1065x Form 2012

What is the 1065x Form

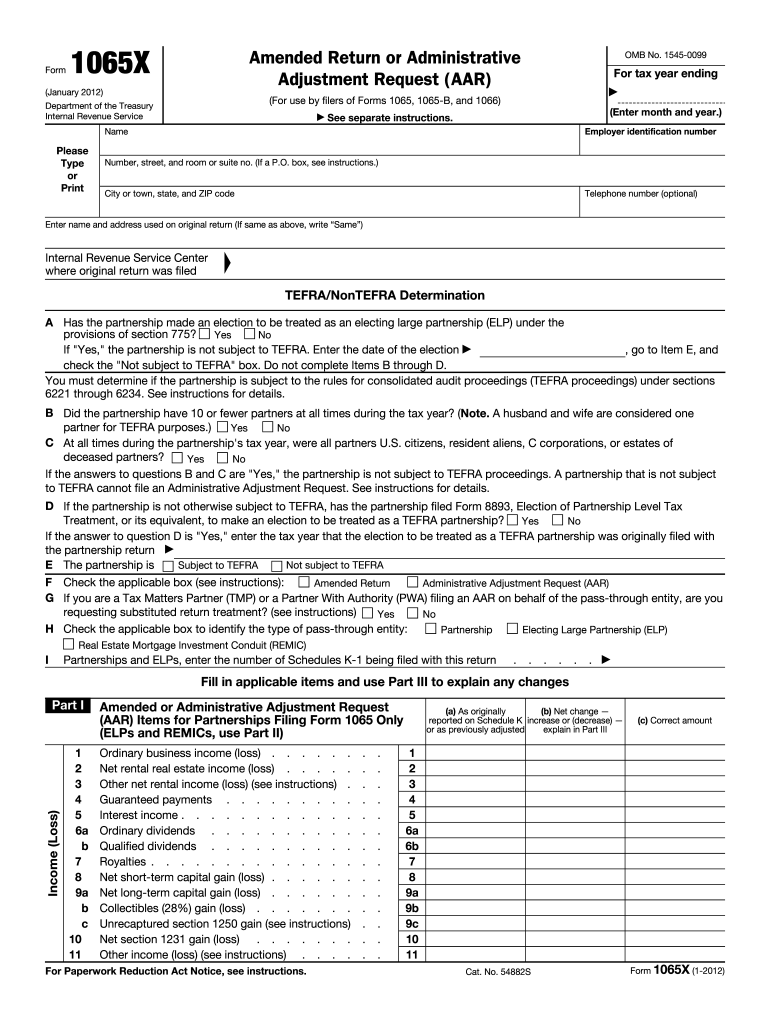

The 1065x Form is an amended version of the 1065 Form, which is used by partnerships to report income, deductions, gains, losses, and other tax-related information to the Internal Revenue Service (IRS). This form allows partnerships to correct errors or make changes to previously filed 1065 Forms. It is essential for ensuring that the partnership's tax obligations are accurately reported and that any adjustments are properly documented.

How to Use the 1065x Form

Using the 1065x Form involves several key steps. First, ensure that you have the correct version of the form for the tax year you are amending. Next, gather all necessary financial documents and information related to the original filing. When completing the form, clearly indicate the changes being made and provide explanations for each amendment. After filling out the form, review it carefully for accuracy before submission.

Steps to Complete the 1065x Form

Completing the 1065x Form requires attention to detail. Follow these steps:

- Obtain the latest version of the 1065x Form from the IRS website.

- Fill in the partnership's name, address, and employer identification number (EIN).

- Indicate the tax year for which you are amending the return.

- Provide the corrected figures in the appropriate sections, including income, deductions, and credits.

- Attach any necessary supporting documents that justify the changes.

- Sign and date the form, ensuring that all partners or authorized representatives have done so.

Legal Use of the 1065x Form

The 1065x Form holds legal significance as it serves to amend previously filed tax returns. To be considered valid, it must comply with IRS regulations and guidelines. This includes accurate reporting of changes and timely submission. The amended form can help mitigate potential penalties or issues arising from inaccuracies in the original filing, ensuring that the partnership meets its legal obligations.

Filing Deadlines / Important Dates

Filing deadlines for the 1065x Form typically align with the original 1065 Form deadlines. Partnerships generally must file their tax returns by March 15 of each year. If an amendment is necessary, it should be filed as soon as the error is discovered, ideally within three years of the original filing date to avoid complications. Keeping track of these deadlines is crucial for compliance with IRS requirements.

Form Submission Methods

The 1065x Form can be submitted in various ways. Partnerships may choose to file electronically through approved tax software or the IRS e-file system. Alternatively, the form can be mailed directly to the IRS at the address specified for partnership returns. In-person submission is generally not available for this form. Ensure that you retain copies of the submitted form and any supporting documentation for your records.

Quick guide on how to complete 1065x 2012 form

Effortlessly Prepare 1065x Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your paperwork swiftly and without hindrance. Handle 1065x Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven processes today.

The simplest method to modify and eSign 1065x Form with ease

- Access 1065x Form and select Get Form to begin.

- Utilize the features we offer to fill out your document.

- Emphasize pertinent sections of the documents or conceal sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your updates.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate creating new copies. airSlate SignNow accommodates all your document management needs in just a few clicks from any device of your preference. Modify and eSign 1065x Form to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1065x 2012 form

Create this form in 5 minutes!

How to create an eSignature for the 1065x 2012 form

How to make an eSignature for the 1065x 2012 Form in the online mode

How to make an electronic signature for your 1065x 2012 Form in Google Chrome

How to generate an electronic signature for putting it on the 1065x 2012 Form in Gmail

How to make an electronic signature for the 1065x 2012 Form right from your smartphone

How to create an eSignature for the 1065x 2012 Form on iOS

How to create an electronic signature for the 1065x 2012 Form on Android

People also ask

-

What is a 1065x Form and why is it important?

The 1065x Form is a crucial document used by partnerships to amend previously filed Form 1065. It allows businesses to correct errors or make changes to income, deductions, or partner information. Properly filing a 1065x Form ensures compliance with IRS regulations and avoids potential penalties.

-

How can airSlate SignNow help me with my 1065x Form?

airSlate SignNow streamlines the process of preparing, signing, and sending your 1065x Form. With our easy-to-use platform, you can quickly upload your document, add necessary fields for signatures, and securely send it for eSignature. This saves time and ensures that your 1065x Form is handled efficiently.

-

Is airSlate SignNow a cost-effective solution for managing my 1065x Form?

Yes, airSlate SignNow offers competitive pricing plans that cater to various business needs, making it an affordable solution for managing your 1065x Form. Our pricing structure is transparent, with no hidden fees, allowing you to budget effectively while benefiting from our comprehensive eSignature services.

-

What features does airSlate SignNow offer for the 1065x Form?

airSlate SignNow includes features such as document templates, customizable signing workflows, and real-time tracking for your 1065x Form. These capabilities enhance the efficiency and accuracy of your document management process, ensuring that you can focus on your business rather than paperwork.

-

Are there integration options available for handling the 1065x Form with airSlate SignNow?

Absolutely! airSlate SignNow integrates seamlessly with a variety of third-party applications, allowing you to manage your 1065x Form alongside other essential business tools. Whether you use cloud storage, CRM systems, or accounting software, our integrations enhance your workflow and boost productivity.

-

Can I track the status of my 1065x Form using airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your 1065x Form, allowing you to monitor its status at every stage of the signing process. You will receive notifications when the document is viewed, signed, or completed, ensuring that you stay informed and can follow up promptly.

-

What security measures does airSlate SignNow implement for the 1065x Form?

airSlate SignNow prioritizes the security of your documents, including the 1065x Form, by employing advanced encryption and secure cloud storage. Our platform is compliant with industry standards, ensuring that your sensitive information is protected throughout the signing process.

Get more for 1065x Form

Find out other 1065x Form

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe