Form 2848 Power of Attorney and Declarationof Representatvie

What is the Form 2848 Power Of Attorney And Declaration of Representative

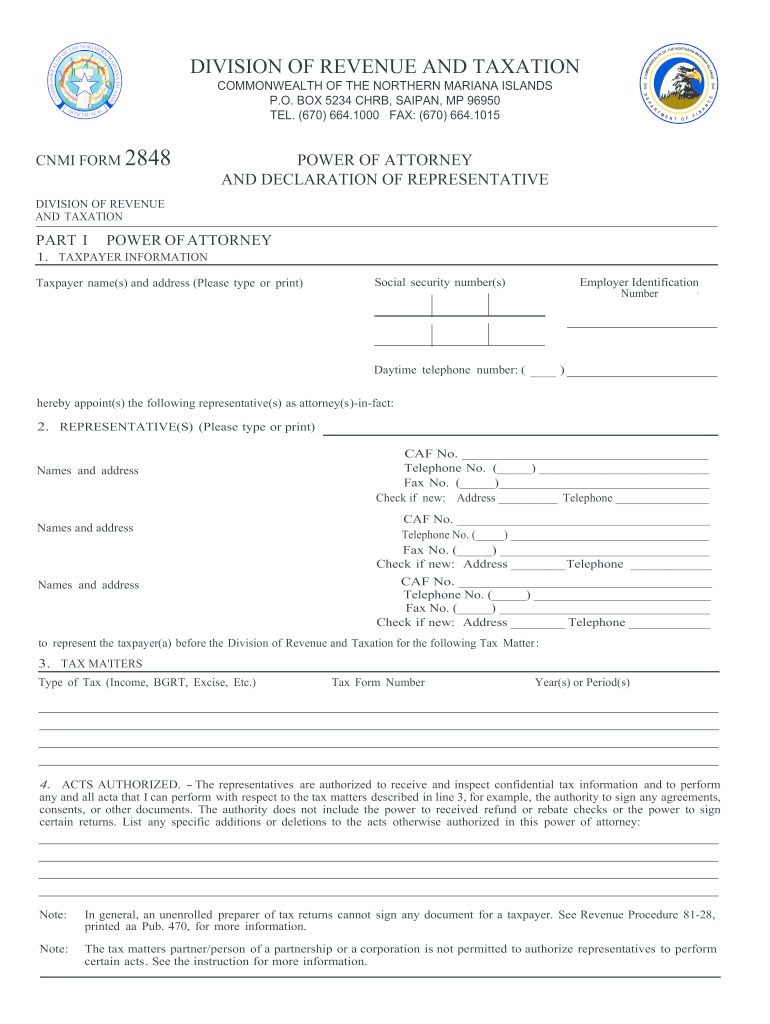

The Form 2848, officially known as the Power of Attorney and Declaration of Representative, is a document used by taxpayers in the United States to authorize an individual to represent them before the Internal Revenue Service (IRS). This form allows the designated representative to receive and inspect confidential tax information, sign documents on behalf of the taxpayer, and make decisions regarding the taxpayer's tax matters. It is essential for individuals who need assistance with their tax filings or who are facing IRS inquiries.

How to use the Form 2848 Power Of Attorney And Declaration of Representative

To use Form 2848 effectively, taxpayers must complete the document accurately, ensuring that all required information is filled out. This includes the taxpayer's name, address, and Social Security number, as well as the representative's details. After completion, the form must be signed and dated by the taxpayer. Once submitted to the IRS, the designated representative can act on behalf of the taxpayer in tax matters, making it crucial to choose someone trustworthy and knowledgeable about tax laws.

Steps to complete the Form 2848 Power Of Attorney And Declaration of Representative

Completing Form 2848 involves several key steps:

- Gather necessary information, including the taxpayer's personal details and the representative's qualifications.

- Fill out the form, ensuring all sections are completed, including the types of tax and years or periods the authorization covers.

- Sign and date the form, confirming that the information provided is accurate and that the taxpayer understands the implications of granting power of attorney.

- Submit the completed form to the IRS, either by mail or electronically, depending on the situation.

Key elements of the Form 2848 Power Of Attorney And Declaration of Representative

Form 2848 includes several critical elements that must be understood:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Representative Details: Information about the individual being authorized, including their name, address, and professional credentials.

- Scope of Authority: Taxpayers must specify the types of tax and the years or periods for which the representative is authorized to act.

- Signature: The taxpayer's signature is necessary to validate the form and grant authority to the representative.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 2848. It is important for taxpayers to ensure that the form is filled out correctly to avoid delays in processing. The IRS requires that the form be submitted for each new representative or when changing the scope of representation. Additionally, taxpayers should be aware of any limitations on the authority granted to their representative, as outlined in the form instructions.

Filing Deadlines / Important Dates

While there are no strict filing deadlines for submitting Form 2848, it is advisable to submit it as soon as representation is needed. For instance, if a taxpayer is facing an IRS audit or needs assistance with tax returns, submitting the form promptly can ensure that the representative can act on their behalf without delay. Keeping track of tax-related deadlines is crucial for maintaining compliance and avoiding penalties.

Quick guide on how to complete form 2848 power of attorney and declarationof representatvie

Complete Form 2848 Power Of Attorney And Declarationof Representatvie effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the correct form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your paperwork swiftly without interruptions. Handle Form 2848 Power Of Attorney And Declarationof Representatvie on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 2848 Power Of Attorney And Declarationof Representatvie without hassle

- Obtain Form 2848 Power Of Attorney And Declarationof Representatvie and click Get Form to commence.

- Employ the tools we provide to finalize your document.

- Highlight pertinent sections of the documents or obscure sensitive data using the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Leave behind worries about missing or lost documents, tedious form searching, or mistakes that require producing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Adjust and eSign Form 2848 Power Of Attorney And Declarationof Representatvie and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2848 power of attorney and declarationof representatvie

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2848 Power Of Attorney And Declaration of Representative?

The Form 2848 Power Of Attorney And Declaration of Representative is a legal document that allows an authorized individual to represent another person before the IRS. This form is crucial for individuals seeking assistance with tax-related matters, ensuring that their representatives can act on their behalf.

-

How can airSlate SignNow help with the Form 2848 Power Of Attorney And Declaration of Representative?

airSlate SignNow streamlines the process of completing and signing the Form 2848 Power Of Attorney And Declaration of Representative. With our easy-to-use platform, you can quickly fill out the form, obtain electronic signatures, and securely send it to the IRS, saving you time and hassle.

-

Is there a cost associated with using airSlate SignNow for the Form 2848 Power Of Attorney And Declaration of Representative?

Yes, airSlate SignNow offers various pricing plans that can accommodate different business needs. Our plans are cost-effective and allow you to manage your documents efficiently, including the Form 2848 Power Of Attorney And Declaration of Representative, without breaking the bank.

-

What features does airSlate SignNow offer for managing the Form 2848 Power Of Attorney And Declaration of Representative?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage specifically for documents like the Form 2848 Power Of Attorney And Declaration of Representative. These features enhance your document management process and ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other applications for handling the Form 2848 Power Of Attorney And Declaration of Representative?

Absolutely! airSlate SignNow provides seamless integrations with popular applications such as Google Drive, Salesforce, and Microsoft Office, enabling efficient management of the Form 2848 Power Of Attorney And Declaration of Representative. This connectivity allows you to maintain your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for the Form 2848 Power Of Attorney And Declaration of Representative?

Using airSlate SignNow for the Form 2848 Power Of Attorney And Declaration of Representative offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform ensures that your documents are handled in compliance with legal requirements while simplifying the signing process.

-

How secure is airSlate SignNow when handling the Form 2848 Power Of Attorney And Declaration of Representative?

Security is our top priority at airSlate SignNow. We employ advanced encryption and security measures to protect all forms, including the Form 2848 Power Of Attorney And Declaration of Representative, ensuring that your sensitive information remains confidential and secure throughout the signing and submission process.

Get more for Form 2848 Power Of Attorney And Declarationof Representatvie

- 504 sample observation form pasco county schools

- Booking form noble caledonia

- Form 18 electrical contractors licence

- Juror qualification questionnaire en espaol form

- Parish courtjefferson parish district attorneys office form

- Software white label agreement template form

- Software work for hire agreement template form

- Softwarer agreement template form

Find out other Form 2848 Power Of Attorney And Declarationof Representatvie

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form