Form it 203 TM ATT a Schedule a Tax NY Gov 2022

What is the Form IT 203 TM ATT A Schedule A Tax NY gov

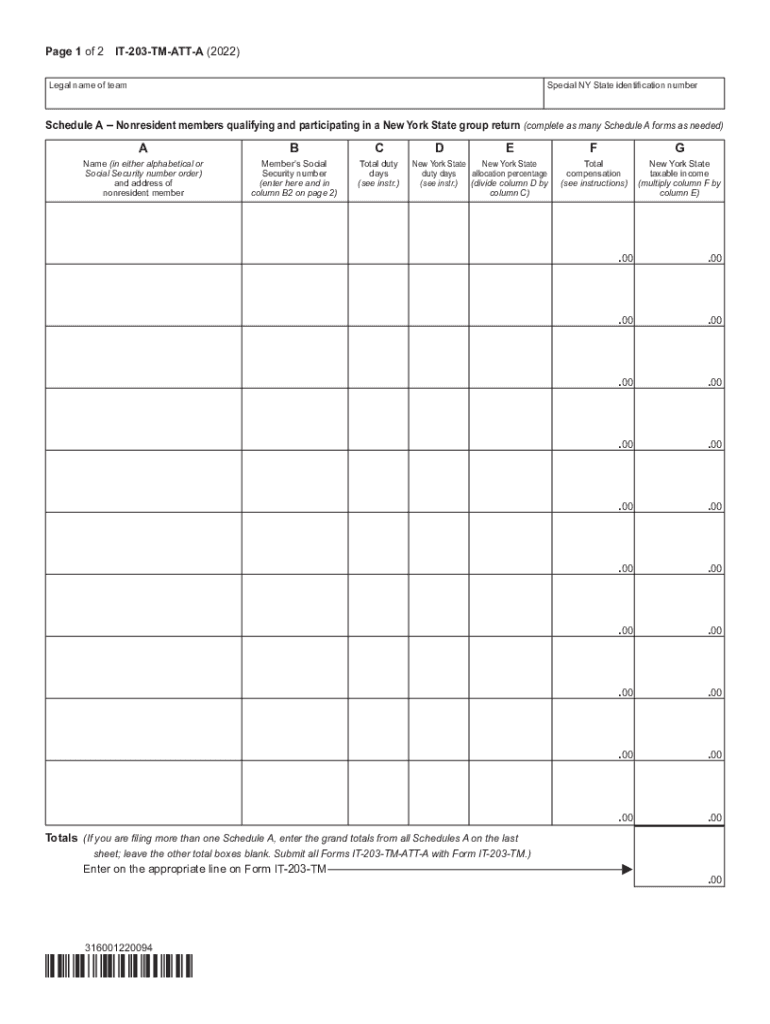

The Form IT 203 TM ATT A Schedule A is a tax document used by non-residents and part-year residents of New York State to report income earned within the state. This form is part of the New York State tax return process and is specifically designed to help individuals calculate their tax liability based on income sourced from New York. It allows taxpayers to detail their income, deductions, and credits applicable to their situation, ensuring compliance with state tax laws.

How to use the Form IT 203 TM ATT A Schedule A Tax NY gov

To effectively use the Form IT 203 TM ATT A Schedule A, taxpayers should first gather all necessary financial documents, including W-2s, 1099s, and any other income statements. The form requires detailed information about income earned in New York, as well as any applicable deductions. After filling out the form, it must be submitted along with the primary tax return, ensuring that all figures are accurate and complete to avoid delays or penalties.

Steps to complete the Form IT 203 TM ATT A Schedule A Tax NY gov

Completing the Form IT 203 TM ATT A involves several key steps:

- Gather all relevant income documentation, including forms from employers and other income sources.

- Fill out personal information, including name, address, and Social Security number.

- Report all income earned in New York, ensuring to include any necessary adjustments.

- Calculate deductions and credits applicable to your situation, referencing New York State guidelines.

- Review the completed form for accuracy before submission.

Legal use of the Form IT 203 TM ATT A Schedule A Tax NY gov

The legal use of the Form IT 203 TM ATT A Schedule A is essential for ensuring compliance with New York State tax laws. This form must be filled out accurately and submitted by the designated deadlines to avoid penalties. Additionally, e-signatures are legally binding, provided that proper electronic signature regulations are followed, ensuring that the form is valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Form IT 203 TM ATT A Schedule A align with the general tax filing deadlines in New York State. Typically, the deadline for filing is April fifteenth of each year. However, if the due date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may apply, as well as any specific deadlines for estimated tax payments if applicable.

Required Documents

To complete the Form IT 203 TM ATT A Schedule A, taxpayers need to provide several documents, including:

- W-2 forms from employers detailing income earned.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductions or credits claimed.

- Previous year’s tax return for reference, if applicable.

Quick guide on how to complete form it 203 tm att a schedule a taxnygov

Effortlessly prepare Form IT 203 TM ATT A Schedule A Tax NY gov on any device

The management of online documents has gained signNow traction among companies and individuals. It serves as an ideal sustainable alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and electronically sign your documents quickly and without delays. Manage Form IT 203 TM ATT A Schedule A Tax NY gov on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Easily edit and electronically sign Form IT 203 TM ATT A Schedule A Tax NY gov without any hassle

- Locate Form IT 203 TM ATT A Schedule A Tax NY gov and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your electronic signature with the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form IT 203 TM ATT A Schedule A Tax NY gov to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 203 tm att a schedule a taxnygov

Create this form in 5 minutes!

How to create an eSignature for the form it 203 tm att a schedule a taxnygov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form IT 203 TM ATT A Schedule A Tax NY gov?

Form IT 203 TM ATT A Schedule A is a tax form used by non-residents and part-year residents of New York to report their income and calculate their tax liability. This form is essential for ensuring proper tax compliance with New York State tax laws. Using airSlate SignNow, you can easily eSign and submit this form online.

-

How can I complete Form IT 203 TM ATT A Schedule A Tax NY gov using airSlate SignNow?

To complete Form IT 203 TM ATT A Schedule A using airSlate SignNow, simply upload the document, fill in the required fields, and eSign it digitally. Our platform streamlines the process, making it quick and easy to complete your tax forms without the hassle of printing and mailing. The user-friendly interface helps you navigate the necessary steps effortlessly.

-

What features does airSlate SignNow offer for Form IT 203 TM ATT A Schedule A Tax NY gov?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage to streamline the signing process for Form IT 203 TM ATT A Schedule A. These features enhance efficiency and ensure your documents are safely stored and easily accessible. Additionally, electronic signatures are legally binding, ensuring compliance.

-

Is airSlate SignNow cost-effective for submitting Form IT 203 TM ATT A Schedule A Tax NY gov?

Yes, airSlate SignNow provides a cost-effective solution for submitting Form IT 203 TM ATT A Schedule A Tax NY gov. Our pricing plans cater to various business needs, allowing you to choose an option that best fits your budget while benefiting from essential features. You can save time and money by digitizing your tax form submission process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like Form IT 203 TM ATT A Schedule A offers multiple benefits, including increased efficiency, reduced paperwork, and enhanced document security. The elimination of physical paperwork streamlines your workflow, allowing you to focus on more critical aspects of your business. Additionally, our platform offers secure storage to protect your sensitive information.

-

Can I integrate airSlate SignNow with my existing software for tax preparation?

Yes, airSlate SignNow offers integrations with various popular software applications, enhancing your tax preparation workflow. This compatibility allows you to import and export your Form IT 203 TM ATT A Schedule A seamlessly, ensuring a smooth process from start to finish. You can connect with tools you already use for a more cohesive experience.

-

How secure is airSlate SignNow for handling Form IT 203 TM ATT A Schedule A Tax NY gov?

airSlate SignNow prioritizes security and compliance, ensuring that all transmissions of Form IT 203 TM ATT A Schedule A Tax NY gov are encrypted and securely stored. Our platform adheres to strict security standards, safeguarding your personal and financial information against unauthorized access. You can trust us to keep your documents safe and confidential.

Get more for Form IT 203 TM ATT A Schedule A Tax NY gov

- Revocation of living trust south carolina form

- Letter to lienholder to notify of trust south carolina form

- South carolina sale contract form

- South carolina forest products timber sale contract south carolina form

- Assumption agreement of mortgage and release of original mortgagors south carolina form

- South carolina estates form

- Summary administration 497325825 form

- South carolina tenant eviction form

Find out other Form IT 203 TM ATT A Schedule A Tax NY gov

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement