D 407 NC K 1 Web 7 24 DOR Use Only Beneficia Form

Understanding the D-407 NC K-1 Form

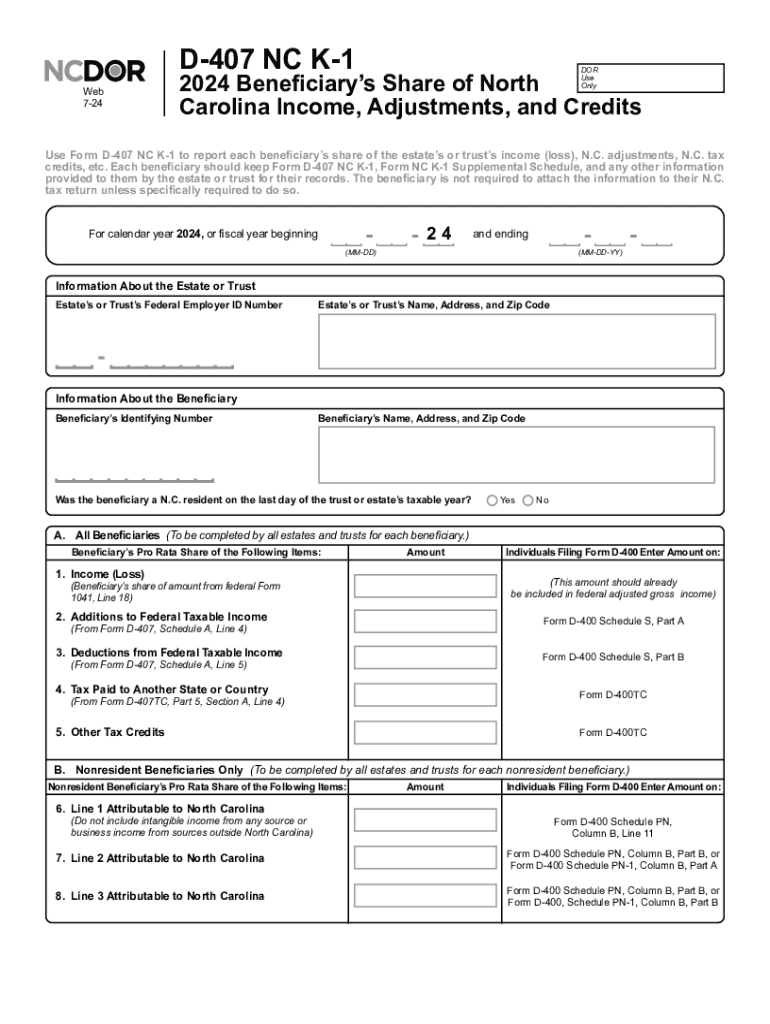

The D-407 NC K-1 form is a crucial document used in North Carolina for reporting income from pass-through entities such as partnerships, S corporations, and limited liability companies (LLCs). This form is essential for beneficiaries who receive income from these entities, as it details each beneficiary's share of the entity's income, deductions, and credits. Understanding this form is vital for accurate tax reporting and compliance with state regulations.

Steps to Complete the D-407 NC K-1 Form

Completing the D-407 NC K-1 form involves several key steps:

- Gather necessary information, including the entity's name, address, and identification number.

- Enter the beneficiary's details, such as name, address, and Social Security number.

- Report the income, deductions, and credits allocated to the beneficiary as outlined in the entity's financial statements.

- Ensure all calculations are accurate and reflect the correct amounts for the tax year.

- Review the completed form for any errors before submission.

Legal Use of the D-407 NC K-1 Form

The D-407 NC K-1 form must be used in accordance with North Carolina tax laws. It serves as an official record of income distribution to beneficiaries and is essential for their individual tax filings. Proper use of this form ensures compliance with state regulations and helps avoid potential legal issues related to tax reporting.

Key Elements of the D-407 NC K-1 Form

Key elements of the D-407 NC K-1 form include:

- Entity Information: Name, address, and identification number of the pass-through entity.

- Beneficiary Information: Name, address, and Social Security number of the beneficiary receiving the income.

- Income Details: Breakdown of the beneficiary's share of income, including ordinary income, capital gains, and other relevant categories.

- Deductions and Credits: Any deductions or credits that the beneficiary can claim based on their share of the entity's income.

Filing Deadlines for the D-407 NC K-1 Form

Filing deadlines for the D-407 NC K-1 form align with the overall tax filing deadlines in North Carolina. Typically, the form must be provided to beneficiaries by the entity by the end of March, allowing beneficiaries to include the information in their tax returns. It is important to stay informed about any changes in deadlines to ensure timely compliance.

Examples of Using the D-407 NC K-1 Form

Examples of scenarios where the D-407 NC K-1 form is utilized include:

- A partnership distributing profits to its partners based on their ownership percentages.

- An S corporation reporting income allocated to its shareholders for tax purposes.

- A limited liability company providing income details to its members for their individual tax filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 407 nc k 1 web 7 24 dor use only beneficia

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an nc k 1 form and why is it important?

An nc k 1 form is a tax document used to report income, deductions, and credits from partnerships or S corporations. It is crucial for ensuring accurate tax reporting and compliance. Understanding how to manage your nc k 1 can help you maximize your tax benefits and avoid potential issues with the IRS.

-

How does airSlate SignNow simplify the nc k 1 signing process?

airSlate SignNow streamlines the nc k 1 signing process by allowing users to electronically sign and send documents securely. This eliminates the need for physical paperwork and speeds up the turnaround time for important tax documents. With our user-friendly interface, managing your nc k 1 forms becomes hassle-free.

-

What are the pricing options for using airSlate SignNow for nc k 1 forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for handling nc k 1 forms. Our plans are designed to be cost-effective, ensuring you get the best value for your investment. You can choose a plan that fits your budget while still accessing all the essential features for managing your nc k 1 documents.

-

Can I integrate airSlate SignNow with other software for managing nc k 1 forms?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your ability to manage nc k 1 forms. Whether you use accounting software or CRM systems, our integrations ensure that your workflow remains efficient. This connectivity allows for easy data transfer and document management.

-

What features does airSlate SignNow offer for nc k 1 document management?

airSlate SignNow provides a range of features tailored for nc k 1 document management, including customizable templates, secure eSigning, and automated workflows. These features help you streamline the preparation and signing of your nc k 1 forms, making the process faster and more efficient. Additionally, you can track document status in real-time.

-

How secure is airSlate SignNow for handling sensitive nc k 1 information?

Security is a top priority at airSlate SignNow, especially when handling sensitive nc k 1 information. We employ advanced encryption and security protocols to protect your documents and data. You can trust that your nc k 1 forms are safe and compliant with industry standards.

-

What are the benefits of using airSlate SignNow for nc k 1 forms?

Using airSlate SignNow for your nc k 1 forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform allows you to manage your documents from anywhere, making it easier to stay organized. Additionally, the electronic signing feature speeds up the process, ensuring timely submissions.

Get more for D 407 NC K 1 Web 7 24 DOR Use Only Beneficia

Find out other D 407 NC K 1 Web 7 24 DOR Use Only Beneficia

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now

- Can I Sign Texas Affidavit of Domicile

- How Can I Sign Utah Affidavit of Domicile

- How To Sign Massachusetts Codicil to Will

- How To Sign Arkansas Collateral Agreement

- Sign New York Codicil to Will Now

- Sign Oregon Codicil to Will Later

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit