Schedule K 1 Form 1041 Deductions, Credits & Other Items 2022

Understanding the Schedule K-1 Form 1041

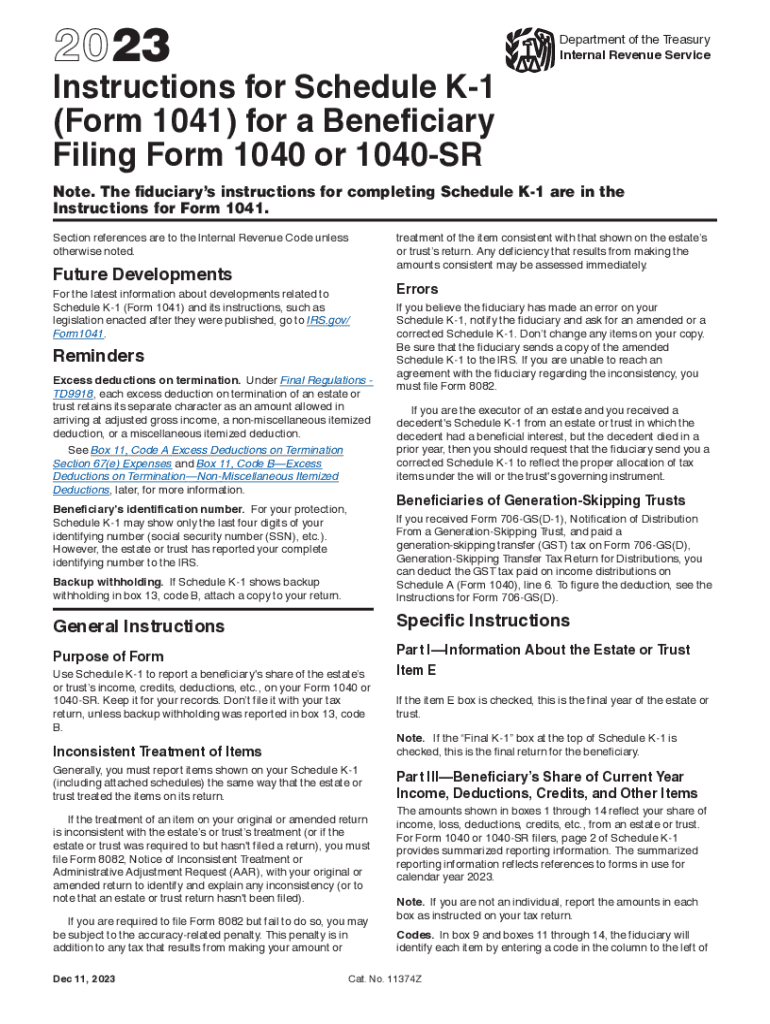

The Schedule K-1 Form 1041 is a crucial document used by estates and trusts to report income, deductions, credits, and other items to beneficiaries. This form provides detailed information on how much income each beneficiary is entitled to receive, which is essential for their individual tax returns. The K-1 form helps ensure that the income is accurately reported to the IRS, allowing beneficiaries to claim their share of the estate or trust's income on their personal tax filings.

Steps to Complete the Schedule K-1 Form 1041

Completing the Schedule K-1 Form 1041 involves several steps to ensure accuracy and compliance with IRS regulations. First, gather all necessary financial documents related to the estate or trust, including income statements and expense records. Next, fill out the form by entering the trust or estate's information, including its name and tax identification number. Then, report the income items, deductions, and credits allocated to each beneficiary. Finally, review the form for completeness and accuracy before submitting it to the IRS and providing copies to the beneficiaries.

Key Elements of the Schedule K-1 Form 1041

The Schedule K-1 Form 1041 includes several key elements that are important for both the estate or trust and its beneficiaries. These elements consist of the estate or trust's name, the beneficiary's name, and the tax identification numbers. Additionally, the form details the income distributions, including ordinary income, capital gains, and any deductions or credits passed on to the beneficiaries. Understanding these elements is vital for accurate tax reporting and compliance.

IRS Guidelines for Schedule K-1 Form 1041

The IRS provides specific guidelines for the Schedule K-1 Form 1041 to ensure proper reporting and compliance. According to IRS regulations, the form must be filed annually for each estate or trust that has income to report. The guidelines also specify the deadlines for filing, which generally coincide with the tax return deadlines for the estate or trust. Familiarizing oneself with these guidelines is essential for avoiding penalties and ensuring that all tax obligations are met.

Filing Deadlines for Schedule K-1 Form 1041

Filing deadlines for the Schedule K-1 Form 1041 are aligned with the tax return deadlines for estates and trusts. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. It is important for fiduciaries to adhere to these deadlines to avoid late filing penalties and ensure beneficiaries receive their K-1 forms in a timely manner.

Digital Submission Methods for Schedule K-1 Form 1041

Submitting the Schedule K-1 Form 1041 can be done through various methods, including digital options. The IRS allows electronic filing for estates and trusts, which can streamline the submission process and reduce the risk of errors. Digital submission can be accomplished using tax preparation software that supports electronic filing. Alternatively, the form can be printed and mailed to the IRS, but electronic submission is often preferred for its efficiency and speed.

Quick guide on how to complete schedule k 1 form 1041 deductions credits ampamp other items

Accomplish Schedule K 1 Form 1041 Deductions, Credits & Other Items effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without interruptions. Manage Schedule K 1 Form 1041 Deductions, Credits & Other Items on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Schedule K 1 Form 1041 Deductions, Credits & Other Items effortlessly

- Find Schedule K 1 Form 1041 Deductions, Credits & Other Items and click on Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Finish button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule K 1 Form 1041 Deductions, Credits & Other Items to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule k 1 form 1041 deductions credits ampamp other items

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 1041 deductions credits ampamp other items

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule K 1 Form 1041 for Deductions, Credits & Other Items?

The Schedule K 1 Form 1041 is a tax document used for reporting income, deductions, credits, and other items for beneficiaries of an estate or trust. It plays a crucial role in helping beneficiaries accurately report their share of income on their personal tax returns. Understanding this form is essential for effectively navigating your tax obligations as a beneficiary.

-

How can airSlate SignNow assist with Schedule K 1 Form 1041 Deductions, Credits & Other Items?

airSlate SignNow provides a user-friendly platform to send, sign, and manage Schedule K 1 Form 1041 documents efficiently. Our eSigning features ensure that critical tax documents are signed and processed quickly, reducing the time needed for compliance. This helps streamline your workflow, allowing for better focus on deductions, credits, and other vital items.

-

What features does airSlate SignNow offer for handling tax forms like Schedule K 1 Form 1041?

airSlate SignNow includes robust features like templates, document tracking, and team collaboration tools specifically for tax forms like the Schedule K 1 Form 1041. Our platform ensures that all related documents can be easily accessed, filled out, and signed digitally without the hassle of paper shuffling. This enhances accuracy and efficiency in managing tax forms.

-

Is there a cost associated with using airSlate SignNow for Schedule K 1 Form 1041?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs when managing Schedule K 1 Form 1041 documents. Each plan provides cost-effective solutions for businesses seeking to streamline their eSigning and document management processes. You can choose the one that best fits your volume of use and required features.

-

Can I integrate airSlate SignNow with other accounting software for Schedule K 1 Form 1041?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting software, making it easy to upload and manage Schedule K 1 Form 1041 alongside your financial records. This ensures a smooth workflow and helps you keep track of deductions, credits, and other essential items without switching platforms.

-

How secure is airSlate SignNow for handling sensitive tax documents like Schedule K 1 Form 1041?

Security is a top priority at airSlate SignNow, where we employ advanced encryption and compliance measures to protect sensitive tax documents such as Schedule K 1 Form 1041. Your data is safeguarded throughout the eSigning process, ensuring that privacy and confidentiality are maintained. This allows you to confidently manage your tax-related documents.

-

What are the benefits of using airSlate SignNow for Schedule K 1 Form 1041 management?

Using airSlate SignNow for Schedule K 1 Form 1041 management can greatly enhance your efficiency and accuracy. Our platform simplifies document workflows, provides tracking features, and reduces the time spent on manual processing. These benefits allow you to focus more on maximizing your deductions, credits, and other financial items.

Get more for Schedule K 1 Form 1041 Deductions, Credits & Other Items

- Identity theft kit new york state attorney general form

- What is ghosting one more form of identity theft lifelock

- Control number ny p085 pkg form

- Control number ny p087 pkg form

- Control number ny p088 pkg form

- And can be adapted to fit your particular circumstances form

- Control number ny p092 pkg form

- Control number ny p093 pkg form

Find out other Schedule K 1 Form 1041 Deductions, Credits & Other Items

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF