IRS 1065 X Fill Out Tax Template Online 2023-2026

Understanding the IRS 1065X

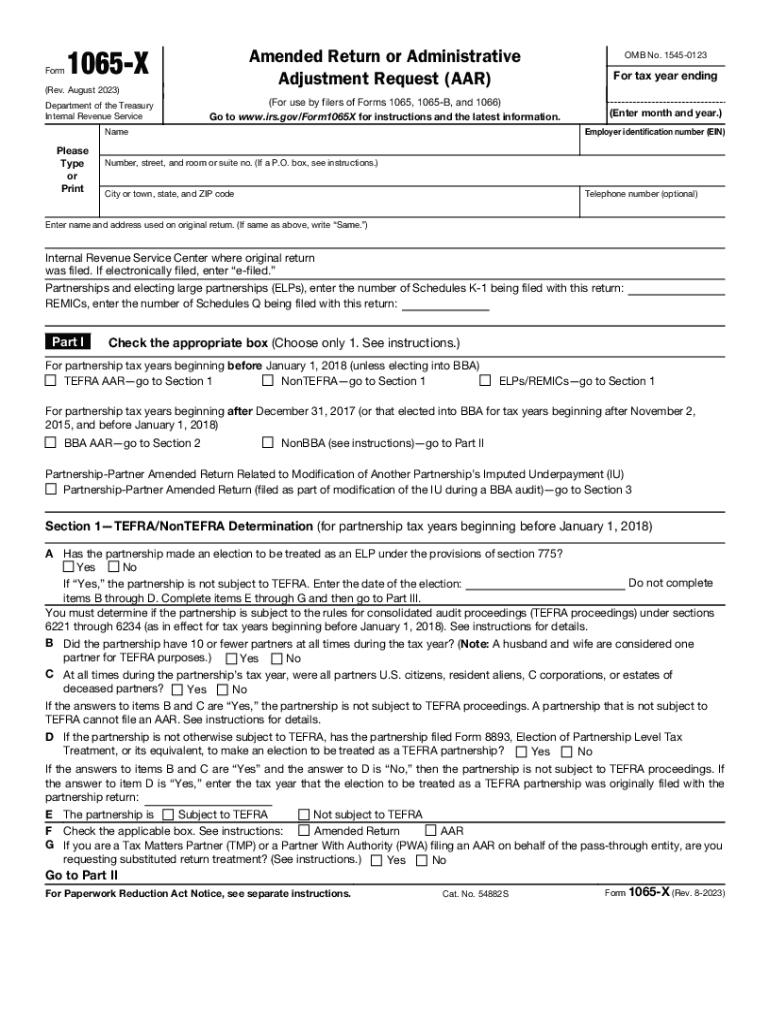

The IRS 1065X is a form used to amend a previously filed partnership return. This form allows partnerships to correct errors or make changes to their original Form 1065 filings. It is essential for ensuring that all information reported to the IRS is accurate and up-to-date. The amended return can include adjustments to income, deductions, and credits, which can affect the partners' K-1 forms. By filing the 1065X, partnerships can avoid potential penalties associated with incorrect filings.

Steps to Complete the IRS 1065X

Completing the IRS 1065X involves several key steps:

- Gather all relevant documents, including the original Form 1065 and any supporting schedules.

- Clearly indicate the changes being made on the 1065X form, providing detailed explanations for each amendment.

- Complete the form accurately, ensuring that all required fields are filled out correctly.

- Attach any necessary documentation that supports the changes, such as revised financial statements.

- Review the completed form for accuracy before submission.

Filing Deadlines for the IRS 1065X

It is important to be aware of the filing deadlines associated with the IRS 1065X. Generally, the amended return must be filed within three years of the original due date of the Form 1065. This timeframe allows partnerships to correct any errors without facing penalties. If the original return was filed late, the deadline for submitting the 1065X may differ, so it is crucial to check the specific circumstances surrounding the original filing.

Legal Use of the IRS 1065X

The IRS 1065X is legally recognized for amending partnership tax returns. Partnerships must use this form to ensure compliance with IRS regulations when correcting previously submitted information. Failing to file an amended return when necessary can lead to penalties and interest on any unpaid taxes. It is advisable for partnerships to consult with a tax professional to navigate the complexities of amending returns and to ensure that all legal requirements are met.

Required Documents for Filing the IRS 1065X

When filing the IRS 1065X, certain documents are required to support the amendments being made. These include:

- The original Form 1065 that is being amended.

- Any K-1 forms that need to be adjusted for the partners.

- Supporting documentation that justifies the changes, such as financial statements or receipts.

- Any other relevant tax documents that may impact the amendments.

Form Submission Methods for the IRS 1065X

The IRS 1065X can be submitted in several ways. Partnerships have the option to file the form electronically or by mail. Filing electronically may expedite the processing time, while mailing the form requires careful attention to ensure it is sent to the correct IRS address. It is important to keep a copy of the submitted form and any supporting documents for record-keeping purposes.

Quick guide on how to complete irs 1065 x fill out tax template online

Complete IRS 1065 X Fill Out Tax Template Online effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle IRS 1065 X Fill Out Tax Template Online on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign IRS 1065 X Fill Out Tax Template Online easily

- Find IRS 1065 X Fill Out Tax Template Online and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether through email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and electronically sign IRS 1065 X Fill Out Tax Template Online and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs 1065 x fill out tax template online

Create this form in 5 minutes!

People also ask

-

What are the 1065x instructions for completing a partnership tax return?

The 1065x instructions provide guidance for correcting previously filed partnership tax returns. It includes steps for filing amendments and details on eligibility. To ensure accuracy, including correct information on the form is crucial.

-

How can airSlate SignNow help with the 1065x instructions process?

airSlate SignNow streamlines the completion of necessary forms, including those related to 1065x instructions, by providing an easy-to-use platform for eSigning. Users can quickly send and receive signed documents without hassle. This enhances compliance and reduces errors during submission.

-

Are there any costs associated with using airSlate SignNow for 1065x instructions?

airSlate SignNow offers a cost-effective solution that can fit various business needs, including those involving 1065x instructions. The pricing is competitive, allowing businesses of all sizes to benefit from an efficient eSigning process. Additionally, there are options for monthly or yearly subscriptions.

-

What features does airSlate SignNow offer for handling 1065x instructions?

airSlate SignNow includes features such as templated forms tailored for 1065x instructions and automated reminders for recipients. The platform also supports multiple document formats and customizable signing workflows, making the eSignature process seamless and efficient.

-

Do I need prior experience to use airSlate SignNow for 1065x instructions?

No prior experience is necessary to navigate airSlate SignNow for tasks like handling 1065x instructions. The platform is user-friendly, designed for individuals and businesses alike. Comprehensive help resources and support are available to ease the learning curve.

-

Can airSlate SignNow integrate with other software while managing 1065x instructions?

Yes, airSlate SignNow offers a variety of integrations with popular software, which enhances the workflow for managing 1065x instructions. This includes accounting and document management systems. Such integrations save time and ensure consistency across platforms.

-

What benefits does using airSlate SignNow provide for 1065x instructions?

Using airSlate SignNow for 1065x instructions offers signNow benefits such as faster processing times and improved accuracy in tax document handling. Automated workflows reduce manual errors, while secure eSigning facilitates quicker turnaround times. Overall, it enhances efficiency in the amendment process.

Get more for IRS 1065 X Fill Out Tax Template Online

- Patient assistance program application form

- Bijlage 32 pdf form

- Texas residency questionnaire houston baptist university hbu form

- Unifor grievance form

- Mortgage interest deduction limit how it works taxes form

- National vessel documentation center instructions and forms

- Common law separation agreement template form

- Common law tenancy agreement template form

Find out other IRS 1065 X Fill Out Tax Template Online

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract