Form it 611 Claim for Brownfield Redevelopment Tax Credit Tax Year 2023-2026

What is the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

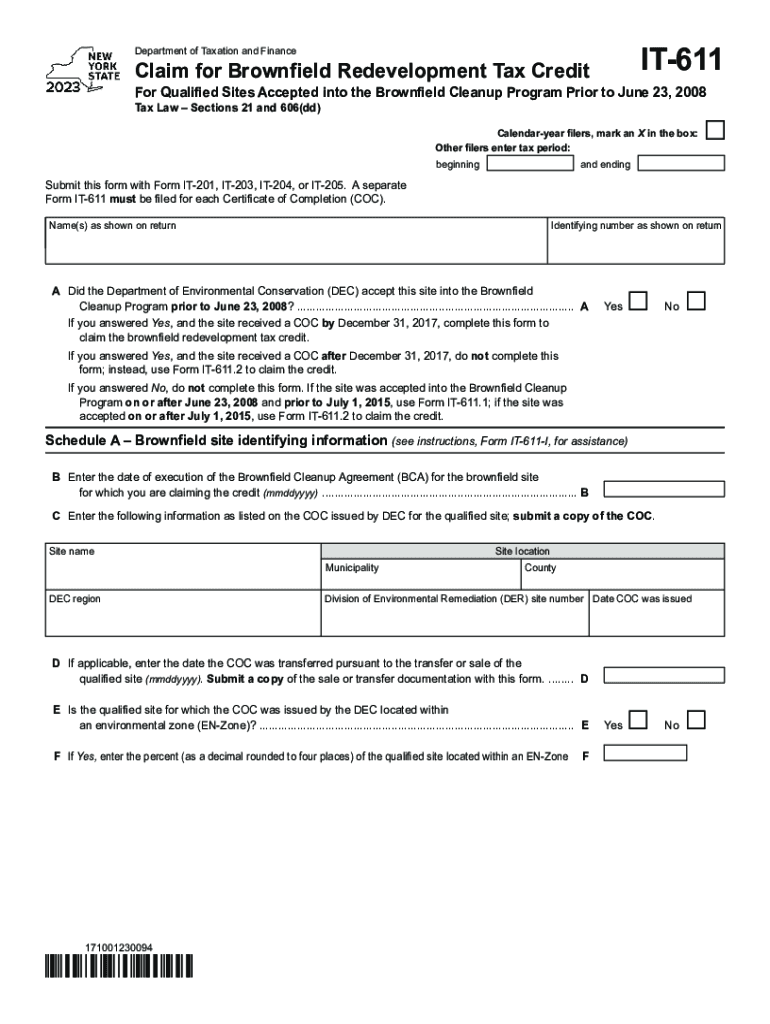

The Form IT 611 is a tax form used in the United States for claiming the Brownfield Redevelopment Tax Credit. This credit is designed to encourage the redevelopment of contaminated properties, known as brownfields, by providing tax incentives to businesses and property owners who invest in cleaning up and revitalizing these areas. The form must be completed accurately to ensure eligibility for the credit, which can significantly reduce tax liabilities for qualifying projects.

Steps to Complete the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

Completing the Form IT 611 involves several key steps:

- Gather necessary documentation, including proof of cleanup efforts and project costs.

- Fill out the form with accurate information regarding the property, the nature of the redevelopment, and the expenses incurred.

- Ensure all calculations for the tax credit are correct, as errors can lead to delays or rejections.

- Review the form for completeness before submission to avoid any issues with processing.

Eligibility Criteria

To qualify for the Brownfield Redevelopment Tax Credit using Form IT 611, applicants must meet specific criteria. The property must be designated as a brownfield site, and the redevelopment efforts must involve significant cleanup activities. Additionally, the applicant must demonstrate that the redevelopment will lead to economic benefits, such as job creation or increased property values. It is essential to review these criteria thoroughly to ensure compliance before filing.

Required Documents

When submitting Form IT 611, certain documents are required to support the claim. These typically include:

- Proof of ownership or lease of the property.

- Documentation of cleanup activities, such as contracts with environmental consultants.

- Invoices and receipts for all eligible expenses related to the redevelopment.

- A detailed project description outlining the scope of work completed.

Filing Deadlines / Important Dates

Timely filing of Form IT 611 is crucial to ensure eligibility for the tax credit. The form must be submitted by the specified deadlines, typically aligned with the tax filing season. It is advisable to check the latest IRS guidelines for any updates on filing dates, as these can vary annually. Missing the deadline may result in the loss of the opportunity to claim the credit.

Form Submission Methods

Form IT 611 can be submitted through various methods to accommodate different preferences. Applicants may choose to file online, which often provides faster processing times, or submit the form via mail. In-person submissions may also be available at designated tax offices. Each method has its own set of requirements, so it is important to follow the instructions carefully to ensure proper handling of the form.

Quick guide on how to complete form it 611 claim for brownfield redevelopment tax credit tax year

Complete Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and eSign your documents swiftly without delays. Handle Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and eSign Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year effortlessly

- Locate Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your PC.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year and ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 611 claim for brownfield redevelopment tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 611 claim for brownfield redevelopment tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 611?

Form 611 is a crucial document used for various business processes. It helps streamline workflows and ensure compliance with necessary regulations. By utilizing form 611, organizations can enhance their documentation management.

-

How can airSlate SignNow help with completing form 611?

airSlate SignNow provides a user-friendly platform for filling out and eSigning form 611 electronically. This eliminates the need for paper-based processes, making it faster and more efficient. With real-time tracking, businesses can monitor who has signed the form 611.

-

What are the pricing options for airSlate SignNow when using form 611?

AirSlate SignNow offers various pricing plans tailored to meet different business needs when handling form 611. The plans are designed to be cost-effective, providing excellent value for electronically managing documents. Potential users can find detailed pricing information on the airSlate SignNow website.

-

Can I integrate form 611 with other applications using airSlate SignNow?

Yes, airSlate SignNow supports integrations with several applications, allowing businesses to seamlessly manage form 611 alongside other tools. This functionality enhances productivity by connecting form 611 to existing workflows. Users can easily link CRM, marketing, and file storage apps.

-

What features does airSlate SignNow offer for managing form 611?

AirSlate SignNow offers features such as eSignature capabilities, document templates, and real-time collaboration tools specifically for form 611. These features ensure your documents are not only compliant but also customizable to your organization’s needs. Businesses can benefit from a simplified signing process.

-

What are the benefits of using airSlate SignNow for form 611?

Using airSlate SignNow for form 611 provides multiple benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform allows for secure storage and easy retrieval of documents. This translates to cost savings and improved compliance for businesses.

-

Is airSlate SignNow secure for handling sensitive form 611 data?

Absolutely, airSlate SignNow employs advanced security measures to protect all data related to form 611. This includes encryption, secure cloud storage, and compliance with regulations such as GDPR. Clients can trust that their information is safe while using the platform.

Get more for Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Baylor university health form fillable

- Eligibility and application information illinois state board of

- Ses foam inc sucraseal form

- Indian visa form for afg

- Optimum bill pdf 404969898 form

- Creamy layer certificate form

- Uab human resources hr forms

- Hs302 duel residents claim form claim as a non resident for relief from uk tax under the terms of a double taxation agreement

Find out other Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile