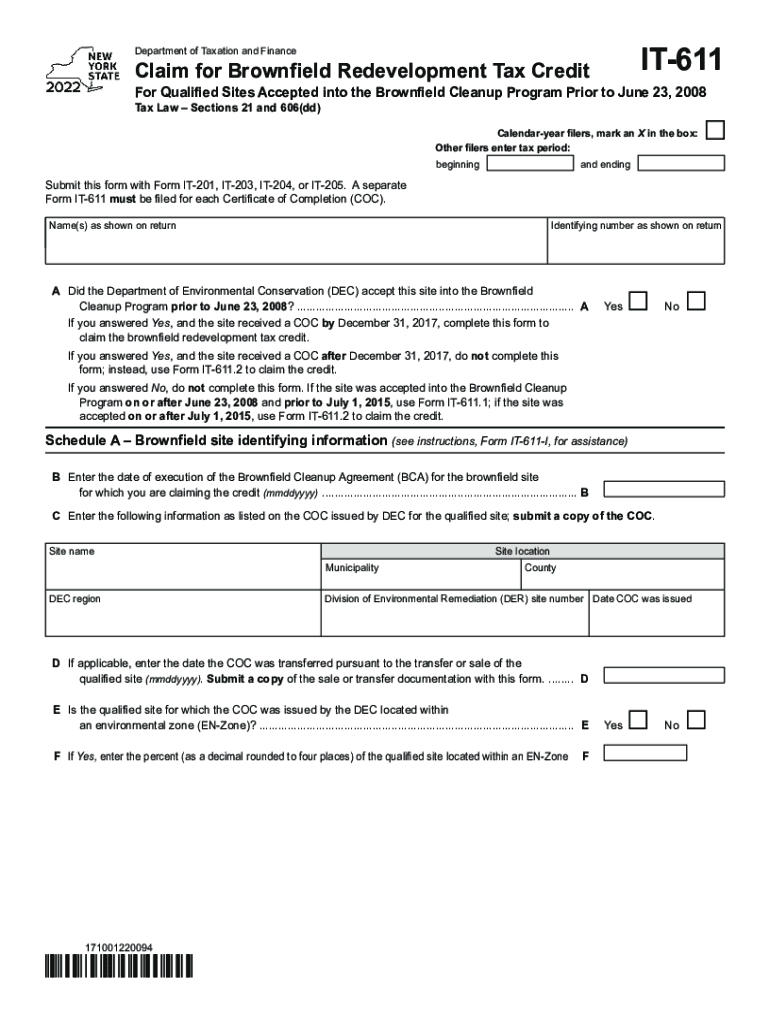

Form it 611 Claim for Brownfield Redevelopment Tax Credit Tax Year 2022

What is the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

The Form IT 611 is a specific document used to claim tax credits for brownfield redevelopment in the United States. This form is essential for businesses and property owners who have engaged in the cleanup and redevelopment of contaminated properties. By completing this form, applicants can potentially receive financial incentives that support environmental remediation efforts. The tax credit is designed to encourage the revitalization of brownfield sites, which can lead to enhanced community health and economic growth.

How to use the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

Using the Form IT 611 involves several key steps. First, gather all necessary documentation that supports your claim, including proof of expenses related to the cleanup and redevelopment of the brownfield site. Next, accurately fill out the form, ensuring that all required fields are completed. It is important to provide detailed descriptions of the work performed and the costs incurred. Once the form is completed, it must be submitted to the appropriate tax authority within the designated timeframe to ensure eligibility for the tax credit.

Steps to complete the Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

Completing the Form IT 611 requires careful attention to detail. Follow these steps:

- Gather all relevant documentation, including invoices and contracts related to the redevelopment project.

- Fill out the form, providing accurate information about the property and the nature of the redevelopment work.

- Include any additional information that may be required, such as environmental assessments or reports.

- Review the completed form for accuracy before submission.

- Submit the form by the specified deadline to ensure consideration for the tax credit.

Eligibility Criteria

To qualify for the tax credit associated with the Form IT 611, applicants must meet specific eligibility criteria. These criteria typically include:

- The property must be designated as a brownfield site by local, state, or federal authorities.

- Redevelopment activities must have been completed within the applicable tax year.

- All cleanup efforts must comply with environmental regulations and standards.

Required Documents

When submitting the Form IT 611, certain documents are required to substantiate the claim. These may include:

- Proof of ownership or lease agreements for the brownfield property.

- Invoices and receipts for cleanup and redevelopment expenses.

- Environmental assessment reports detailing the contamination and remediation efforts.

- Any correspondence with regulatory agencies regarding the brownfield site.

Form Submission Methods

The Form IT 611 can typically be submitted through various methods, depending on the jurisdiction. Common submission methods include:

- Online submission through the relevant tax authority's website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if applicable.

Quick guide on how to complete form it 611 claim for brownfield redevelopment tax credit tax year 2022

Complete Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a superb environmentally-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and safely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year without any hassle

- Obtain Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year and then click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize important sections of your documents or conceal sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to secure your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about missing or lost documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management within just a few clicks from any device you choose. Edit and eSign Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 611 claim for brownfield redevelopment tax credit tax year 2022

Create this form in 5 minutes!

How to create an eSignature for the form it 611 claim for brownfield redevelopment tax credit tax year 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 611 form?

A 611 form is a designated document that businesses often use for specific applications and processes. In the context of digital signatures, the 611 form can streamline the eSigning process, ensuring all parties can execute agreements efficiently.

-

How can airSlate SignNow help with 611 forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign 611 forms. With our solution, you can easily manage and automate the entire process, reducing the time and effort needed to complete documentation.

-

Are there any costs associated with using airSlate SignNow for 611 forms?

airSlate SignNow offers competitive pricing plans tailored to fit various business needs for managing 611 forms. We provide flexible subscription options that ensure you get the best value while maximizing your eSigning capabilities.

-

What features does airSlate SignNow offer for managing 611 forms?

Some key features of airSlate SignNow for handling 611 forms include customizable templates, real-time status tracking, automated reminders, and secure cloud storage. These functionalities enhance the efficiency of document management and signing processes.

-

Can airSlate SignNow integrate with other tools for 611 forms?

Yes, airSlate SignNow seamlessly integrates with numerous third-party applications, making it easier to manage 611 forms alongside your essential business tools. This allows for greater flexibility and efficiency in your document workflows.

-

What are the benefits of using airSlate SignNow for 611 forms?

Using airSlate SignNow for your 611 forms offers signNow benefits, such as reduced turnaround time, improved accuracy, and enhanced security. Our platform ensures that your documents are securely stored and easily accessible.

-

Is there customer support available when using airSlate SignNow for 611 forms?

Absolutely! When you use airSlate SignNow for managing 611 forms, our dedicated customer support team is available to assist you. Whether you have questions about features or need help troubleshooting, we're here to help.

Get more for Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Notice of dishonored check civil keywords bad check bounced check tennessee form

- Tennessee certificate of trust by individual tennessee form

- Tennessee certificate trust form

- Mutual wills containing last will and testaments for man and woman living together not married with no children tennessee form

- Mutual wills package of last wills and testaments for man and woman living together not married with adult children tennessee form

- Mutual wills or last will and testaments for man and woman living together not married with minor children tennessee form

- Non marital cohabitation living together agreement tennessee form

- Paternity law and procedure handbook tennessee form

Find out other Form IT 611 Claim For Brownfield Redevelopment Tax Credit Tax Year

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation