IRS Tax Return Forms and Schedule for Tax Year IRS Tax Return Forms and Schedule for Tax Year IRS Tax Return Forms and Schedule 2021

What are IRS Tax Return Forms and Schedules?

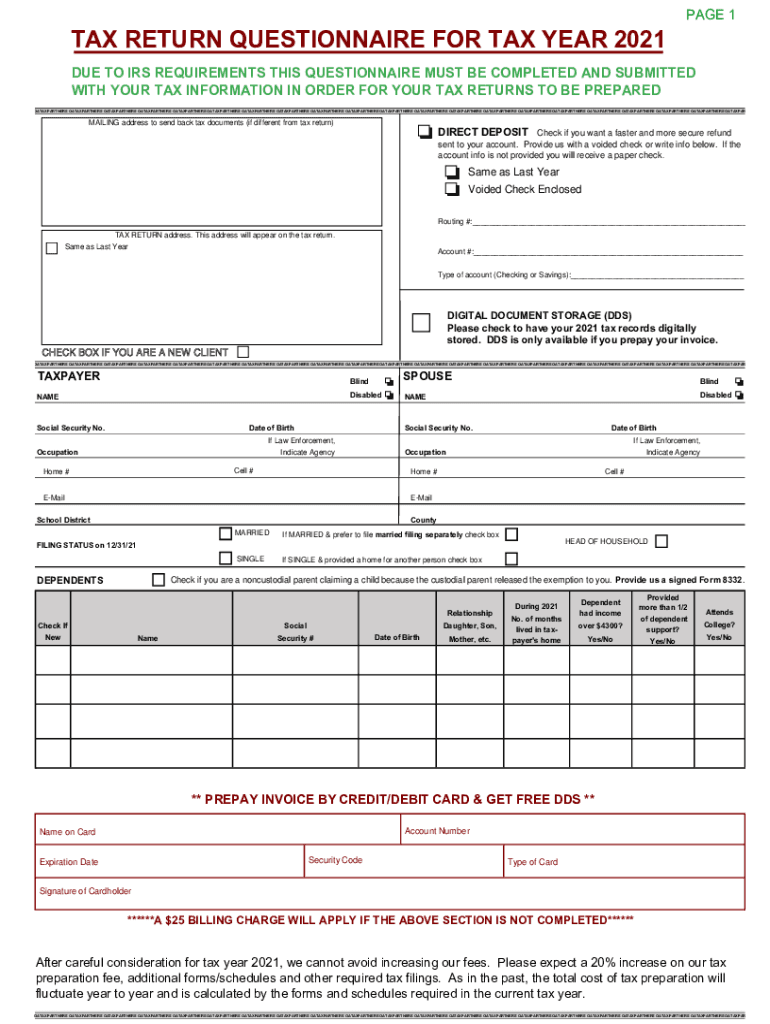

The IRS Tax Return Forms and Schedule for the tax year are essential documents that taxpayers in the United States use to report their income, calculate taxes owed, and claim any applicable deductions or credits. These forms vary based on the taxpayer's situation, such as individual, business, or self-employed status. The main form for individual taxpayers is the Form 1040, which is accompanied by various schedules that provide detailed information on income sources, deductions, and credits. Understanding these forms is crucial for accurate and compliant tax reporting.

How to Use IRS Tax Return Forms and Schedules

Using IRS Tax Return Forms and Schedules involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and other income statements. Next, select the appropriate forms based on your filing status and income level. Complete the forms accurately, ensuring that all income and deductions are reported. It is advisable to review the IRS instructions for each form to avoid errors. Finally, submit the completed forms either electronically or by mail, depending on your preference and the requirements of the IRS.

Steps to Complete IRS Tax Return Forms and Schedules

Completing IRS Tax Return Forms and Schedules requires a systematic approach. Start by collecting all relevant financial documents, such as income statements and receipts for deductions. Next, choose the correct form, typically the Form 1040 for individuals. Fill out the form by entering your personal information, income details, and applicable deductions. Be sure to attach any necessary schedules that provide additional information about your income or deductions. After completing the forms, review them for accuracy before submitting them to the IRS.

Legal Use of IRS Tax Return Forms and Schedules

IRS Tax Return Forms and Schedules are legally binding documents that must be completed truthfully and accurately. Providing false information can lead to penalties, including fines and potential criminal charges. It is essential to understand that these forms must comply with IRS regulations and guidelines. When filing electronically, ensure that you use a secure and compliant eSignature solution, which can provide a legally binding signature and maintain the integrity of your documents.

Required Documents for IRS Tax Return Forms and Schedules

To complete IRS Tax Return Forms and Schedules, certain documents are required. Taxpayers should gather their W-2 forms from employers, 1099 forms for any freelance or contract work, and documentation for any other income sources. Additionally, receipts for deductible expenses, such as medical bills, mortgage interest, and charitable contributions, should be collected. Keeping these documents organized will simplify the process of filling out the tax return forms and ensure that all relevant information is included.

Filing Deadlines and Important Dates

Filing deadlines for IRS Tax Return Forms and Schedules are crucial to avoid penalties. Typically, individual tax returns are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of deadlines for estimated tax payments and extensions, which can provide additional time to file but not to pay any taxes owed. Staying informed about these dates helps ensure compliance and avoids unnecessary penalties.

Examples of Using IRS Tax Return Forms and Schedules

Examples of using IRS Tax Return Forms and Schedules can help clarify the filing process. For instance, a self-employed individual may need to file a Form 1040 along with a Schedule C to report business income and expenses. A taxpayer claiming education credits would need to include Form 8863 with their return. Each situation may require different forms and schedules, so understanding the specific requirements based on one's financial circumstances is essential for accurate reporting.

Quick guide on how to complete irs tax return forms and schedule for tax year 2022irs tax return forms and schedule for tax year 2022irs tax return forms and

Effortlessly Prepare IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule on Any Device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule from any device with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The Easiest Way to Modify and eSign IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule

- Find IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive details with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or to download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule to ensure excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs tax return forms and schedule for tax year 2022irs tax return forms and schedule for tax year 2022irs tax return forms and

Create this form in 5 minutes!

People also ask

-

What are IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates?

IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates are essential documents that taxpayers need to complete when filing their returns. These templates simplify the process, allowing users to have a structured format to input their financial information accurately. By using airSlate SignNow, businesses can easily create and sign these templates digitally.

-

How does airSlate SignNow help with IRS Tax Return Forms and Schedule for Tax Year?

airSlate SignNow provides a user-friendly platform for creating and eSigning IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates. With features like document storage and sharing, it streamlines the tax preparation process. Users can manage all their tax documents efficiently in one place, ensuring compliance and accuracy.

-

What are the pricing options for using airSlate SignNow for IRS Tax Return Forms?

airSlate SignNow offers several pricing plans that fit different budget needs for managing IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates. Each plan includes unique features, allowing users to choose one that best fits their requirements. There’s also a free trial available, so potential customers can test the service before committing.

-

Are there any integrations available with airSlate SignNow for IRS Tax Return Forms?

Yes, airSlate SignNow seamlessly integrates with various accounting and productivity software, making it easier to manage IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates. Popular integrations include QuickBooks and Google Drive, which enhance user convenience. These integrations allow for smooth document transfers and collaboration among team members.

-

Can I customize IRS Tax Return Forms using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates to suit their specific needs. Users can add fields, signatures, and notes as required, ensuring every document is tailored to their business requirements. This flexibility makes the tax filing process more efficient.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow employs advanced security features to protect sensitive tax documents like IRS Tax Return Forms and Schedule for Tax Year 12 Tax Return Questionnaire Templates. The platform uses encryption and compliant storage solutions to ensure data privacy. Users can confidently create and share documents without worrying about unauthorized access.

-

What support options are available for users of airSlate SignNow?

Users of airSlate SignNow can access comprehensive support options, including live chat, email support, and an extensive knowledge base. Whether you have questions about IRS Tax Return Forms or need assistance with using the platform, dedicated support staff are available to help. The goal is to ensure all customers have an optimal experience when handling their tax documents.

Get more for IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule

- Jury instruction punitive damages instruction mississippi form

- Jury instruction court form

- Jury instruction damages for breach of contract mississippi form

- Jury instruction evidence form

- Classified military information

- Energy assistance programs application july may 2026 form

- Planilla individuos forma unica 16 nov 16

- Permit to use dealers license plates dmv virginia form

Find out other IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule For Tax Year IRS Tax Return Forms And Schedule

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT