology form

- National key point registration form

- Credit card authorisation form template australia

- Katz assessment form

- Points of you cards pdf download form

Find out other Schedule J Form And Instructions Income Tax Pro

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed