Indiana's CollegeChoice 529 Education Savings Plan Credit 2022

What is the Indiana's CollegeChoice 529 Education Savings Plan Credit

The Indiana's CollegeChoice 529 Education Savings Plan Credit is a state tax credit designed to encourage families to save for future education expenses. This credit allows contributors to receive a percentage of their contributions back as a tax benefit, making it an attractive option for those planning for higher education costs. The program is named after Indiana's CollegeChoice 529 plan, which offers tax advantages for contributions made to education savings accounts.

Eligibility Criteria

To qualify for the Indiana's CollegeChoice 529 Education Savings Plan Credit, individuals must meet specific criteria. Contributors must be Indiana residents and must have made contributions to a CollegeChoice 529 account. The credit is available for contributions made by individuals, including parents, grandparents, and other family members. There is no limit on the number of accounts that can be opened, but the total contributions eligible for the credit are capped at a certain amount per year.

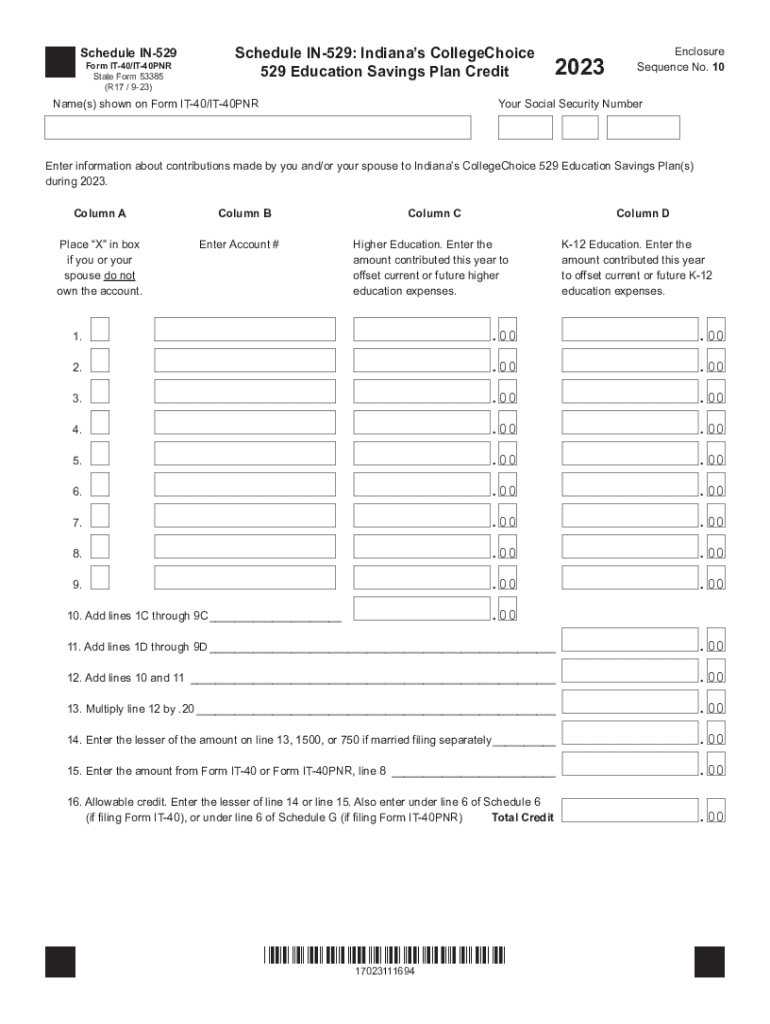

Steps to complete the Indiana's CollegeChoice 529 Education Savings Plan Credit

Completing the process for the Indiana's CollegeChoice 529 Education Savings Plan Credit involves several straightforward steps. First, ensure that you have made eligible contributions to a CollegeChoice 529 account. Next, gather the necessary documentation, including your contribution records and any relevant tax forms. When filing your state tax return, include the amount of your contributions to claim the credit. It is important to keep accurate records of your contributions, as these may be required for verification.

How to obtain the Indiana's CollegeChoice 529 Education Savings Plan Credit

Obtaining the Indiana's CollegeChoice 529 Education Savings Plan Credit is a process that begins with contributing to a CollegeChoice 529 account. After making contributions, you will receive statements that detail your contributions, which are necessary for claiming the credit. When you file your Indiana state tax return, include the contributions as part of your tax information to receive the credit. Ensure that you are aware of the contribution limits to maximize your tax benefits.

Required Documents

To successfully claim the Indiana's CollegeChoice 529 Education Savings Plan Credit, certain documents are required. These include proof of contributions made to your CollegeChoice 529 account, such as account statements or receipts. Additionally, you will need your Indiana state tax return forms, where you will report your contributions. Keeping organized records will facilitate the filing process and ensure that you can substantiate your claim if necessary.

Filing Deadlines / Important Dates

Filing deadlines for the Indiana's CollegeChoice 529 Education Savings Plan Credit align with the standard state tax return deadlines. Typically, Indiana state tax returns are due on April 15 each year. It is essential to be aware of any changes to these dates, as they can vary from year to year. Planning ahead and submitting your tax return on time will help you avoid penalties and ensure that you receive your credit promptly.

Quick guide on how to complete indianas collegechoice 529 education savings plan credit

Effortlessly Prepare Indiana's CollegeChoice 529 Education Savings Plan Credit on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the right form and reliably store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Indiana's CollegeChoice 529 Education Savings Plan Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest method to edit and eSign Indiana's CollegeChoice 529 Education Savings Plan Credit with minimal effort

- Obtain Indiana's CollegeChoice 529 Education Savings Plan Credit and click on Get Form to commence.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Verify the details and click the Done button to confirm your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching for forms, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Indiana's CollegeChoice 529 Education Savings Plan Credit and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct indianas collegechoice 529 education savings plan credit

Create this form in 5 minutes!

How to create an eSignature for the indianas collegechoice 529 education savings plan credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Indiana's CollegeChoice 529 Education Savings Plan Credit?

Indiana's CollegeChoice 529 Education Savings Plan Credit is a tax benefit offered to incentivize families in Indiana to save for future education expenses. Contributions made to a CollegeChoice 529 plan qualify for a state tax credit, making it an effective way to manage educational costs.

-

How can I benefit from Indiana's CollegeChoice 529 Education Savings Plan Credit?

By contributing to Indiana's CollegeChoice 529 Education Savings Plan, you can receive a state tax credit of 20% on contributions, up to a maximum of $1,000 per tax year. This means that saving for your child's higher education not only accumulates funds but also provides immediate tax savings, enhancing your overall savings strategy.

-

Are there fees associated with Indiana's CollegeChoice 529 Education Savings Plan?

Indiana's CollegeChoice 529 Education Savings Plan typically has very low fees compared to other investment options. However, you should review the plan details for specific information on management fees and any potential account maintenance fees to ensure transparency in your investment.

-

What are the features of Indiana's CollegeChoice 529 Education Savings Plan?

Indiana's CollegeChoice 529 Education Savings Plan offers a variety of investment options tailored to different risk tolerances. Additionally, it provides flexible contribution amounts and allows funds to be used for a wide range of qualified educational expenses, such as tuition, fees, and room and board at colleges nationwide.

-

Can I make contributions to Indiana's CollegeChoice 529 Education Savings Plan while using airSlate SignNow?

Yes, you can easily manage and document contributions to Indiana's CollegeChoice 529 Education Savings Plan using airSlate SignNow. The platform allows you to send, eSign, and securely store documents related to your education savings plan, ensuring that all your paperwork is organized and easily accessible.

-

How does Indiana's CollegeChoice 529 Education Savings Plan Credit work with other tax benefits?

Indiana's CollegeChoice 529 Education Savings Plan Credit can be combined with other tax benefits for education savings. While it provides a state tax credit, you can also benefit from federal tax advantages on earnings if the funds are used for qualified education expenses, making it a robust option for maximizing your savings.

-

What happens if I don't use funds from Indiana's CollegeChoice 529 Education Savings Plan?

If you do not use the funds accumulated in Indiana's CollegeChoice 529 Education Savings Plan for qualified educational expenses, you may face tax penalties and a recapture of any credits. However, the plan allows you to change the beneficiary to another eligible family member, keeping your savings intact for future education needs.

Get more for Indiana's CollegeChoice 529 Education Savings Plan Credit

Find out other Indiana's CollegeChoice 529 Education Savings Plan Credit

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding