Form 4506 T EZ Sp Rev 6 Short Form Request for Individual Tax Return Transcript Spanish Version 2023-2026

What is the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

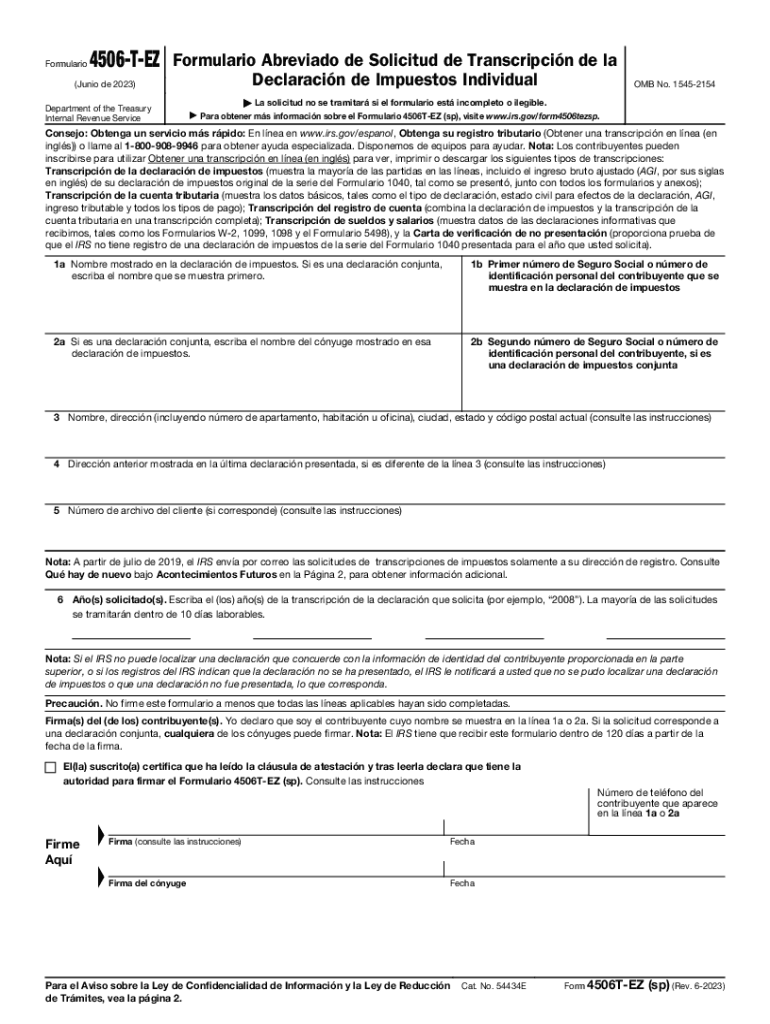

The Form 4506 T EZ sp Rev 6 is a simplified request for obtaining an individual tax return transcript from the Internal Revenue Service (IRS). This form is specifically designed for Spanish-speaking individuals, providing a streamlined process to access tax information. It allows taxpayers to request transcripts for the most recent tax year, making it easier to verify income, apply for loans, or fulfill other financial obligations. The form is particularly useful for those who need to provide proof of income for various purposes, such as securing a mortgage or applying for financial aid.

How to use the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

Using the Form 4506 T EZ sp Rev 6 is straightforward. Taxpayers need to fill out their personal information, including name, Social Security number, and address. The form requires the taxpayer to specify the type of transcript needed and the tax year for which the transcript is requested. After completing the form, it can be submitted to the IRS either by mail or electronically, depending on the preferences outlined by the IRS. It is important to ensure all information is accurate to avoid delays in processing.

Steps to complete the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

Completing the Form 4506 T EZ sp Rev 6 involves several key steps:

- Begin by entering your personal details, including your full name, Social Security number, and address.

- Select the type of transcript you wish to receive, such as a tax return transcript or an account transcript.

- Indicate the tax year for which you are requesting the transcript.

- Provide your signature and date to authorize the request.

- Submit the completed form to the IRS via the designated method, either by mail or electronically.

Legal use of the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

The Form 4506 T EZ sp Rev 6 is legally recognized as a valid request for tax return transcripts. It is essential for individuals to understand that this form must be completed accurately to comply with IRS regulations. Misuse or falsification of information on the form can lead to penalties or delays in obtaining the requested transcripts. It is advisable to keep a copy of the submitted form for personal records and future reference.

Required Documents

When submitting the Form 4506 T EZ sp Rev 6, no additional documents are typically required. However, it is beneficial to have your previous tax returns and any identification documents on hand to ensure accuracy when filling out the form. If the IRS requires further information, they may contact you directly, so providing accurate contact information is crucial.

Form Submission Methods

The Form 4506 T EZ sp Rev 6 can be submitted to the IRS through various methods. Taxpayers may choose to mail the completed form to the appropriate IRS address based on their location. Additionally, electronic submission options may be available, allowing for quicker processing times. It is important to check the IRS guidelines for the most current submission methods and any updates to the process.

Quick guide on how to complete form 4506 t ez sp rev 6 short form request for individual tax return transcript spanish version

Effortlessly Prepare Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Simplest Way to Edit and eSign Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version with Ease

- Obtain Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious search for forms, or mistakes that require new copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4506 t ez sp rev 6 short form request for individual tax return transcript spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version?

The Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version is a simplified form that individuals can use to request their tax return transcripts from the IRS. This version is specifically designed for Spanish speakers, ensuring clear communication and ease of use. Using airSlate SignNow makes it quick and straightforward to complete and eSign this form.

-

How much does it cost to use airSlate SignNow for the Form 4506 T EZ sp Rev 6?

airSlate SignNow offers a cost-effective solution for eSigning and sending documents, including the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version. Pricing varies based on the plan you choose, with various tiers available to suit individual and business needs. Investing in our service means you gain access to a streamlined process without hidden fees.

-

What are the benefits of using airSlate SignNow for the Form 4506 T EZ sp Rev 6?

Using airSlate SignNow for the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version comes with multiple benefits. You gain enhanced document security, streamlined workflows, and the ability to eSign directly online. This can signNowly reduce processing times and improve efficiency in managing your tax documents.

-

Can I save my Form 4506 T EZ sp Rev 6 as a template in airSlate SignNow?

Absolutely! AirSlate SignNow allows you to save the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version as a reusable template. This feature helps you to fill out and eSign the document quickly each time you need it, making the process more efficient for future requests.

-

Is airSlate SignNow compliant with IRS regulations for the Form 4506 T EZ sp Rev 6?

Yes, airSlate SignNow is compliant with IRS regulations for submitting the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version. Our platform is designed to ensure that all signed documents meet the necessary legal standards, giving you peace of mind while managing your sensitive tax information.

-

What integrations does airSlate SignNow offer for the Form 4506 T EZ sp Rev 6?

AirSlate SignNow integrates seamlessly with various software and applications, enhancing the usability of the Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version. You can connect it with CRM systems, cloud storage, and more, streamlining your document management process and improving productivity.

-

How do I track the status of my Form 4506 T EZ sp Rev 6 in airSlate SignNow?

Tracking the status of your Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version is easy with airSlate SignNow. Our platform provides real-time updates and notifications, allowing you to stay informed on the progress of your document, from sending to completion.

Get more for Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

- First report of injury form for ri

- Designation of beneficiary form 105 public school teachers ctpf

- Teejay maths book 3a pdf form

- Fullerton college request transcripts form

- Gid 37 c doc gainsurance form

- Wake county inspections permits 336 fayetteville form

- Wake county building inspections workers comp affidavit form

- Supplier buyer agreement template form

Find out other Form 4506 T EZ sp Rev 6 Short Form Request For Individual Tax Return Transcript Spanish Version

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now