DUE to IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED and SUBMITTED 2022

Understanding the DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

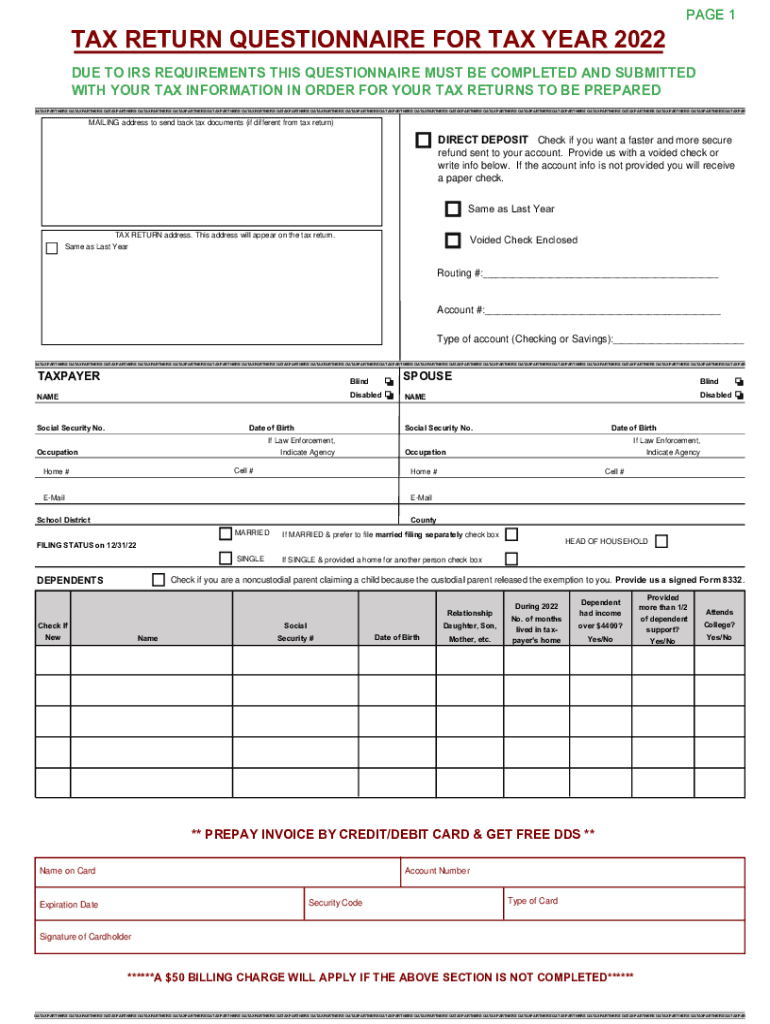

The phrase "DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED" refers to a specific compliance obligation for individuals and businesses in the United States. This requirement typically arises when the IRS mandates the collection of certain information to ensure accurate tax reporting and compliance. The questionnaire may pertain to various tax-related matters, including income reporting, deductions, or eligibility for specific tax credits.

Understanding the purpose of this questionnaire is essential for ensuring compliance with IRS regulations. It serves as a tool for the IRS to gather necessary data that can impact tax liabilities and entitlements. Failing to complete and submit this questionnaire can lead to delays in processing tax returns or potential penalties.

Steps to Complete the DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

Completing the questionnaire involves several key steps to ensure accuracy and compliance with IRS guidelines. Here’s a straightforward approach:

- Gather Required Information: Collect all necessary documents and information, such as Social Security numbers, income statements, and deduction records.

- Review Instructions: Read the instructions provided with the questionnaire carefully to understand what information is required.

- Complete the Questionnaire: Fill out the form accurately, ensuring all information is correct and complete.

- Review for Accuracy: Before submission, double-check all entries for any errors or omissions.

- Submit the Questionnaire: Follow the specified submission method, whether online, by mail, or in person.

Legal Use of the DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

This questionnaire is legally required under IRS regulations, meaning that individuals and businesses must comply to avoid potential legal repercussions. The information collected through this form is used to verify tax compliance and ensure that taxpayers are meeting their obligations under U.S. tax law.

Failure to submit the questionnaire can result in penalties, including fines or delays in processing tax returns. It is crucial to understand that this requirement is not optional; it is a part of the broader framework of tax compliance mandated by the IRS.

Required Documents for the DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

To complete the questionnaire effectively, certain documents are typically required. These may include:

- Social Security card or Individual Taxpayer Identification Number (ITIN)

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any deductions or credits claimed

- Previous year’s tax return for reference

Having these documents ready will streamline the process of completing the questionnaire and ensure that all necessary information is provided.

Filing Deadlines / Important Dates for the DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

Timely submission of the questionnaire is critical. The IRS typically sets specific deadlines for when this form must be submitted, often aligning with the annual tax filing deadline. Understanding these dates helps taxpayers avoid penalties and ensures compliance with IRS requirements.

It is advisable to check the IRS website or consult with a tax professional for the most current deadlines, as they can vary from year to year and may be influenced by changes in tax law or policy.

Quick guide on how to complete due to irs requirements this questionnaire must be completed and submitted

Effortlessly Prepare DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to quickly create, edit, and eSign your documents without delays. Manage DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The Easiest Way to Modify and eSign DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED with Ease

- Find DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED and click Get Form to begin.

- Use the available tools to complete your document.

- Select important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you want to send your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED and guarantee effective communication at every point of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct due to irs requirements this questionnaire must be completed and submitted

Create this form in 5 minutes!

How to create an eSignature for the due to irs requirements this questionnaire must be completed and submitted

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Why is it important to complete the questionnaire?

DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED to ensure regulatory compliance. Completing this questionnaire helps streamline your document processing and avoids potential issues with the IRS.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides features such as eSigning, document templates, and real-time notifications. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED to take full advantage of these features, ensuring your documents are securely processed according to regulations.

-

How does airSlate SignNow ensure the security of my documents?

airSlate SignNow employs advanced encryption and authentication methods to protect your documents. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED, ensuring that all signed documents are legally binding and secure.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to fit various business needs. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED as part of the onboarding process to choose the correct plan that meets your document signing needs.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow seamlessly integrates with various applications such as Salesforce, Google Drive, and Dropbox. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED to enable these integrations for a more efficient workflow.

-

What benefits does electronic signing provide?

Electronic signing speeds up the document signing process, reduces paper usage, and improves accessibility. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED to ensure that your electronic signatures are recognized as valid by the IRS.

-

How can I get support if I have questions about airSlate SignNow?

airSlate SignNow offers comprehensive customer support through various channels including live chat, email, and phone. DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED, ensuring that you receive timely help while navigating our services.

Get more for DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

Find out other DUE TO IRS REQUIREMENTS THIS QUESTIONNAIRE MUST BE COMPLETED AND SUBMITTED

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now