Form it 203 TM ATT a Schedule a Group Return for Nonresident Athletic Team Members Tax Year 2023-2026

What is the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

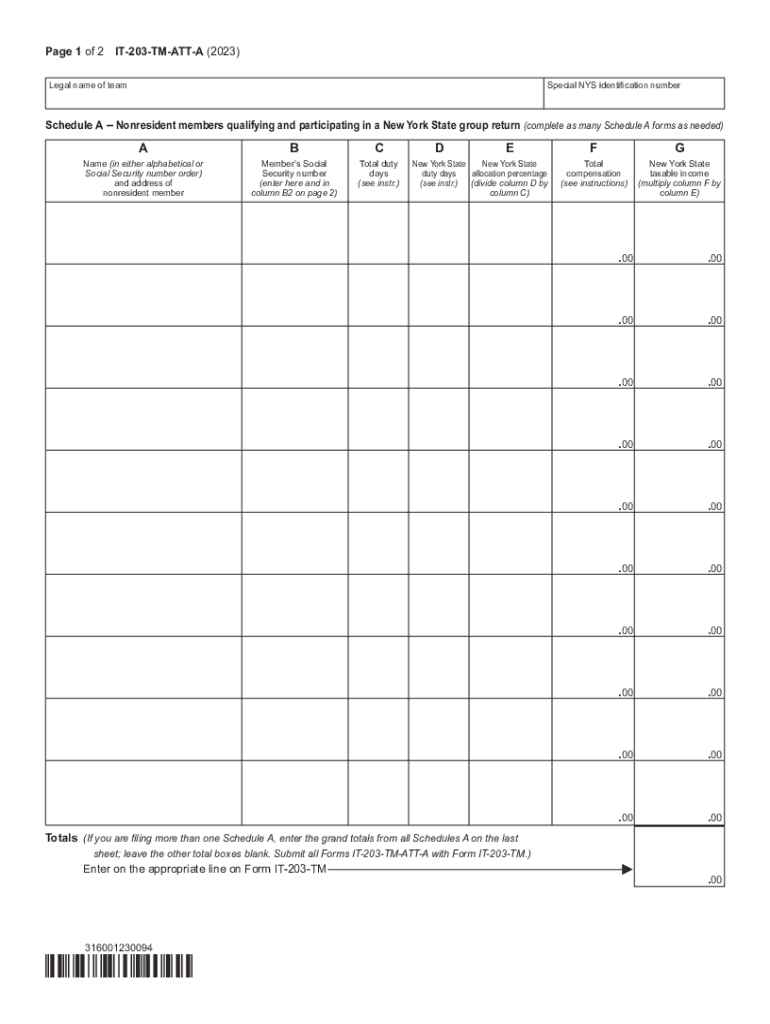

The Form IT 203 TM ATT A Schedule A is a specialized tax document designed for nonresident athletic team members who participate in events within the United States. This form allows these athletes to file a group return, simplifying the tax process for those who may not have a permanent tax obligation in the U.S. It is particularly relevant for teams that travel to the U.S. for competitions, ensuring compliance with state tax regulations while providing a streamlined method for reporting income earned during their stay.

How to use the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

Using the Form IT 203 TM ATT A involves several steps to ensure accurate completion. First, gather all relevant information about the team members, including their individual income earned in the U.S. during the tax year. Next, fill out the form with the necessary details, such as the names and identification numbers of each athlete. After completing the form, it should be submitted to the appropriate state tax authority. This group return helps to consolidate the tax obligations of multiple athletes, making the process more efficient.

Steps to complete the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

Completing the Form IT 203 TM ATT A requires careful attention to detail. Follow these steps:

- Collect individual income information for each nonresident athlete.

- Obtain the Form IT 203 TM ATT A from the state tax authority or authorized sources.

- Fill in the required fields, including personal details and income amounts.

- Ensure all information is accurate and complete to avoid delays.

- Review the form for any errors before submission.

- Submit the completed form by the designated filing deadline.

Legal use of the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

The legal use of the Form IT 203 TM ATT A is essential for nonresident athletes participating in U.S. events. This form complies with state tax laws, allowing athletes to report income earned during their temporary stay. It is important for teams to ensure they are using the correct version of the form and adhering to all local regulations to avoid potential legal issues. Proper use of this form helps maintain transparency and compliance with tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 TM ATT A vary by state, but typically fall within the same timeframe as general tax filings. It is crucial for teams to be aware of these deadlines to ensure timely submission. Missing a deadline can result in penalties or complications for the athletes involved. Teams should keep a calendar of important dates related to tax filings, including any extensions that may apply.

Required Documents

To complete the Form IT 203 TM ATT A, several documents are necessary. These include:

- Individual income statements for each athlete.

- Identification numbers, such as Social Security numbers or ITINs.

- Any relevant tax forms from the state where the income was earned.

- Documentation proving participation in events, such as contracts or invitations.

Having these documents ready will facilitate a smoother filing process.

Quick guide on how to complete form it 203 tm att a schedule a group return for nonresident athletic team members tax year

Execute Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

Steps to edit and electronically sign Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year with ease

- Locate Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight essential parts of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form searches, or errors requiring new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm att a schedule a group return for nonresident athletic team members tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att a schedule a group return for nonresident athletic team members tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year' used for?

The 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year' is utilized to report income earned by nonresident athletes participating in competitions in New York. This form allows teams to file a consolidated return, streamlining the tax filing process for eligible athletic teams.

-

How can airSlate SignNow assist with filing the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow simplifies the process of preparing and submitting the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year' by providing customizable templates and eSignature capabilities. This ensures that all necessary documents are organized and signed electronically, reducing the administrative burden on teams.

-

What are the pricing options for using airSlate SignNow for the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow offers a variety of pricing plans designed to fit the needs of different users, including single users and larger organizations. You can check our website for detailed information on features included in each plan that help in managing the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year.'

-

Is airSlate SignNow secure for handling sensitive tax documents like the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure data storage, to protect sensitive information, such as that on the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year.' Your documents remain confidential while you ensure compliance.

-

Can airSlate SignNow integrate with other accounting software for filing the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

Yes, airSlate SignNow integrates seamlessly with various accounting software platforms to streamline the workflow associated with the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year.' This integration can help automate data transfer and retrieval, minimizing errors and saving time.

-

What features does airSlate SignNow offer that are specifically beneficial for the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

airSlate SignNow provides features such as easy document creation, eSignature capabilities, and automated reminders that promote timely filing for the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year.' These tools enhance efficiency and ensure that deadlines are met.

-

How does airSlate SignNow support collaboration among team members when filing the Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year?

With airSlate SignNow, team members can collaborate in real-time on the 'Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year' through shared access to documents and comments. This facilitates quicker approvals and ensures everyone is aligned in the filing process.

Get more for Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

- Lawyers title company statement of information

- Mass dor form 355

- Bill of sale template form

- Acr bi rads us lexicon classification form american acr

- Kipp lesson plan template 481966434 form

- Disbursement request form account number wtc

- Bill of sale issued shares of corporate stock 609863110 form

- 529 college savings plan distribution request form

Find out other Form IT 203 TM ATT A Schedule A Group Return For Nonresident Athletic Team Members Tax Year

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form